Bitcoin’s post-halving price may not awe the retail players

According to Google Trends, Bitcoin’s halving has gained traction like never before. It has surpassed its previous halving hype; although to be fair, Bitcoin wasn’t as well-known in 2016. Regardless, the anticipation over the third Bitcoin halving has caused the price to not only hit $10,000 but also dip as low as $8,100.

However, all the halvings are encoded in Bitcoin; at each halving, the reward gets halved. For the third halving, it will reduce from 12.5 BTC to 6.25 BTC. Bitcoin’s price variation before and after the halving seems to be following a similar trend around the time of halving.

The reason for this can be split up into two aspects – the economics, the emotion. The emotion drives the narrative before and after the halving economics paints the picture. The anticipation of halving and price increase causes frenzy and a lot of retail to buy BTC, thus driving up the price. The price rises because of the economic conditions in play, ie., supply drops while demand remains the same, hence the price appreciates. Therefore, each halving, the price rises in anticipation and drops after the halving and continues to surge later.

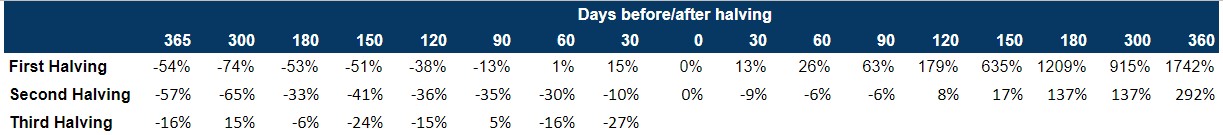

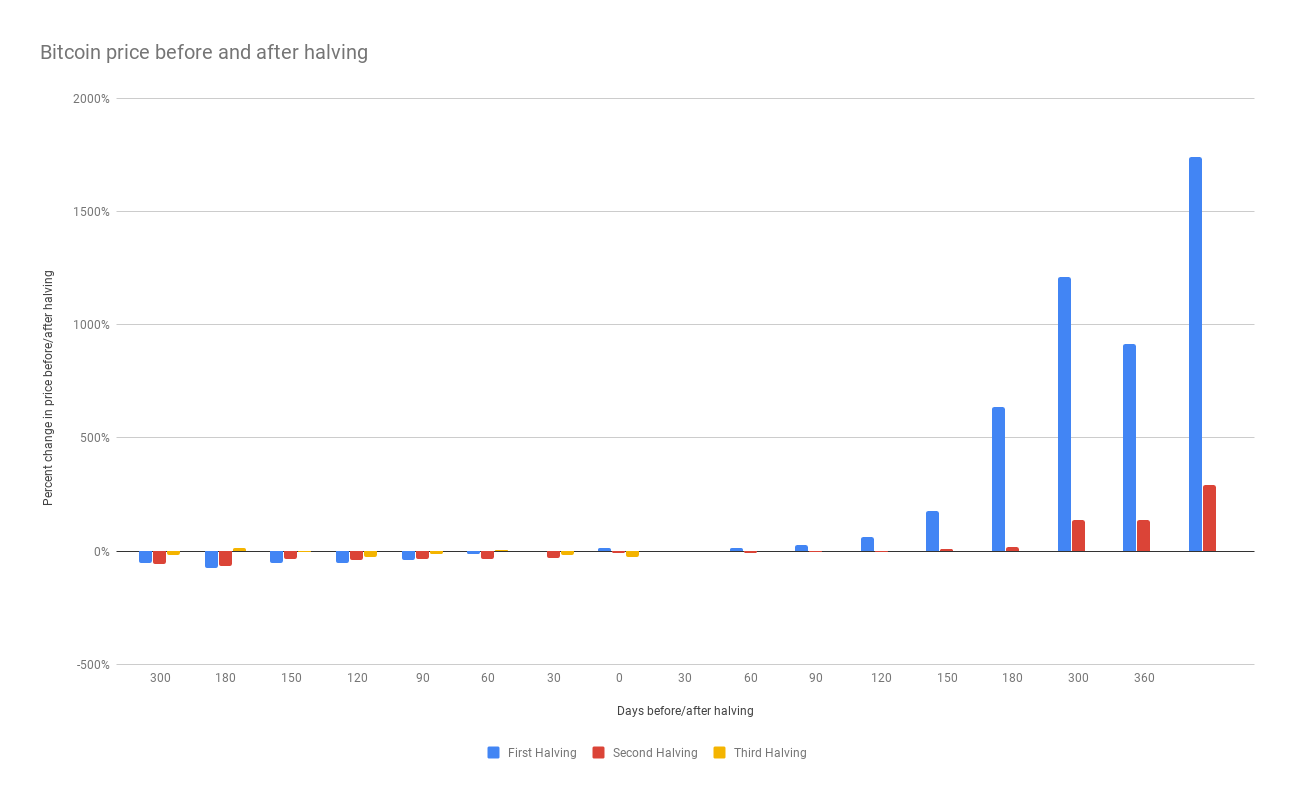

As seen in the above table the price before and after halving shows that the price of Bitcoin 12 months before halving is usually in the negative in relation to the price of Bitcoin during halving. Furthermore, the chart shows that for the first two halvings, the price of Bitcoin surged to its maximum, 12 months after halving, hence, 12 months after the third halving, the same can be expected.

In addition, the price of Bitcoin before the halving is usually low and the same can be observed across the first two halvings. However, things seem to have changed this time around, as the price has managed to rise to the occasion. Another observation is that the surge of Bitcoin, 12 months after halving is reducing since the first halving from 1742% to 292% in the second halving. Hence, for the third halving, a smaller surge can be expected.

The reason for this could be the increase in Bitcoin adoption and introduction of innovative products like Bitcoin Futures, Options, and other derivatives. This has created deeper liquidity for the Bitcoin and the cryptocurrency community hence, the price surges don’t measure up to the extent they once were.