Chainlink: Should investors expect a price correction soon?

- LINK’s price has appreciated by >64% over the past month

- RSI was overbought, and a few indicators were bearish at press time

Chainlink [LINK] has performed very well over the last few weeks as its market capitalization climbed. However, after a comfortable rally, LINK’s price action has now turned red. A possible reason for this could be a drop in investors’ interest.

Read Chainlink’s [LINK] Price Prediction 2023-24

Trouble on the road?

Over the last 30 days, LINK’s price rallied by more than 64%. In the last seven days alone, its value surged by over 12%. While this was promising, it isn’t the case anymore. In fact, at the time of writing, a correction seemed very likely.

According to CoinMarketCap, LINK’s market cap fell to $6.93 billion over the last few hours. A possible reason behind the same could be a drop in investors’ interest.

The same was initially predicted by Michaël van de Poppe, a popular crypto-analyst. He tweeted that despite a positive price chart, LINK accumulation had come to an end.

Done deal. ?

Expecting way more upside, but accumulation seems to be over for $LINK. https://t.co/y7LWThTO9R

— Michaël van de Poppe (@CryptoMichNL) November 5, 2023

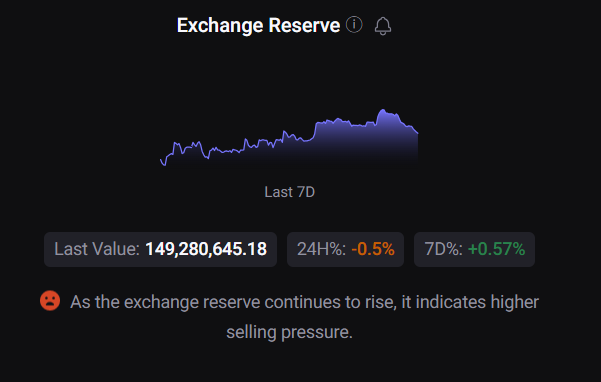

CryptoQuant’s data underlined something similar too. According to the same, LINK’s exchange reserves have been increasing. A high exchange reserve is a sign of higher selling pressure. Additionally, LINK’s Relative Strength Index (RSI) was also in the overbought zone. This could be a sign of selling pressure which, in turn, could push the token’s price down.

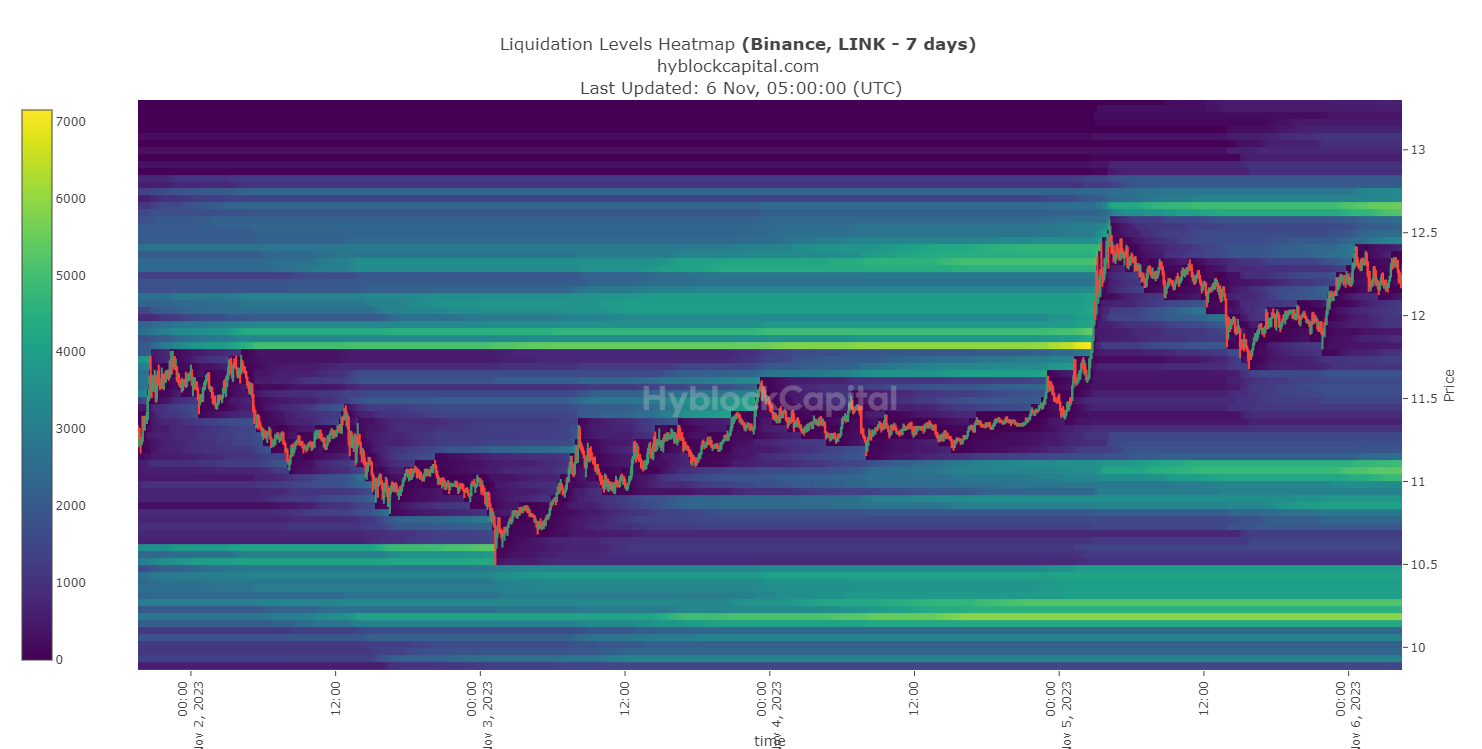

Hyblock Capital’s data also revealed that LINK’s liquidation increased on the 5th of November, when its price hit the $12.4-mark. What this means is that investors were expecting a price correction, so they preferred to sell their holdings at a profit.

On the contrary, Santiment’s charts told a different story. For example, both LINK’s supply on exchanges and supply outside of exchanges remained flat, which didn’t suggest that investors were selling. A similarly flat chart was also noted in terms of its supply held by top addresses.

On the other hand, total amount of holders went up over the last seven days.

How much are 1,10,100 LINKs worth today

Is a price drop inevitable?

Maybe, but there is no clear signal from the charts yet. For instance, the Money Flow Index (MFI) went down sharply, increasing the chances of a price decline. The MACD predicted an upcoming bearish crossover too.

On the contrary, the Chaikin Money Flow (CMF) remained bullish.