Crypto-market’s reaction to COVID-19 suggests ‘realistic’ approach from users

In times of geopolitical uncertainty resulting from the likes of the COVID-19 pandemic, many believe non-correlated assets like Bitcoin and other cryptocurrencies offer solace and act as safe-haven assets. However, the past few months have also exhibited crypto’s characteristics when confronted by a global pandemic, which in turn, led to an economic meltdown.

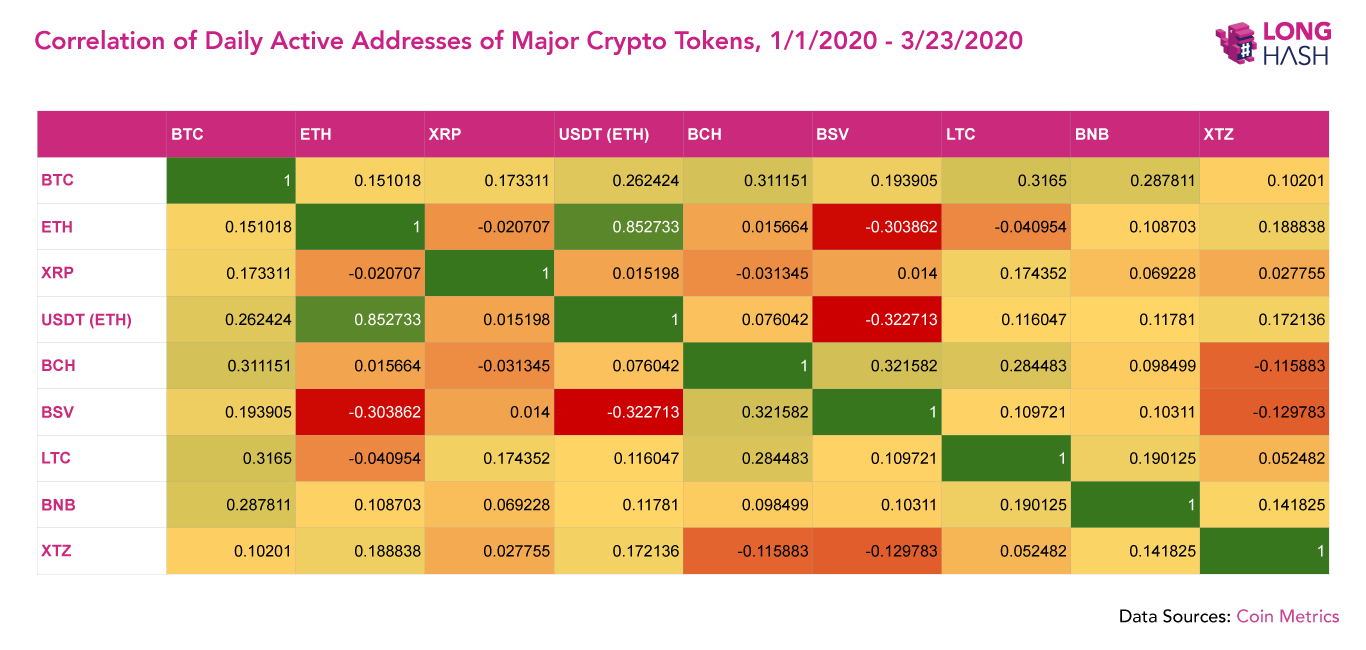

A recent LongHash report analyzed COVID-19 pandemic’s effects on popular cryptocurrencies, in terms of user activity. Taking into account the user activity of the top ten cryptocurrencies in terms of market cap, the report looked at the Pearson correlation scores that identify patterns in terms of the close correlation between the active address counts from the start of the year till 23 March 2020.

Source: LongHash

While the majority of the cryptos failed to show any pattern pertaining to the correlation, an exception to this was Ethereum and USDT’s ERC20 implementation on the Ethereum chain.

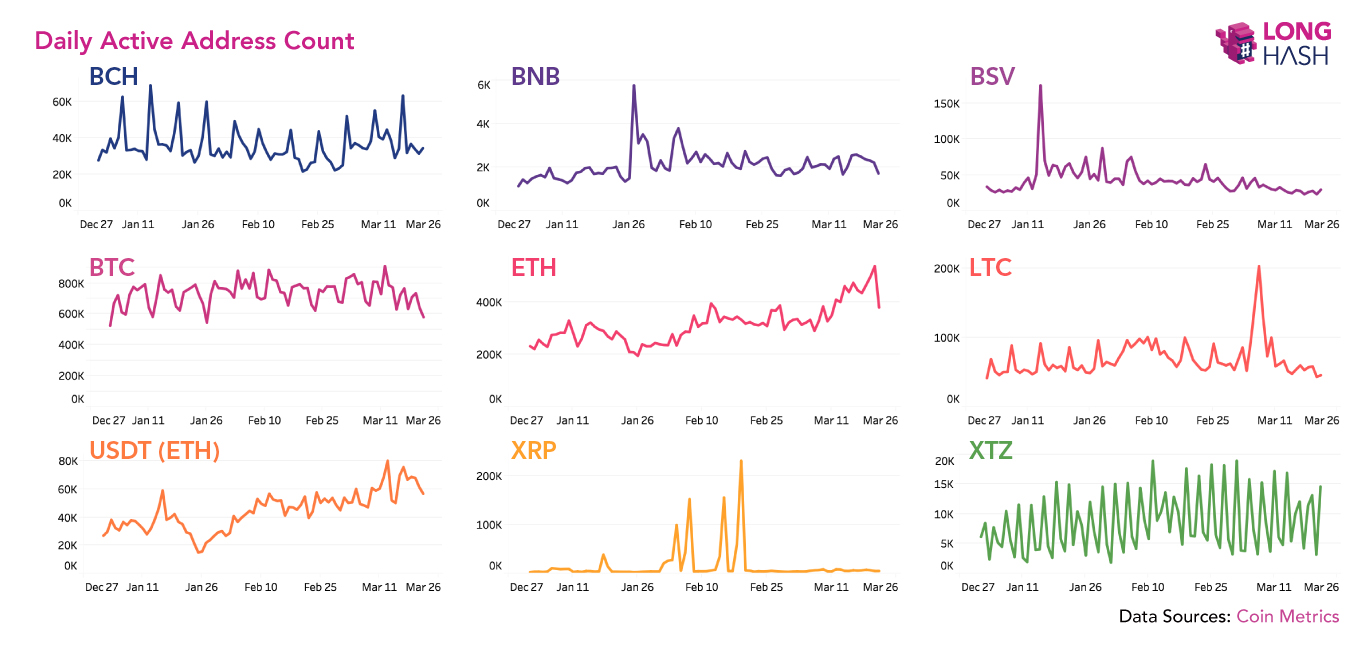

Source: LongHash

However, on analyzing data of the cryptocurrencies individually, with regard to its daily active address count, the report found,

“Active addresses on Ethereum (and USDT’s Ethereum implementation) have climbed pretty noticeably as the COVID-19 crisis has escalated. It may be that many users who aren’t generally active have turned to USDT as a safe haven over the past few weeks, leading to a spike in active addresses here.”

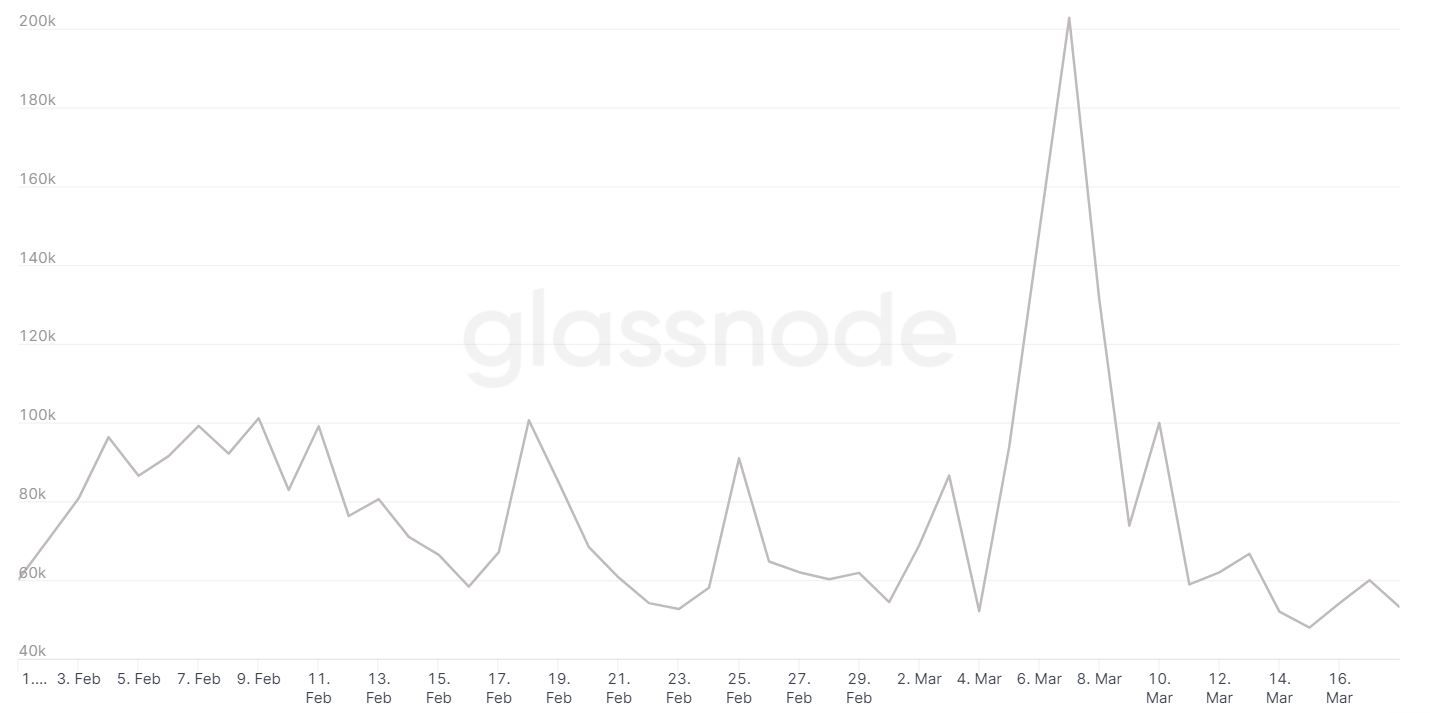

The report also highlighted that between the period of Italy’s lockdown and the announcement of a state of emergency in California, Litecoin recorded a huge spike in active address counts.

Source: Glassnode

In fact, while on 4 March the active address count for LTC was around 52,000, as per data from Glassnode, three days later, the same was over 202,000.

The report went on to highlight that,

“Interestingly, it doesn’t seem like most of these major tokens saw any major changes in active address patterns even as life changed massively for millions as the pandemic spread.”

This finding is of significance primarily because it shows a growing maturity of the crypto and digital assets market. During the course of the study, it was found that there was a notable absence of users abandoning crypto during the crisis. According to LongHash’s study, users today have a more realistic approach and view of the crypto-market. It concluded,

“The fact that many people see the industry as stable enough to withstand this crisis And the fact that people haven’t flocked to it, while less positive, at least suggests that the crypto mainstream may have more realistic expectations about the market, and people aren’t turning to it for some kind of magical rescue from the traditional stock market that isn’t likely to happen.”