Ethereum Options OI rises to its peak as market predicts bullish move

The cryptocurrency market has been noticing a rising price in the spot market. Ethereum, the second-largest cryptocurrency has seen strong green candles over the past couple of days. According to data, ETH’s price has climbed up by 12.44% in the past two days and was valued at $211.96, at press time. As the spot price rises, the ETH derivatives market has also been registering a growing trend and points at a bullish trend that may overtake the market.

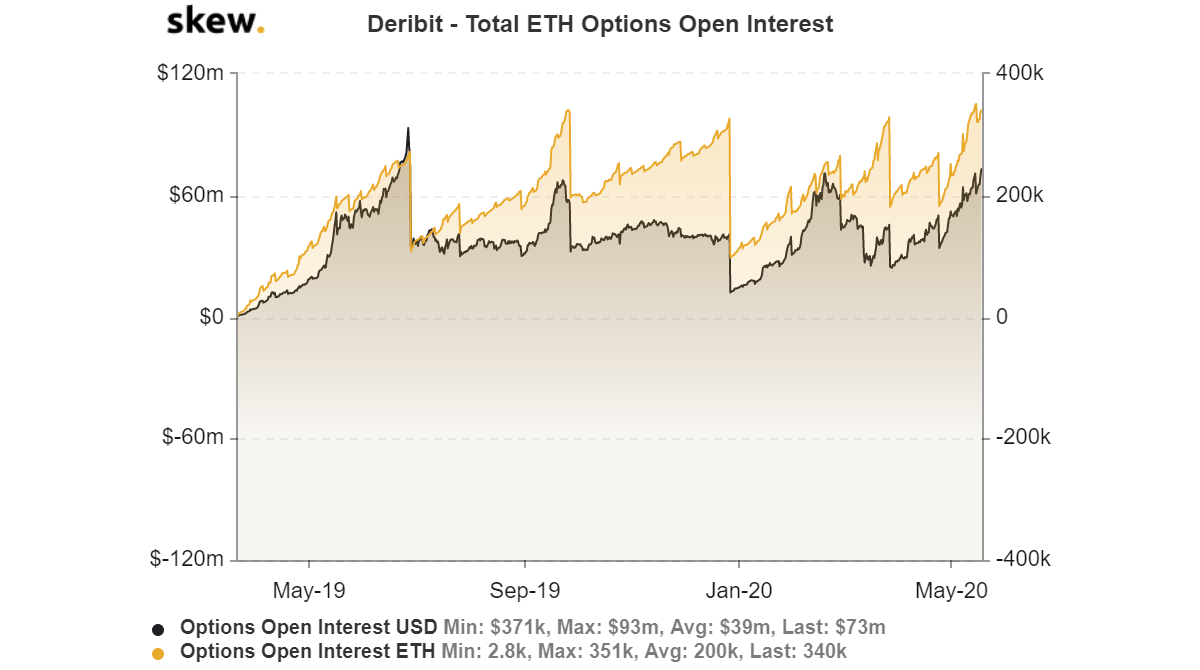

Ethereum Options market has been witnessing increasing interest from the traders as well as a growing number of contracts. Deribit has been the largest and prominent platform for ETH Options, and as per data provider Skew, the total number of open contracts currently on the exchange has reached an all-time high of $341k.

Source: Skew

The value of these open contracts in terms of USD has been higher than in the past six months too. The current value of the contracts stood at $72 million, whereas the last time this metric reached its peak was in July 2019, after which it swiftly collapsed.

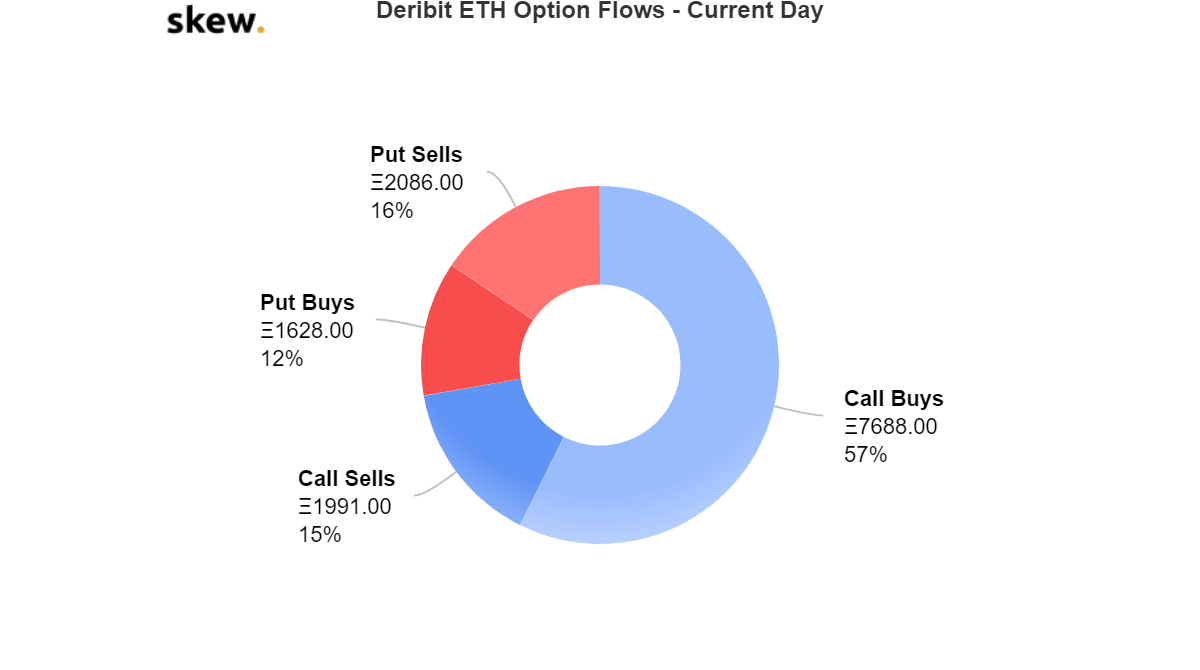

As the BTC halving posed a question for the state of the rest of the market, there were puts overtaking calls even on ETH options. However, ever since the halving completed the traders were back and were bidding on the price of the digital asset to rise. This was indicated on the Deribit exchange as four out of the five contracts, with high volume, were mainly call options.

Source: Skew

According to data, traders have been buying more call options [57%], which gave them the right to own the asset at a predetermined price, and as they predicted its price to rise. The rising call options, especially buying call options, indicated a bullish sign in the market, as market bought ETH at its present price.

This bullishness was complemented by the OI set to expire on 29 May. Data suggested that approximately 68.7 ETH Options open interest was set to expire on Deribit.