Why Bitcoin bears can’t hamper BTC’s movement

- Bitcoin may resist a decline because of the waning distribution of coins.

- Compared to the 10 to 100 BTC selling cohort, the 100,000 to 1 million group were accumulating.

Bitcoin [BTC], once again, moved past $35,000 as the coin gained $3.18% in the last seven days. While the rise may not be convincing enough compared with the performance in October, Mignolet, an author on CryptoQuant, noted that a significant downtrend is unlikely to happen.

Is your portfolio green? Check out the BTC Profit Calculator

Sellers’ weak hands have nothing on BTC

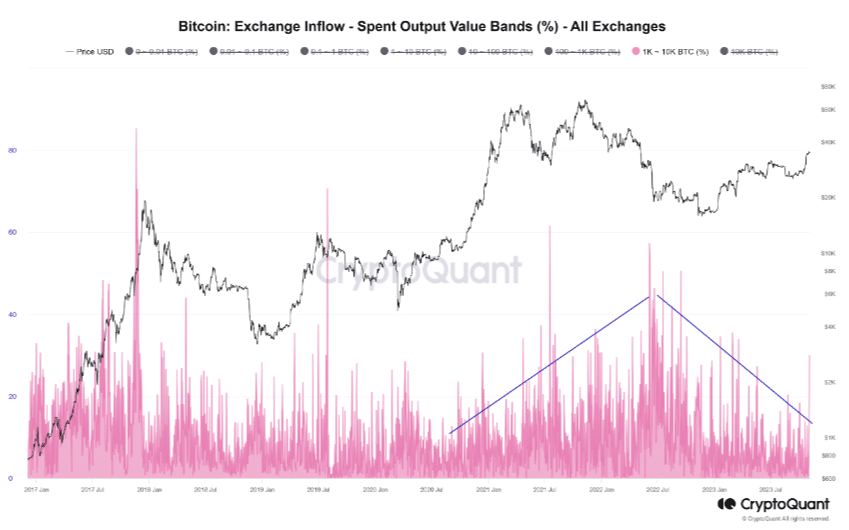

Mignolet, in his analysis, used the Bitcoin exchange inflow Spent Output Value Bands (SOVB) to come to the conclusion mentioned above. The Bitcoin SOVB shows the distribution of all spent outputs flowed into exchange wallets according to their value.

With this metric, one can get the total value of coins spent by a certain cohort. From the chart shared by Mignolet, whales holding around 1000 to 10,000 BTC were quiet around press time.

Although the analyst opined that there have been some movements, he mentioned that it could be irrelevant to BTC’s price action, saying that:

“Recent increase in movement is estimated to be due to the reflection of internal wallet transfer data, and even if it is considered actual investor deposits, it may not be a significant concern.”

Mignolet also mentioned that the 10 to 100 BTC cohort were taking profits. But compared with the current accumulation going on in the market, the selling pressure could be termed weak.

So, when critically looked at, the circumstances suggest that Bitcoin may not experience a significant plunge over the next few days.

Upside potentials and caution

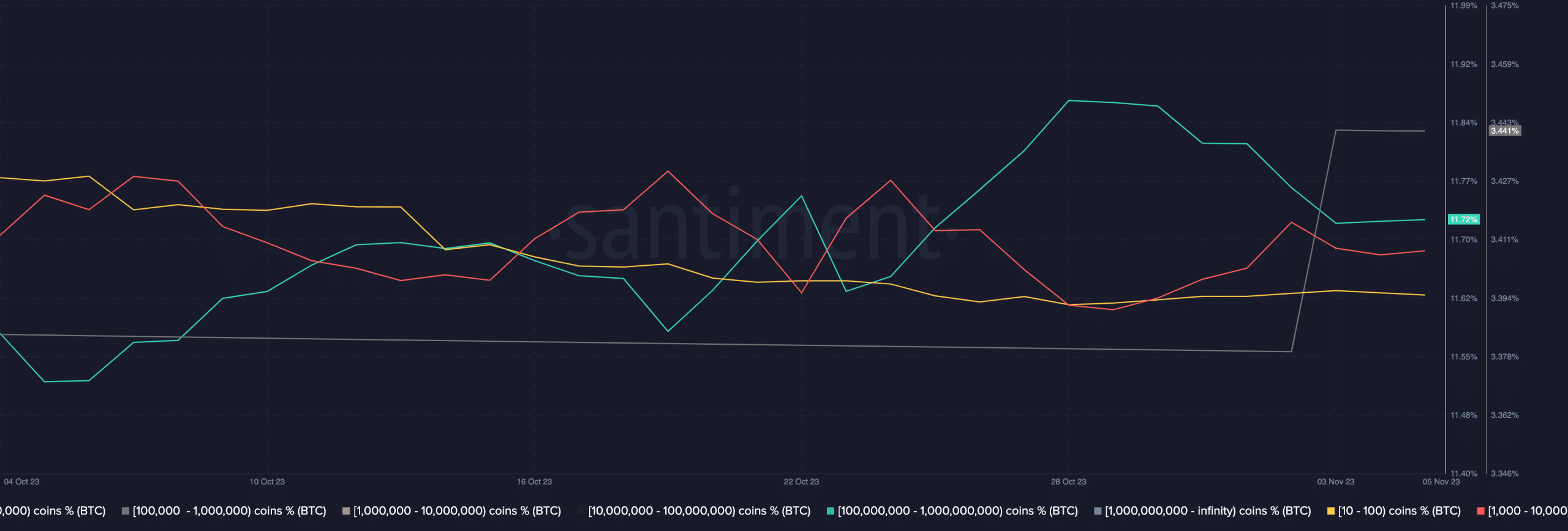

Using Santiment’s data, AMBCrypto also assessed the current Bitcoin accumulation to distribution activity. Accumulation means market players are buying. Distribution implies that holders of a coin are selling.

From the evaluation, the balance of addresses showed that 10,000 to 1 million coin holders were increasing their holdings in droves. AMBCrypto also used the opportunity to compare with the group discussed earlier.

We found out that the pressure applied by the 10,000 to 1 million cohort was much higher than others. Therefore, it is possible that BTC may continue to change hands above $35,000. If the accumulation continues to increase, then $36,000 may not be far off.

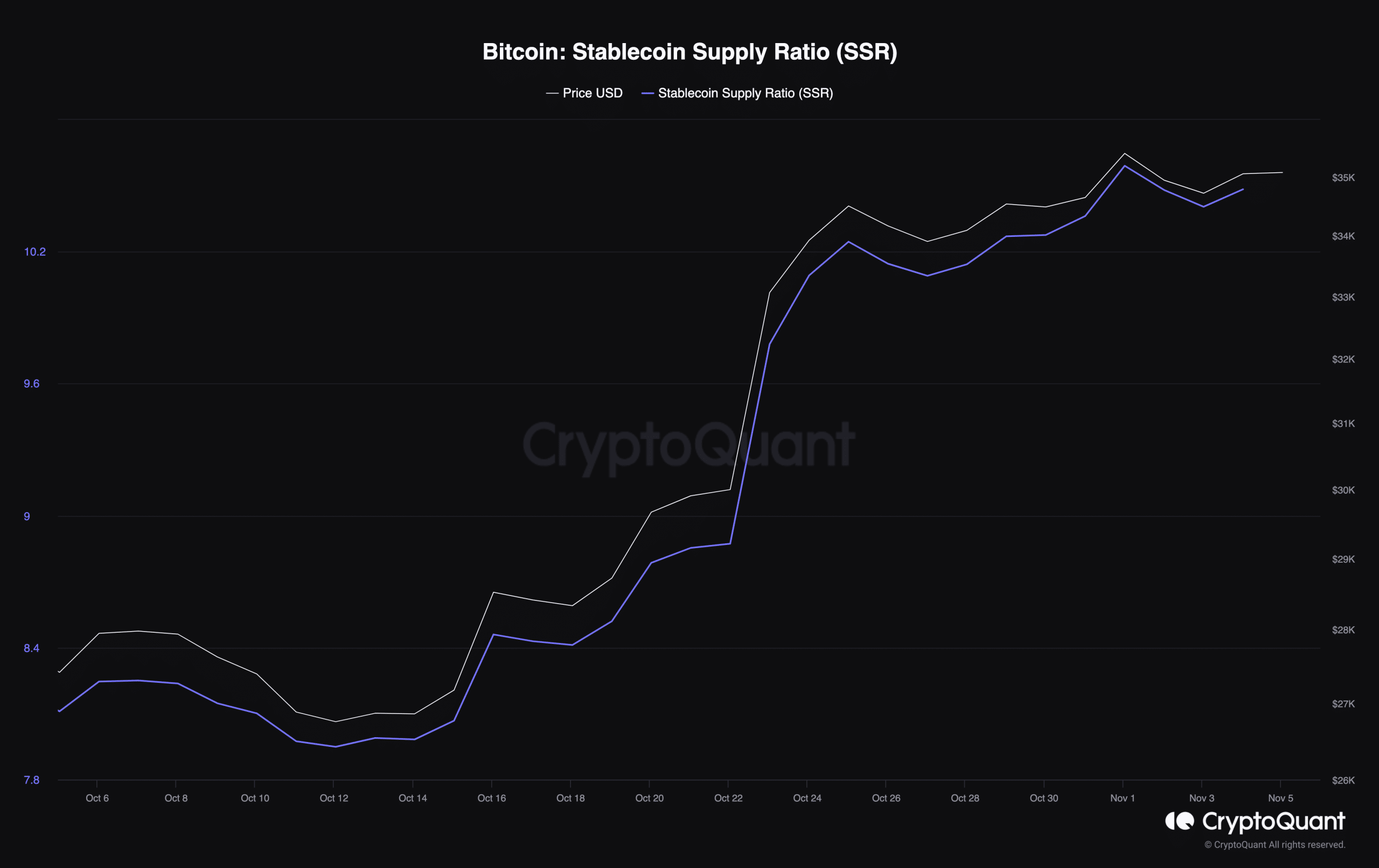

However, market participants would need to be on the lookout for the Stablecoin Supply Ratio (SSR). The SSR reveals the pace at which traders are holding stablecoins. When the value of the SSR is high, it means a low stablecoin supply and potential price fall.

How much are 1,10,100 BTCs worth today?

When the metric is low, it means a high stablecoin supply and potential price rise. At press time, Bitcoin’s SSR had increased. This indicated a possible retracement of the coin’s price.

However, a thorough assessment of the market showed that the stablecoin may have been converted into Bitcoin. If that’s the case, then it could serve as strength for a BTC uptick.