Cardano long-term price analysis: 08 July

Cardano has seen a massive surge in the last 10 days with its price appreciating by a massive 82%. In the last 24-hours, the coin has seen a surge of 25%, and its market cap has increased from $1.9 billion to $3.4 billion, and now stands as the sixth-largest cryptocurrency in the world.

3-day chart

ADAUSD TradingView

The 3-day chart of ADA is the only chart that makes sense considering Cardano’s recent exponential surge in value. This surge has put Cardano in the price range that was last seen almost 2 years ago.

At press time, ADA is still in the surge-mode, however, it is faced with an overhead resistance at $0.138. Here, the price will either get rejected or breach the level. If the former takes place, then the ADA will retrace to the immediate support at $0.0936, which is a 32% decline. However, if the price breaches the resistance at $0.138, it will have the opportunity to surge another 40% to the resistance at $0.1881.

The RSI indicator has been overbought for a while, with the overbought level [70] acting as support. The July 2nd pump ended with a retracement of 23% causing the RSI to bounce off the 70-level. Hence, the same might happen again while the price surges exponentially. Not just the price but also the RSI has formed a new ATH due to the recent pump.

Perhaps, the systematic launch of the Shelley from testnet to mainnet is what’s causing this surge. On July 1, a Shelley upgraded node components were deployed on the mainnet and the same changes will be Cardano’s network through a hard fork by the month’s end.

Dropping Correlation with Bitcoin

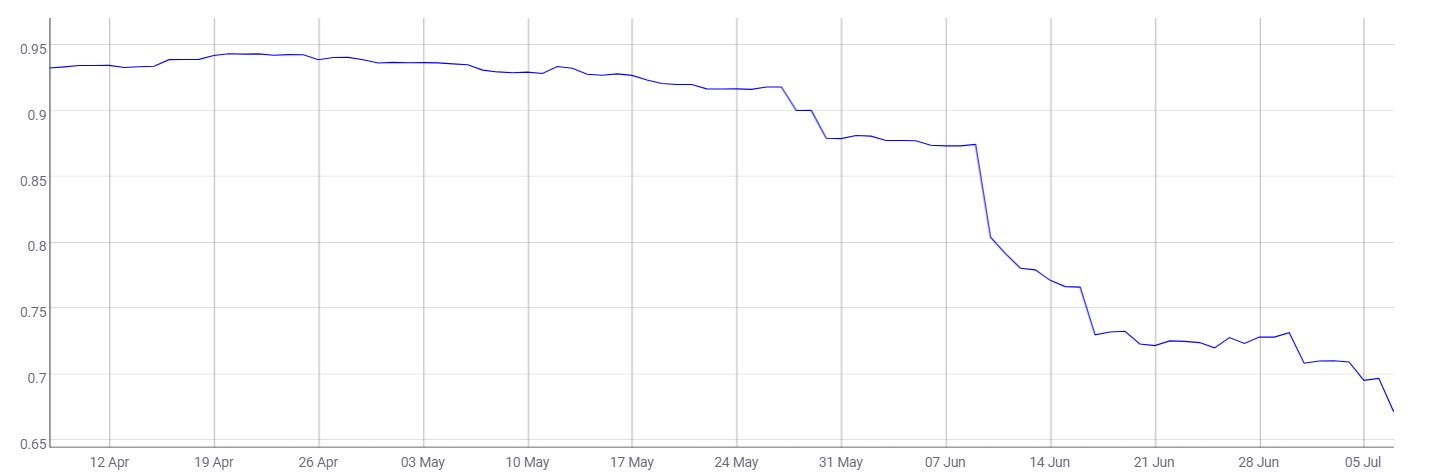

Source: Coinmetrics

All in all, the sixth-largest cryptocurrency is looking rather bullish, especially considering the altcoins pumping while Bitcoin moves sideways. In the last 3 months, the 90-day Pearson correlation of ADA with BTC has fallen off the cliff from 0.932 to 0.671. This reduction could show that altcoins have started a rally without the king coin.