Bitcoin

Bitcoin’s upcoming bull run might be similar to that of 2017

The 2020 Bitcoin bull run might mirror the 2017 bull run. While some know and understand the “Lambo and moon” memes, others have forgotten it, however, there are some that don’t relate to these words; these are the new entrants to the world of bitcoin and cryptocurrencies. These are the people that missed the 2017 bull run, which was the first bull run for most people. It has been quite a while since that bull run; two and a half years to be precise.

When moon?

The last time bitcoin was in a bull run was on December 17, 2017, when it hit a new all-time high of $19,666. Since this point, the coin has struggled to hit new highs. People who missed this bull run or came at the end, have been waiting for a rally for way too long. The 2017 rally was in a league of its own as it was coupled with the ICO boom.

Though some ICOs aimed at doing good using the new-found technology, most were literally advertising their tokens to scam unbeknownst investors out of their money, only to get-rich-quick. According to research conducted by AMBCrypto, it was found out that 45% of the ICOs withered away and never came through with their promises.

Hence, the main reason why the nostalgia of 2017 still reverberates the ecosystem is due to the surge in the value of shitcoins. Not only did Bitcoin surge by 11,600% in the third cycle, but some altcoins beat this surge. Hence, the euphoria of the 2017 cycle is one that just won’t go away.

So, the question that both new and existing enthusiasts keep asking is “when moon?”

Bitcoin Cycles

Source: BTCUSD TradingView

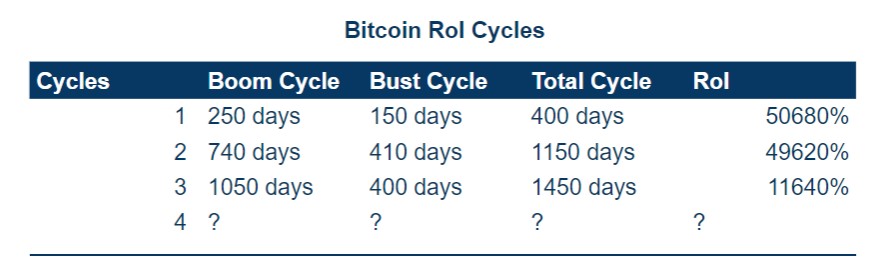

To understand this, there needs to be a brief understanding of how BTC is performing as an asset. Bitcoin, like any other asset, undergoes bull and bear rallies, and together, it constitutes one full cycle. So far, BTC has undergone 3 cycles, the first cycle lasted 400 days in total, while the second – 1150 days, and the third – 1450 days. Obviously, the time taken for eventual cycles to complete has been on the rise, hence, the yet-to-be bull rally will take its time.

Based on general observations, the next rally will peak towards the end of 2022, hence, the price is now setting up for this rally by moving sideways. Additionally, yesterday’s article also mentions why the bull run is just around the corner.

A caveat to all of the above is how similar the next rally is to the previous. The 2017 rally had ICOs booming while the upcoming rally might be accompanied/triggered by DeFi and more specifically, governance tokens. Compound, one of the largest lending platforms on DeFi, birthed this trend and soon, different platforms are coming up with similar processes.

While governance token, yield/liquidity farming has just begun, there’s no telling if this really will trigger the bull run. Hence, this is mere speculation, and perhaps, this trend, like STOs, IEO will also disappear into the oblivion. Regardless, the bull rally is around the corner and is precisely following the plotted curve as seen above.

In summary, the next bull run might not exhibit RoI similar to 2017 rally, but it will push the price of bitcoin in the six-digit zone. Based on a previously written article, Bitcoin is likely to surge by at least 1000%.