Cryptocurrency users failing to file AML forms may face trouble this tax season

With cryptocurrencies like Bitcoin gaining in adoption and mainstream recognition, the IRS has added measures to ensure that crypto traders pay their fair share of taxes this tax season. With over a month left to file tax returns in the US, many crypto users continue to find the process harrowing with regard to appropriately reporting their crypto activity and gains.

In a recent episode of the Epicenter podcast, Clinton Donnelly, Founder of CryptoTaxAudit, spoke about the intricacies in crypto-tax, the importance of tax amnesty and highlighted some of the biggest mistakes crypto-users tend to make when it comes to filing their tax returns.

Regarding the nature of crypto taxes, Donnelly remarked that “with crypto-taxes, there were a lot of new terms. We didn’t know how to pigeonhole crypto into the tax code or how the tax code applied to cryptos and a lot of accountants are skilled in the manipulation of numbers but not skilled in the reading of the tax law.”

For most crypto users there exist quite a few challenges this tax season. Donnelly highlighted that tax services such as TurboTax, TaxAct do not provide adequate support to ensure that crypto traders and users report their crypto-related activity adequately on tax forms. Many people who deal with cryptocurrency, according to Donnelly, fail to file the Anti-money laundering forms that are mandatory and can attract a $10,000 fine.

“The Report of Foreign Bank and Financial Accounts (FBAR) in From 8938, these are massive. These are $10,000 penalties. Moment, the IRS finds it, mails you a letter that you didn’t submit an FBAR. That’s a $10,000 penalty right there.”

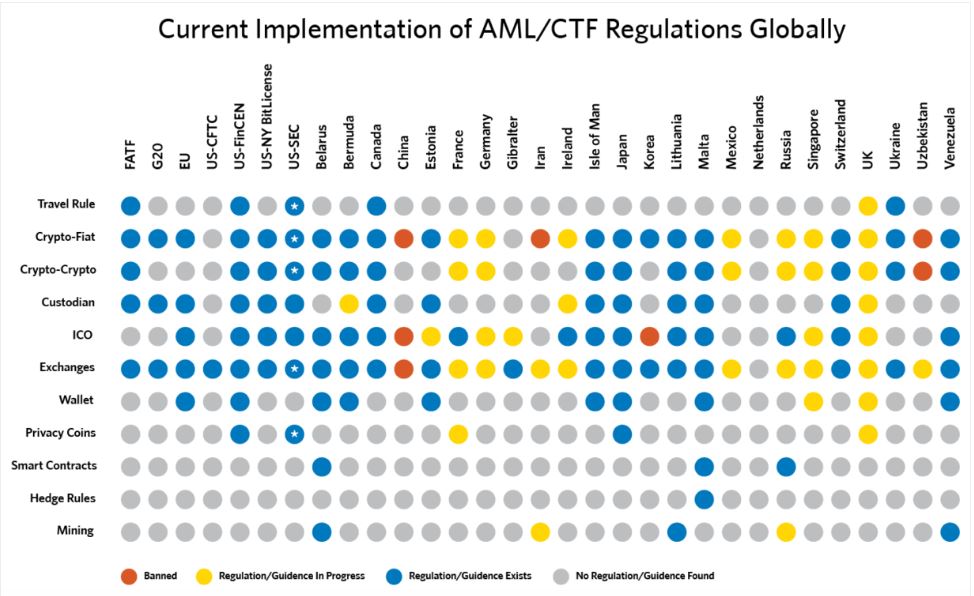

With growing concern across the globe with regard to Anti-money laundering and the role of cryptocurrencies in it, the increasing crackdown by the IRS is understandable. A recent report by CipherTrace showed that across the globe cryptocurrency and AML legislation are becoming more sophisticated particularly in the US.

Source: CipherTrace

For individuals that have made similar discrepancies in their tax forms, Donnelly highlighted how claiming tax-amnesty can be a fail-safe. The tax-amnesty according to Donnelly constitutes a written legal affidavit signed under the penalty of perjury along with the tax return. He went on to add that while filing taxes it is imperative to report all income, fill out the AML forms and report losses if you were victim to a financial scam.

Regarding some of the ambiguity in the IRS’s guidelines, Donnelly stated,

“I think the IRS is leaving taxpayers out in the lurch, and it tells me that they’re not completely clear in their own mind what their strategy is, which puts everybody at risk.”