This is what DeFi should do to ensure a favorable 2021

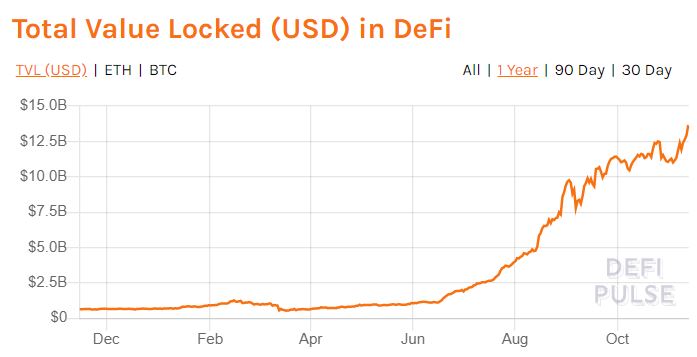

DeFi’s growth this year has been staggering. Towards the start of the year, DeFi’s total value locked (TVL) had managed to hit the $1 billion mark. However, over the next 9 months, DeFi’s TVL jumped to $13.5 billion.

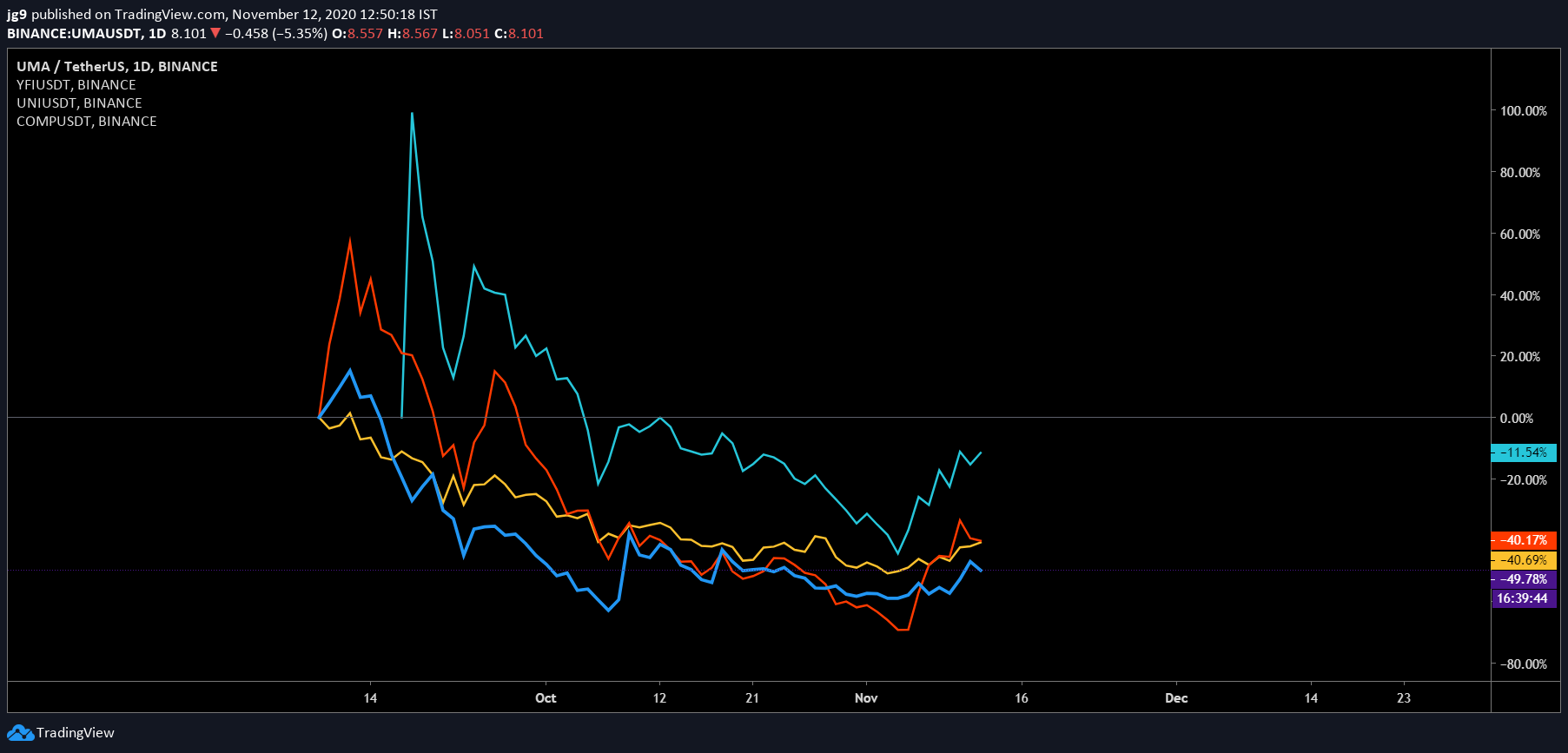

Interestingly, the past month saw the DeFi hype slightly die down, and during the course of October, many DeFi tokens fell on the charts, only to rise again as November kicked in with renewed bullish sentiment for tokens like YFI and COMP.

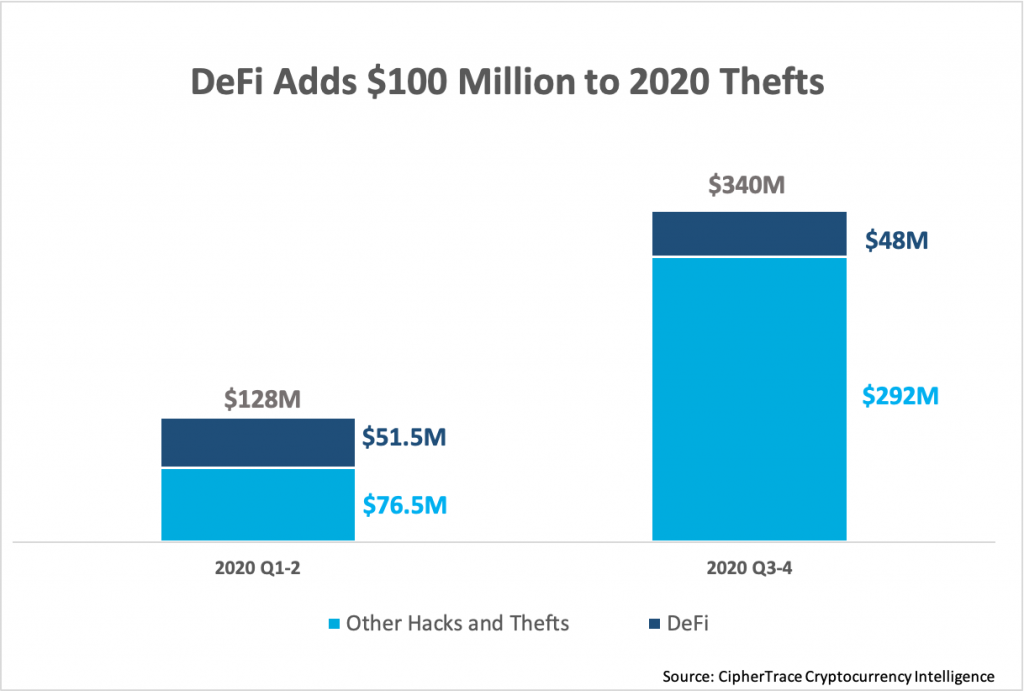

However, while DeFi’s story seems to be progressing from strength to strength in 2020, a darker side of the ecosystem seems to be growing simultaneously. According to a recent report published by CipherTrace, this boom has also attracted criminal hackers to DeFi, resulting in the most DeFi hacks in a year to date. The report highlighted,

“In the first six months of 2020, 45% of all thefts were DeFi hacks, equating to about $51.5M—40% of hacked volume for that time period. So far, in the second half of 2020, DeFi has dominated 50% of all thefts, equally roughly $47.7M—14% of hacked volume for this time period.”

As DeFi grew and rose by a whopping 700 percent in terms of TVL from the beginning of 2020, a troubling underbelly formed. In fact, the aforementioned finding led to CipherTrace’s data concluding that DeFi hacks made up 21% of 2020’s hack and theft volume.

While many would like to believe that the DeFi hype has come to a conclusion, the decentralized finance ecosystem continues to be one of the hot properties of the digital asset market. While September and October painted a fairly different picture for many projects with tokens like YFI, UNI, COMP, UMA, etc. falling by over 50 percent, DeFi’s strong fundamentals seem to have aided these tokens, allowing them to correct their falling trajectories during the first week of November.

According to a recent Longhash report,

“On September 1, when most DeFi tokens reached their peak in terms of market price, the TVL of DeFi was at $9.66 billion. The value locked in DeFi has actually increased since then, despite the correction of DeFi tokens.”

DeFi’s 2020 definitely represents two sides of the same coin. The space has managed to attract substantial interest in 2020, while also managing to raise concerns regarding Ethereum blockchain’s efficiency and capabilities behind handling such high demands and increased activity.

Source: DeFi Pulse

With a TVL that has risen by 14x, the DeFi ecosystem seems to be setting new standards. However, if 2021 is to remain favorable for the space, bad actors within DeFi will have to be weeded out. Highlighting this intrinsic conflict within DeFi and the regulatory scrutiny it could attract if crime levels continue to remain the same, the report noted,

“As such, it is important to be vigilant to its money laundering risks. DEXs have no way of freezing funds like a centralized exchange; instead, this power lies with the individual DeFi projects themselves. However, if the proper steps aren’t taken to ensure the security of the smart contracts on which many DeFi projects rely, it is likely that DeFi will only continue to suffer from the consequences resulting from inadequate AML and security.”