Dogecoin, Maker, Ethereum Classic Price: Market uncertainty despite positives

After welcoming a bullish trend as the month dawned, a few altcoins underwent a downside correction and propelled a fresh market, one where the alts were closer to their support levels.

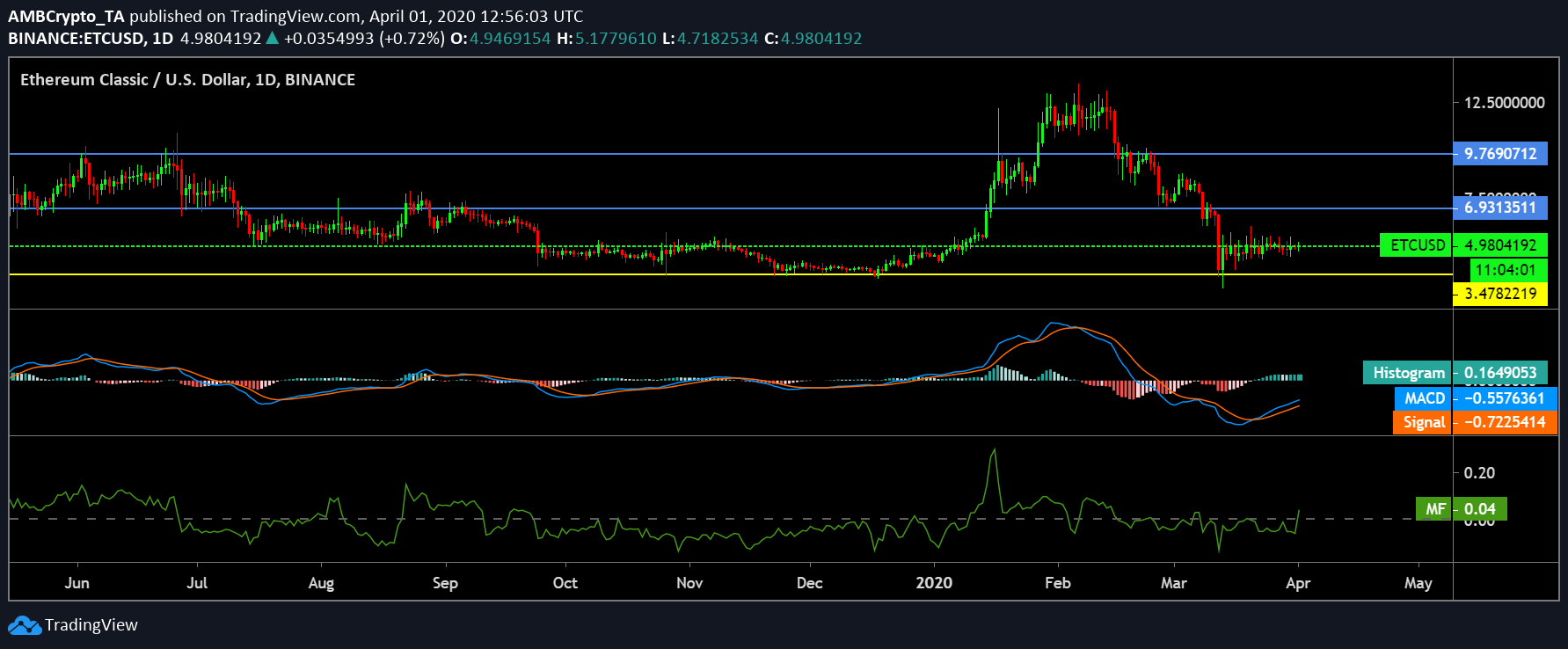

Ethereum Classic [ETC]

Source: ETC/USD on TradingView

Ethereum Classic’s partnership with Chainlink earlier last month has been one of the biggest highlights for the ecosystem this year.

At press time, ETC was priced at $4.80 with a market cap of $575.7 million and a 24-hour trading volume of $1.31 million. Further, the coin recorded a slight change of 0.12% to the positive side.

Resistance: $6.93, $9.76

Support: $3.47

MACD: The MACD line moving above the signal line represented a bullish phase for the coin.

CMF: The CMF also appeared to have sprung up to the bullish region.

Maker [MKR]

Source: MKR/USD on TradingView

In a bid to bring in more decentralization into the Maker ecosystem, the foundation recently announced the transfer control of MKR tokens to the community.

At press time, MKR was registering a market cap of $320.1 million and a 24-hour trading volume of $3.20 million. The token was up by a whopping 7.66%, a movement that prompted its price to climb to $284.9.

Resistance: $657.9

Support: $201.7

Parabolic SAR: The dotted markers below the MKR candlesticks implied a bullish trend for the coin in the offing.

Awesome Oscillator: The AO indicator, however, was slightly bearish as the final closing bar was red.

Dogecoin [DOGE]

Source: DOGE/USD on TradingView

This world’s most famous memecoin found support from Tesla honcho, Elon Musk, recently. On its price side, the coin registered a market cap of $224.2 million and was trading at $0.0017, at press time. Additionally, DOGE recorded a trading volume of $156.7 million after a minor decline of 0.71% over the last 24-hours.

Resistance: $0.0025, $0.0032

Support: $0.0015

Klinger Oscillator: Despite the KO line hovering close to the signal line, this indicator noted a bullish trend for the memecoin.

Relative Strength Index: The RSI indicator appeared to be in the oversold region, suggesting that selling pressure was weighing down the DOGE market.