Crypto News

Central banks actively exploring types of CBDCs – general purpose and wholesale

International Monetary Fund’s [IMF] Deputy Managing Director Tao Zhang in his recent keynote address noted that CBDC was a “widely accessible, digital form of fiat money that can be legal tender.” Believing that digital currencies issued by central banks could bring a number of benefits, he stated,

“First, a more efficient payment system.Second, enhanced financial inclusion. Third, more stability and lower barriers to entry for new firms in the payments system. Fourth, enhanced monetary policy. And fifth, a means of countering new digital currencies.”

Research firm CB Insights recently published a report titled ‘The Blockchain Report 2020‘, which outlined developments and the status of CBDC across various countries. The firm highlighted two types of CBDCs – General Purpose and Wholesale.

While General Purpose CBDC is the digital replacement for cash which would enable customers to open banking accounts directly with the federal reserve, wholesale CBDC is exclusively designed for bank-to-bank payments, which if implemented, would be a threat to the correspondent banking system.

Source: The Blockchain Report 2020, CB Insights

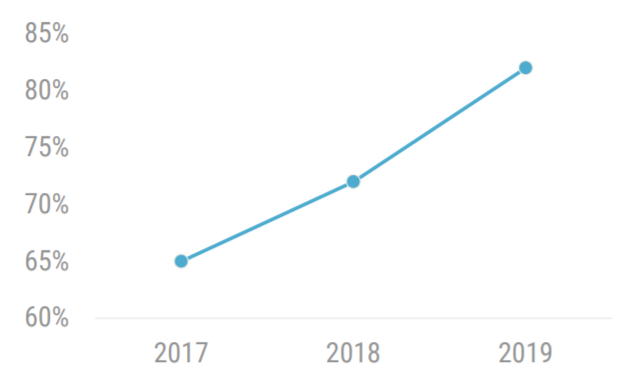

The firm also noted that 80% of surveyed central banks were actively exploring CBDCs; the number has only increased over the past three years, as indicated by the graph. Further analyzing the current status of the CBDC project in various countries, the report pointed out that while China’s Digital Yen is expected sometime in 2020, all the other countries are still in the experimenting phase.

Source: The Blockchain Report 2020, CB Insights

However, Steven Mnuchin, United States Secretary of the Treasury, recently took a stand on ‘Fedcoin’ and stated that there was no need for the Fed to issue a digital currency.

“…Chair Powell and I have discussed this at length – we both agree that in the near future, in the next five years, we see no need for the Fed to issue a digital currency.”

Bank of England‘s Deputy Governor Sir Jon Cunliffe also recently addressed CBDCs and stablecoins and asserted that this new wave of technological development and crypto adoption could “pose a threat to traditional lending”.