Bitcoin options trading shows 25% probability of BTC crossing $10k by June 2020

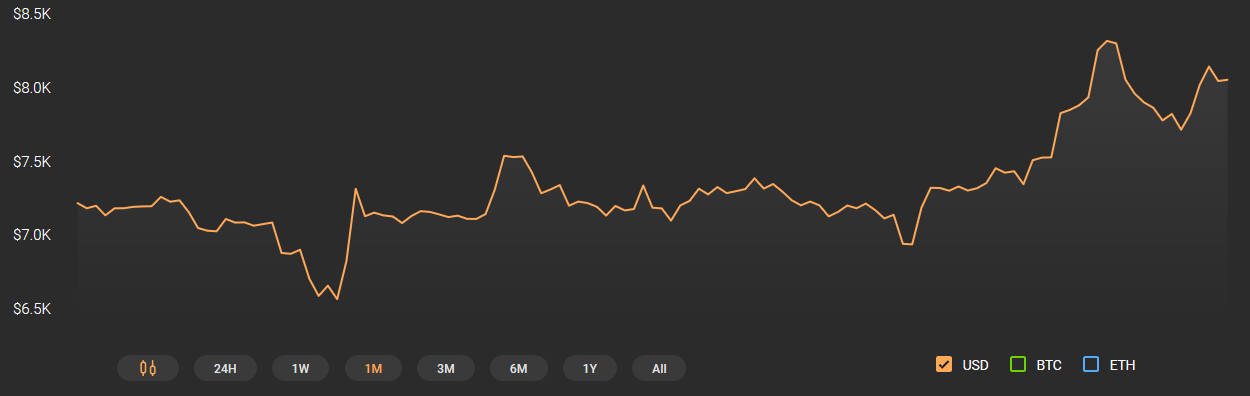

Over the past seven days, Bitcoin’s price has been revived after witnessing a lukewarm period in December 2019.

Source: Coinstats

Since January 4th, BTC’s valuation has scaled up to 15 percent, and at press time the largest digital asset held strong consolidation above the $8000. It is important to note BTC’s price was around $6900 on the 2nd day of the month.

Source: Arcane Research

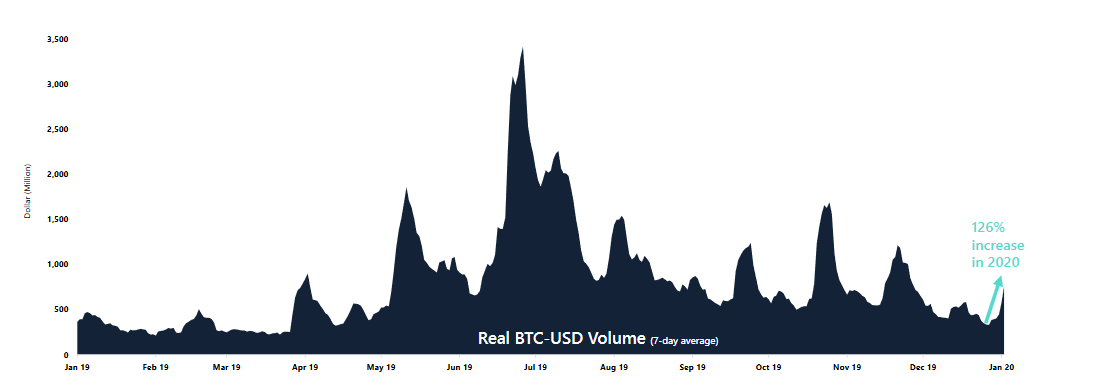

According to Arcane Research, Bitcoin’s real-time trading volume exhibited a huge pump after depreciating to major low levels during the last week of 2019. The 7-day average real trading volume was not impressive on 1st January either, which was estimated to be around a meager $192 million.

However, a sharp recovery unfolded in the market since then, as a spike of 126 percent has been calculated over the last 11 days. The trading volume of 8th January was $1.5 billion, which marked a radical transition from the previous month.

Source: Coinmetrics

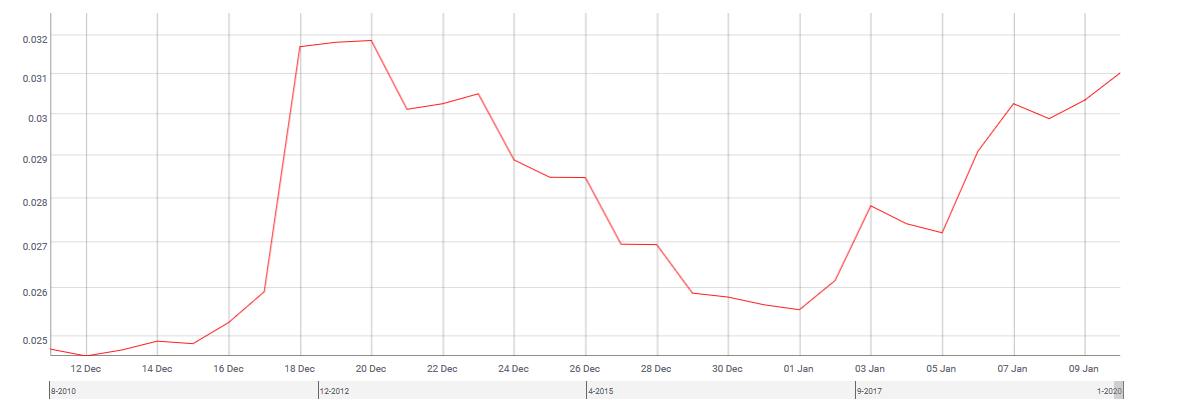

Along with the rise in price and volume, Bitcoin’s volatility naturally followed suit as the 30-day BTC volatility nullified a downtrend that stretched from 20th December to 1st January. The levels surged, climbing above 3 percent again.

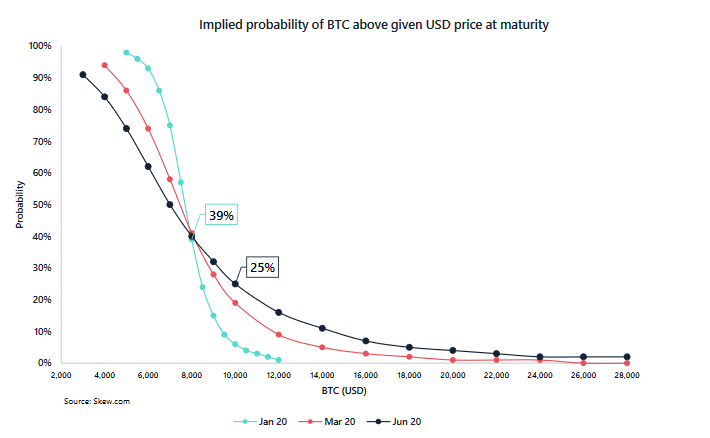

The major narrative that improved over the past week and turned bullish is the Bitcoin probability index for Options Trading.

Source: Arcane Research

The report suggested that the probability of Bitcoin crossing $10,000 by June 2020 had increased by up to 25 percent in terms of Options Trading. Back in November 2019, the probability was less than 10 percent, which indicated that a bearish stronghold.

The recent change in sentiment is a positive outlook for Bitcoin, as Options trading for the short-term also pictured a 39 percent probability of ending January 2020 above $8000.