Ethereum

Ethereum 2.0’s delays fail to hinder positive outlook

Ethereum has been one of the best performers among the top 10 on the cryptocurrency charts. Even on the development side, it has been in the news a lot – Ethereum 2.0 launch date is yet to be scheduled, a major update and transition to Proof-of-Stake which was initially slated to release in January this year. This has, however, not deterred the Ethereum community’s interest.

According to stats revealed by IntoTheBlock, there are currently 667.83 million addresses on the Ethereum blockchain, a figure that represented a surge of 9.7% YTD. Out of these, 30.26 million addresses had some amount of balance in ETH. Additionally, the highest number of addresses with a balance was 30.48 million ETH.

As ETH 2.0’s launch approaches, Ethereum has witnessed a rapid surge in terms of the number of addresses. When ETH’s price hit an ATH of around $1,400 in 2018, the number of Ethereum addresses was less than 10 million. Despite the price of ETH declining by more than 80% since then, the figures for the number of addresses with non-zero balance have actually increased by 350%.

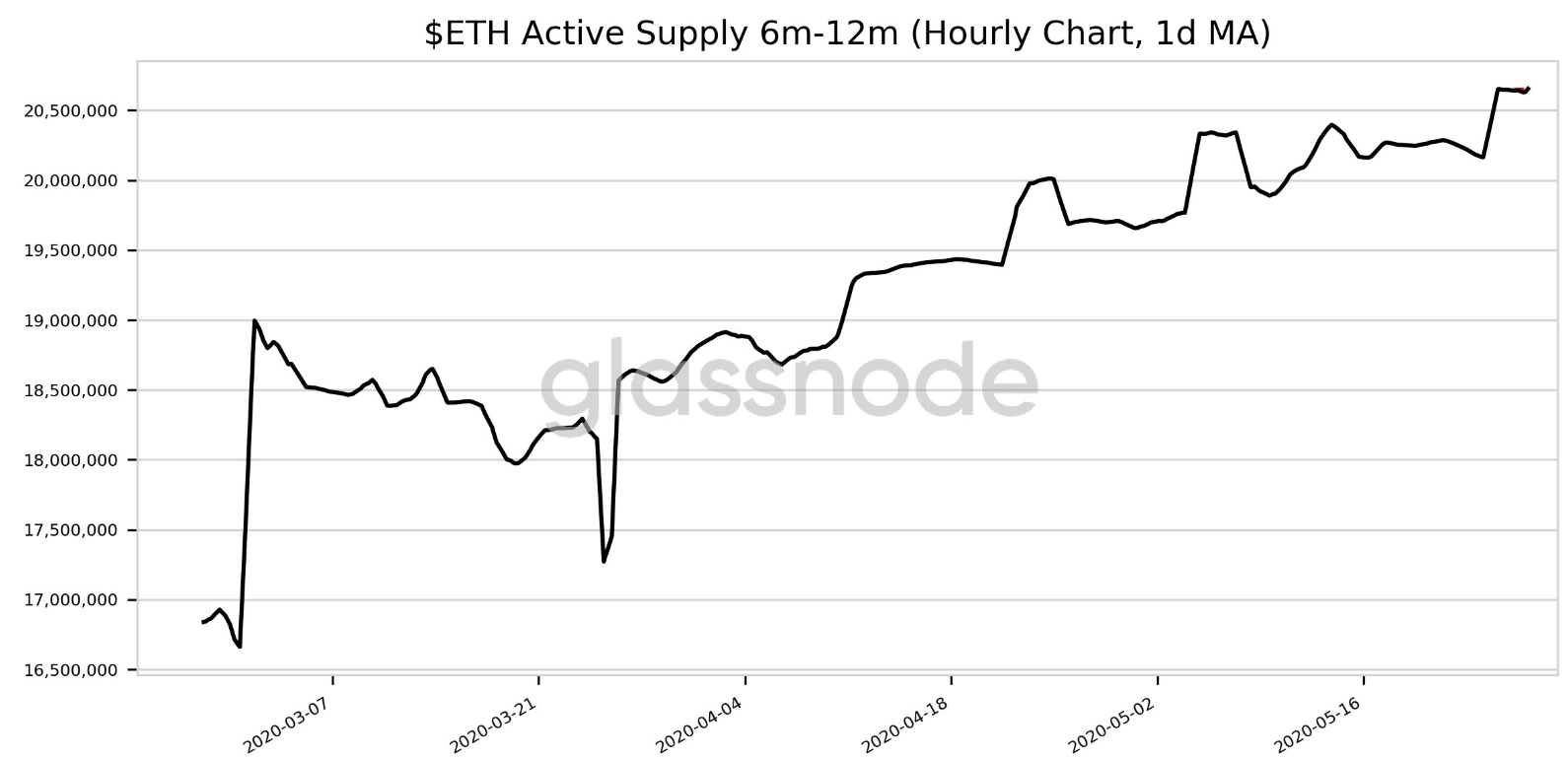

Source: Glassnode

Further, at the time of writing, Ethereum’s Active Supply for 6 months-12 months [1d MA] had reached a 3-month high of 20,653,710.315. This pointed to a rise in small ETH hodlers as they anticipated the 2.0 launch.

The institutional demand for ETH has also been observed to be surging. Grayscale happens to be one of the leading digital asset managers in the space and its Ethereum Trust has noted a significant increase in demand, despite a rather flat price action throughout May. The platform offers digital currency exposure for institutional investors and high-net-worth individuals via traditional investment vehicles that have underlying crypto-assets without the challenges of buying, storing, and safekeeping them.

Interestingly, Grayscale Investment’s Ethereum Trust witnessed its AUM grow from $11.7 million to $276.5 million, a 23.6x increase.

AMBCrypto had previously reported that the institutional investment platform Grayscale had purchased nearly half of all mined Ethers in 2020. Further, the platform had 5,230,200 shares issued and outstanding on 31 December 2019, with the figure rising to 13,255,400 on 24 April 2020.

Interestingly, another strong indication of a bullish outlook in the community was the rise in daily ‘Gas’ usage in Ethereum. Essentially, Gas is burned when users execute transactions on Ethereum DApps. Higher gas usage is evidence that either there are increasing DApp users or more usage among existing users, or both. Further, according to data from Etherscan, the growing usage of Ethereum Gas depicted an increase in user activity on the ETH network.

In either case, this is positive news for Ethereum’s long-term price.

Source: Etherscan