Ethereum 2.0 might be catalyzing growing accumulation as hodlers eye profits

It has been a couple of days since Bitcoin underwent its heavily-publicized halving. In fact, many were speculating what its effects would be on accumulation, something that has been on the rise for quite some time now. Interestingly, the accumulation rates of cryptocurrencies continued to rise, even after the supply cut event of the world’s larger cryptocurrency.

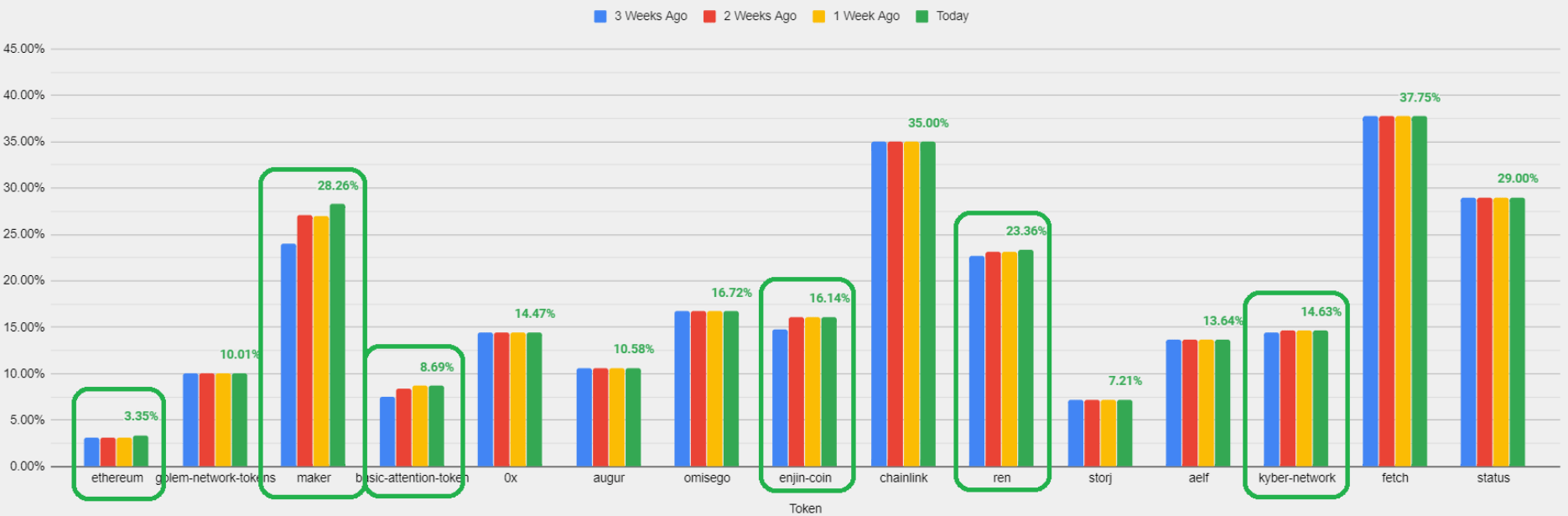

This was evident when observing the latest charts by crypto-analytics platform Santiment, with its latest tweet reading,

“What has the #1 respective top holder done with their holdings for several key crypto assets over the past few weeks? Short answer: ACCUMULATING”

Source: Santiment

The largest addresses for every ERC-20 token, tracked by Santifeed’s top holder model, were either observed to be hodling or accumulating greater total supplies over time. Top token holders essentially describe a set of up to 100 Ethereum addresses which have the highest balances at a given time, either in Ether or in a specific ERC-20 token.

This finding means that many of the market’s hodlers are in anticipation of bullish price movements in the near-term, with most of them eyeing the accumulation of more profits. So, what is catalyzing this trend?

The much-awaited Ethereum 2.0 could potentially be driving this trend. Ethereum 2.0 represents a fundamental shift in the consensus mechanism of the blockchain from a proof-of-work [PoW] consensus algorithm to proof-of-stake [PoS]. Its release has been met with significant roadblocks and missed deadlines due to which it remained a moving target for the most part of 2019.

The initial launch date for the roll-out of Phase 0 was scheduled for the second week of January this year, but it was postponed at the last minute. Later in March, it was reported that the goal was to release Phase 0 before Ethereum’s 5th anniversary in July. But, this too might not work out. While Ethereum 2.0 is still very much on track, its schedules might not be written in stone, clarified Vitalik Buterin.

Despite delays, however, Ethereum 2.0 is touted as a major development, something evidenced by the altcoin’s positive price action of late as it held its position at $200. While Bitcoin’s halving did catapult Ethereum’s price post the March crash, the whole new transition to a completely new economic model for Ethereum blockchain has garnered significant traction across the ecosystem.

In fact, Messari’s Ryan Watkins had also recently tweeted,

“ETH 2.0 is a much stronger catalyst than the Bitcoin halving simply because it’s an uncertain and fundamental change.”

Further, analyst and former marketing director of Dogecoin, Adam Cochran, had stated recently that Eth 2.0 will create the next economic shift as large investors are likely to “pour money into the lock-up” as well as the supply shock that will result from the accumulation of the whales.