Ethereum DeFi tokens may not scream investment opportunity

Ethereum’s DeFi platform has been able to grab significant attention over the past year. In fact, a recent announcement had revealed that the total value locked [TVL] had surpassed a sum of $1 billion, further solidifying the sector’s importance in the ecosystem.

Although the growth of the lending platform is undeniable and the reception positive, the investment case for these DeFi tokens may lack clarity presently.

A recent study released by Ryan Sean Adams assessed various DeFi tokens in terms of a price-to-earnings ratio of P/E, allowing investors to understand the future growth and expectations of any investment asset, relative to its present earnings.

Here, it is important to note that most of the DeFi tokens generated cash flows by charging a small fee for usage.

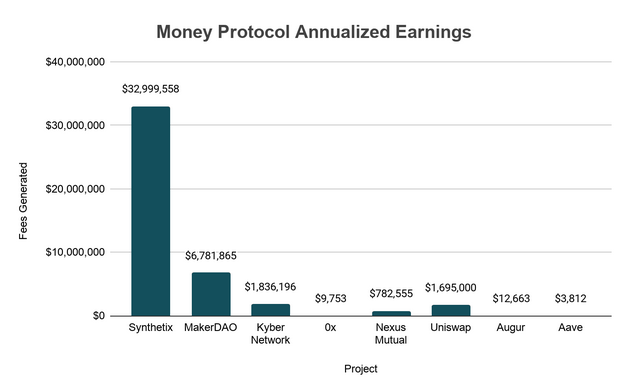

Some of the major tokens in comparison included MakerDAO, Synthetix, Ox, etc.

With respect to money protocol annualized earnings, Synthetix dominated the ecosystem with over $32 million fees generated. This is largely because Synthetix charges a fixed 0.30 percent on all trades and the fee generated is distributed among SNX stakers.

Source: bankless

In spite of MakerDAO’s market cap dominance, its DeFi token only registered $6.7 million in annualized earnings through its stability fee. The post added,

“The Dai Saving Rate introduced for MCD uses the stability fees accrued from the system’s outstanding debt to distribute it to Dai holders who lock their Dai into the smart contract. With that, there’s a spread between the DSR and the Stability Fee, currently sitting at 0.25% (7.5% DSR and 8% SF).”

Other assets such as Ox and Augur recorded a negligible amount in fees, therefore registering lower annualized earnings.

Source: bankless

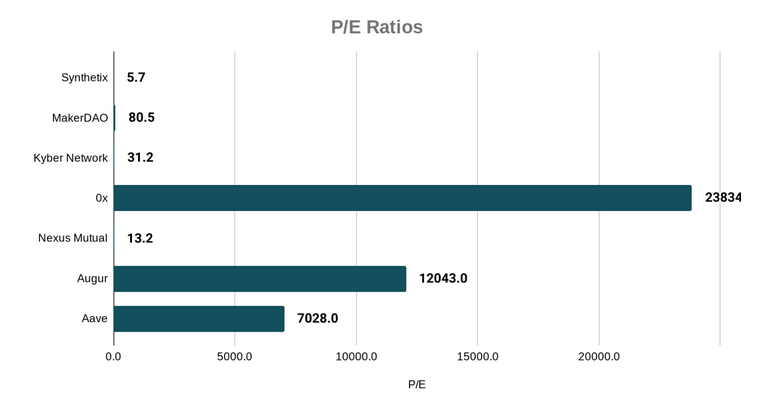

When the P/E ratios were compared, Ox and Augur dominated the chart. However, it is important to understand that their market caps are significantly smaller and they have spent a little less time then MakerDAO and Synthetix on the Ethereum mainnet. Hence, these tokens need to establish a better token economic structure in order to capture value from protocol fees.

In comparison, MakerDAO held a respectable 80 P/E ratio which outperformed Synthetix’s low P/E returns. The general difference between their annualized earnings and P/E ratios indicated that these money protocols generate cash flows and mirror properties of traditional assets, but they are unlikely to produce monetary premiums because currently, they are responsible for supporting the lending protocol, rather than acting as store-of-value.

The P/E ratio analysis suggested that DeFi tokens may have thrived in the industry, but in terms of cultivating significant cash flows, there is still a lot of work to do.