DeFi

Which assets stand to gain from ETH-BTC correlation?

With Bitcoin’s price rallying, altcoins that are strongly correlated to the world’s largest cryptocurrency are set to benefit immensely from it. However, one unusual category of projects, DeFi, may benefit from Bitcoin’s rally too, despite its top projects being inversely correlated with Bitcoin.

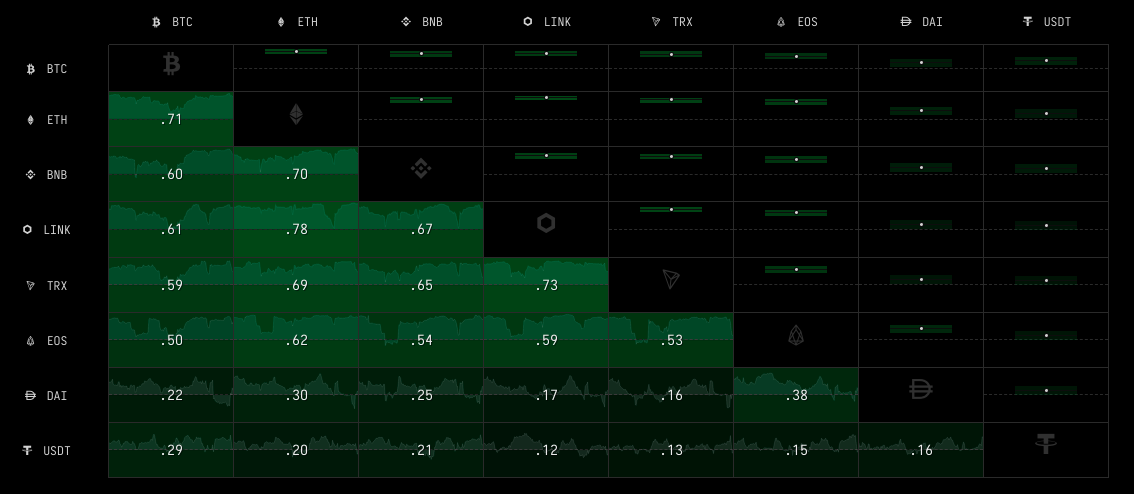

Correlation of cryptocurrency projects with BTC || Source: Cryptowatch

Based on data from Cryptowatch, ETH’s correlation with BTC, at the time of writing, was 0.71, the highest among altcoins. In fact, ETH’s price has rallied by 16.89% in one week, in response to BTC’s one week gain of 12.45%.

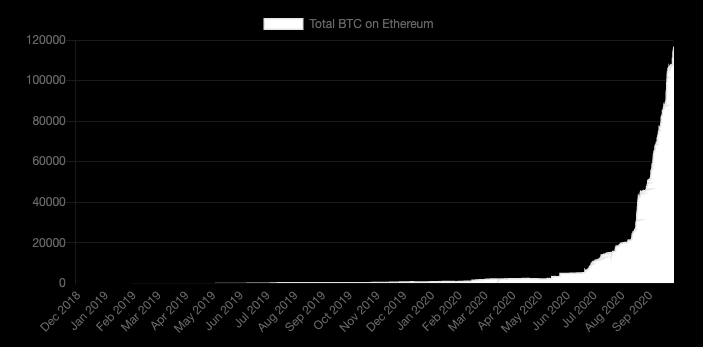

ETH’s correlation with BTC was 0.95 in July 2020. And, while the same has dropped to 0.71, the asset continues to benefit from a relatively high correlation, when compared to other market altcoins. A total of 152.9k BTC is on ETH, based on data from BTC on ETH. This BTC is in wBTC, renBTC, HBTC. This BTC on ETH implies that when BTC’s price goes up, the collateralized value becomes available for leverage. This is possibly pushing BTC’s price higher and due to the drop in the correlation spread of ETH-BTC, ETH’s price is rallying, alongside Bitcoin’s.

BTC on ETH || Source: BTConETH

Though some DeFi projects have a notoriously inverse correlation with BTC, they continue to benefit directly from their correlation with ETH. In fact, DeFi’s correlation with ETH has remained high for months now, though it is low with BTC. Ergo, DeFi may benefit from the ETH rally as its TVL, despite several drops over the past 30 days, has recovered subsequently and is 10% higher, when compared to the first week of October 2020.

TVL in DeFi || Source: DeFiPulse

Interestingly, TVL in DeFi had dropped considerably over the last week of October, however, it soon recovered almost entirely, with the same noted to be as high as $12.32B on 8 November 2020.

What makes DeFi projects different from other altcoins in retail traders’ portfolios is its unique positioning with ETH. Back in July 2020, DeFi’s boom powered the ETH rally. Transaction fees were up considerably and ETH was congested. However, ETH rallied and it was driven entirely by DeFi. This relationship with ETH may benefit DeFi projects in the long run, despite their inverse correlation with BTC. Higher the price of BTC, the higher the TVL, and volumes, and fees in DeFi, especially blue-chip DeFi projects that are widely being used.

Such a sentiment was also shared by Three Arrows Capital CEO Su Zhu who recently tweeted about this unfair advantage of DeFi projects over altcoins,

Source: Twitter

Other altcoins may benefit, entirely from their correlation with BTC, when the altcoin rally begins. However, DeFi has had a high correlation with ETH since July 2020 and this is sure to benefit DeFi projects more, both in the long and short-term. Despite most top DeFi projects giving negative returns in September 2020, the potential for profits in DeFi is high and the lucrative incentive structure is enough for most retail traders to park their funds.