Cardano long-term Price Analysis: 13 September

Crypto-markets, including Cardano’s, have been in limbo for a long time over the direction they are supposed to go. However, since the price isn’t clearly following a trend, it might just be a good time to scalp trade.

At the time of writing, ADA was trading below the $0.1-level and had a market cap of $3 billion. Positioned as the market’s 12th largest cryptocurrency, ADA’s 7-day, 24-hour, and even 1-hour price changes were all positive.

Cardano 4-hour chart

Source: ADA/USD TradingView

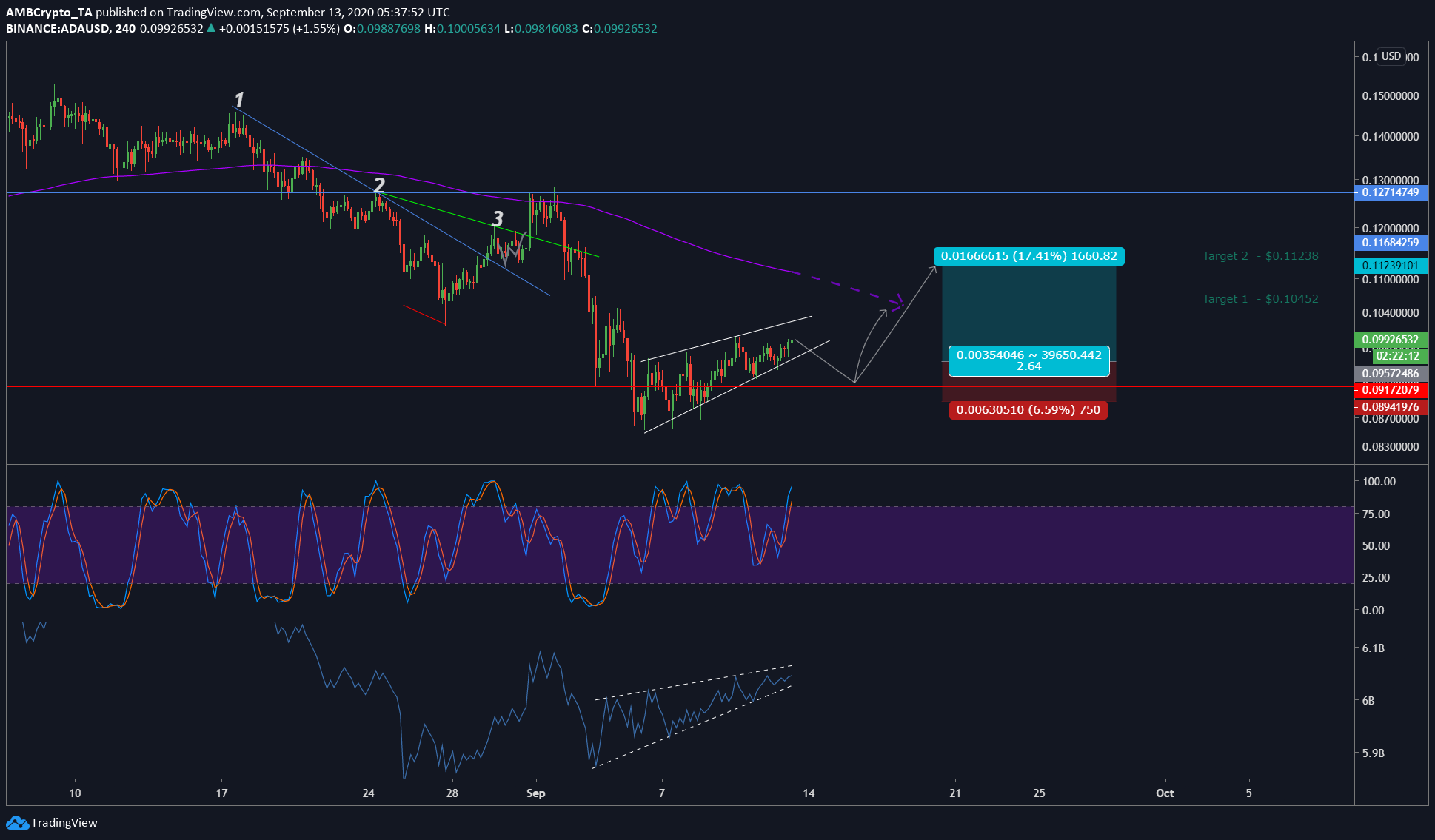

Cardano’s 4-hour chart highlighted a small rising wedge, one that is almost ready for a breakout. Regardless, considering the support/resistance levels present, it might be a good time to open a long position here.

The breakout from the rising wedge might push ADA down to $0.0917, however, the support will push the price even higher, which is the rationale for this long position.

Entering the aforementioned long position at $0.09572 with a stop-loss [$0.0894] well below the immediate resistance at $0.0917 would yield a loss of 6.59%. However, if the price reaches the first target at $0.10452, it would mean a 9.17% profit or 1.39R. Additionally, the target would yield a total R of 2.64 or 17.41% profit.

Although the second target does give more profit, it seems tough to achieve considering the 200 EMA on the 4-hour chart. Moreover, the confluence of the 200-EMA with the resistance at $0.10452 would be the perfect take-profit level.

Additionally, the Stochastic RSI was also in the overbought territory, indicating a reversal soon. This goes hand-in-hand with the rising wedge break, as mentioned above. The OBV indicator also formed a rising wedge similar to the price, which was also hinting at a breakout soon.

Moving the stop-loss after target 1 is achieved could help in maximizing the profit should the price hit target 2. Although unlikely, there is a chance the price might hit it as Bitcoin might be hinting at a higher move, perhaps somwhere near $11,000 or $11,100.