Can cryptocurrency portfolios be aided by tools built for traditional finance?

Ever since the crash, on-chain metrics suggest that investors now have predominantly bullish sentiment and are increasing their positions and hodling even more. With an increased interest in Bitcoin as a long term digital asset, there have been also increased development of investment products to cater to the demand.

Chandan Lodha, Co-founder of Cointracker, speaking on The Pomp podcast delved into the crypto ecosystem and highlighted the opportunities and challenges faced when it comes to investment portfolios and in portfolio tracking products for investors. He highlighted how tools built for traditional finance can positively benefit the crypto industry as well, he said,

“There are lots of very intelligent people who have been thinking about this outside of crypto, for regular finances and many of those strategies and tools can be built for the crypto ecosystem, and that’s a lot of what we’re doing. There are certain nuances and idiosyncrasies about cryptocurrency specifically, and that is what makes it challenging to build the tool in this space.”

While decentralization is a boon when it comes to better security and as a form of democratization within the financial sector, for fintech innovations like DeFi, its decentralized nature makes it a challenging arena in relation to the regulations. Lodha pointed out how the absence of financial statements adds a layer of complexity when it comes to compliance and building a portfolio tracking mechanism, he said,

“Another example of this is around DeFi. So there are so many different products now, where you can earn interest, you can do lending, you can do derivatives and the weird thing is those platforms oftentimes are decentralized in a way where there’s no company that’s providing you financial statements.”

Lodha pointed out that in the case of margin trading when fees are paid in crypto, the fees are subject to capital gains, and these intricacies once again highlight the intricate nuances that need to be tracked for investors. He said, “In some of these margin accounts are paying fees in crypto itself. So it’s not only the regular transaction but the fees themselves that are incurring capital gains. So there are all of these kinds of weird nuances that we have to integrate with and keep track of. ”

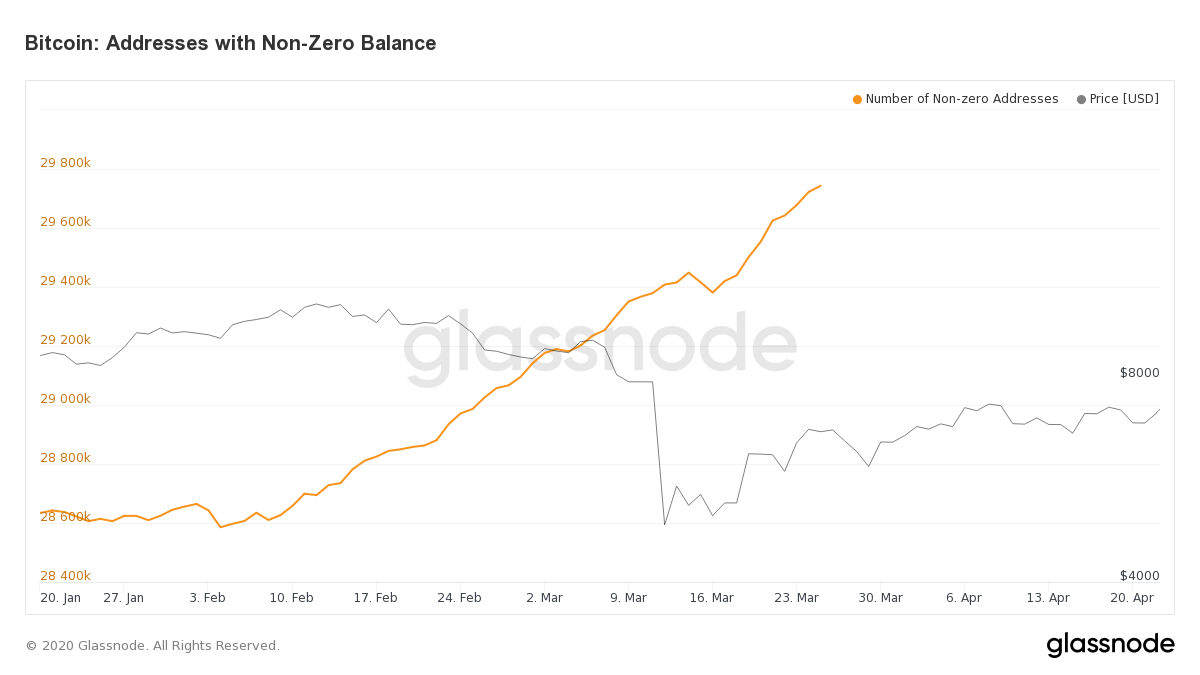

Source: Glassnode

As Bitcoin goes into the third halving after having endured a huge price drop, network data for Bitcoin suggests a surge in interest as non-zero balance addresses spiked when the price registered record lows. This shows a solid interest in the king coin’s fate and also hints at the need for new investment vehicles into crypto and Bitcoin. Lodha noted,

“Ideally, we want to support every kind of interaction and transaction type platform, user flow that is popular and so we kind of prioritize things based on user demand that way.”