Bitcoin

CME Bitcoin Options volume hits ATH as expectation of uptrend remains strong

The halving is less than a week away and with the price of Bitcoin rallying above the $9,200-level, the market has been eagerly anticipating some profits from a potential price pump right after the event. This was evidenced by figures of the Bitcoin Options market. A stalwart in the derivatives ecosystem, the CME has recorded a rise in volume with respect to both its Futures and Options market.

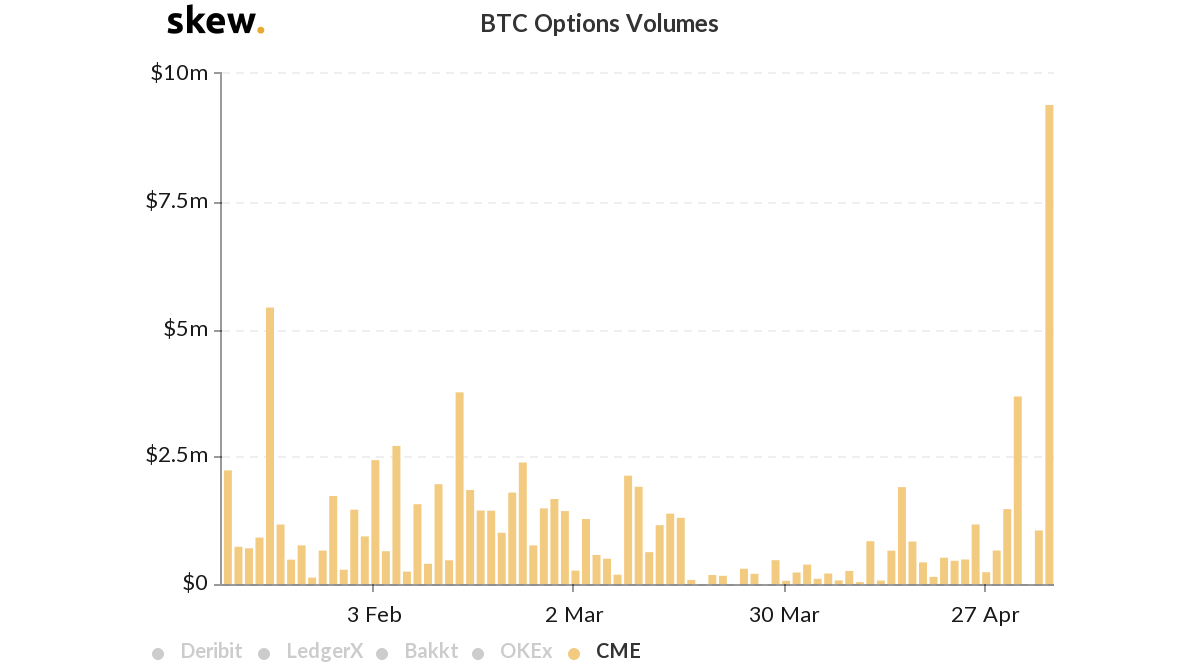

In a recent development, Bitcoin Options volume on the CME hit an all-time high on 5 May, with its volume surging all the way to $9.4 million.

Source: Skew

According to the latest chart from the crypto-analytics firm Skew market, this was accompanied by a rise in Open Interest of BTC Options which witnessed a steady surge, along with the recovering spot price which rose to $14 million. This figure is the highest since the prices fell on 12 March.

An increase in the derivatives trading activity usually follows when a huge spot move occurs and this could be one of the cases. The overall volume of BTC Options rose all the way to $188 million on 29 April and $209 million on the 30th of April.

Besides, realized volatility was mounting over that of implied volatility. To top that, the gauge has been expanding. On 5 March, based on the two volatility charts, the IV was observed to be 4.1 percent while the RV was noted to be 6.6 percent. Based on the difference, it can be noted that there is low anticipation about Bitcoin’s price volatility in the near-term.

Source: Skew

The actions of Options market participants are generally considered crucial, primarily because of the complex nature of the market with experienced players. Therefore, the above data gives a fair view of what Options market players think of Bitcoin’s price post-halving. The sentiment is overall bullish and the expectation of price volatility is low.

This was further validated by the volume on CME BTC Futures, a figure that also surged as Open Interest rose to $339 million recently.