Ethereum’s annual issuance hikes to 4.51% post-Ethereum Ice Age

It has been a good start to the year for Ethereum.

After registering minor hikes on 3rd and 6th January, the world’s 2nd largest crypto-asset recorded a significant pump on the 14th, recording a hike of 18.88 percent. The valuation pushed the price of Ethereum from $143 to $170 as major resistances at $150 and $154 were breached.

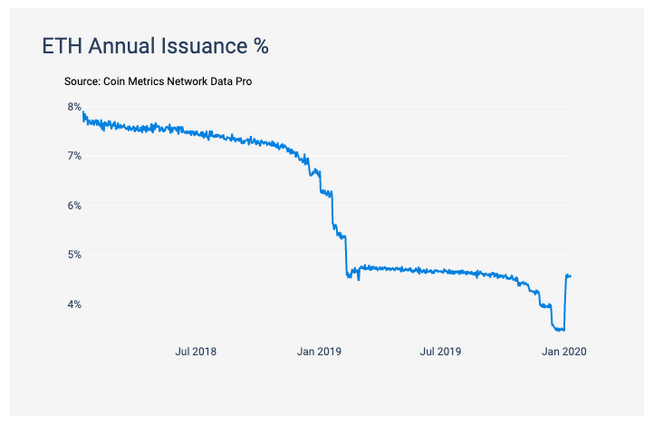

According to the latest Coinmetrics State of the Network report, the annual issuance percentage for ETH slumped to an all-time low at the end of December 2019. The decline was observed right before the implementation of the Ethereum Ice Age, a planned difficulty increase to make mining more strenuous.

Initially, the ice age was planned in order to incorporate a transition and encourage users to shift from ETH 1.0 to ETH 2.0. However, the plan failed after ETH 2.0 did not get launched by the end of 2019 and the hardfork commenced on 2 January 2020.

Source: Coinmetrics

As observed in the chart above, after recording a drop to 3.45 percent in December 2019, the annual ETH issuance percentage climbed its way back to 4.56 percent.

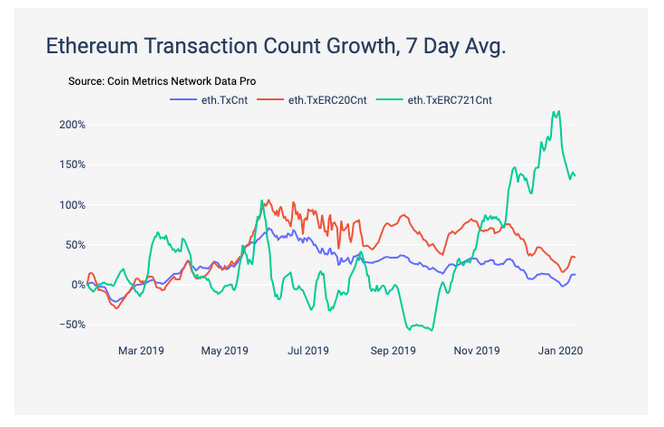

However, the Ethereum ERC-721 tokens pictured a cooling-off period at the start of 2020 after pretty much dominating ERC-20 towards the end of 2019. The transaction count growth over a 7-day avg suffered a sharp slump, with ERC-20 tokens’ periodic depreciation continuing to unfold.

Source: Coinmetrics

Previously, Ethereum’s ERC-2o tokens experienced a steep rise back in November, when over 3.7 million ERC-721 tokens were transferred in a single day. However, it is important to note that a majority of these transfers were associated with an ETH-based game, “Gods Unchained.”

Many people in the community have regularly discarded Ethereum’s valuation and position in the crypto-industry. However, some like Nate Maddrey, Senior Research Analyst at Coinmetrics, has recently noted that Ethereum could be undervalued, when compared to Bitcoin.