Bitcoin’s low MVRV score suggests it is still undervalued

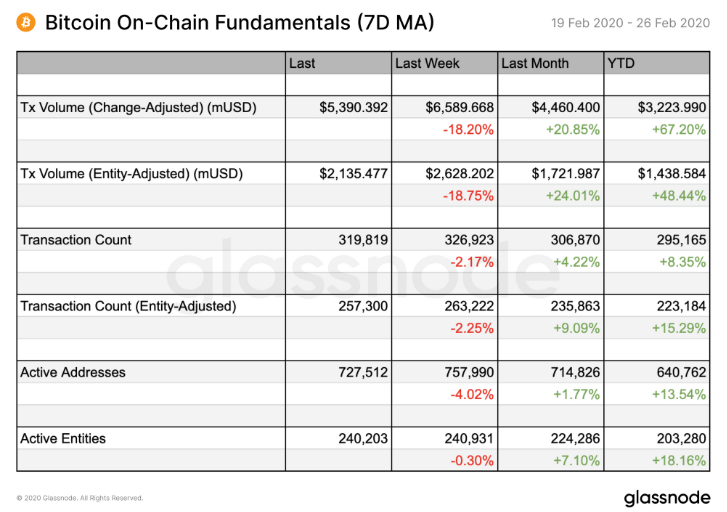

Bitcoin has recovered by 3.18% since 27 February, a day after the king coin lost a significant chunk of its valuation. However, it is yet to ward off the bears in the market. With its current value at $8,676.98, BTC might have to fight back those strong resistances going upward. The fall in BTC’s price has coincided with a significant downturn in its on-chain activities. Between 19 February and 26 February, BTC’s transaction count dropped by 2.17%, when compared to last week. Even BTC’s active addresses took a hit, falling by 4.02%, as per Glassnode Insights.

Source: Glassnode

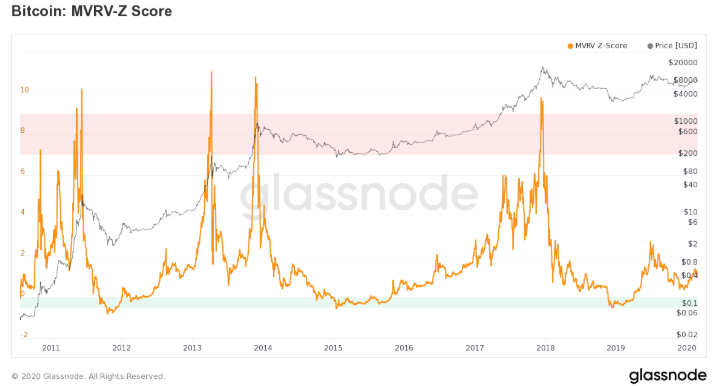

The value of Bitcoin has fallen, but according to the asset’s MVRV Z-score, it is still undervalued. Used to assess whether Bitcoin is overvalued or undervalued relative to its “fair value,” MVRV makes uses of BTC’s realized cap. The chart below explained the variations taking place in the Bitcoin market, wherein the red-zone indicated the market top, while the green-zone referred to the market bottoms.

Source: Glassnode

The report added,

“The present low MVRV Z-Score suggests that BTC is still undervalued, with significantly more room to grow before reaching the next market top. This provides support for many analysts’ prediction that bitcoin will stay above $8000 for the time being.”

The Short Term Holder [STH] MVRV came to a similar conclusion as well. Until 16 January 2020, the STH-MVRV, using the 7-day moving average, had remained well above 1 and often coincided with the rising price of Bitcoin. This could be indicative of fundamental support for higher BTC prices. The report went on to add,

“Barring any radical events that might affect confidence in the market, this metric suggests that BTC has room for more imminent growth.”

BTC’s price had previously slumped under $9k on 12 November. In that case, it took the coin 66 days to surpass the immediate resistances and another 23 days to reach the $10k mark. However, the drastic fall has once again pushed Bitcoin to the $8k level and this time, it might take Bitcoin some time to climb back up.