Bitcoin’s block reward halving may be a blessing in disguise for efficient miners

Bitcoin’s block reward halving is a timely reminder of its scarcity. While the king coin has already faced two halving events in the past, the third one is to take place in little over a month’s time. 2020, being a halving year, led most investors to expect the price to soar. The recent price crash has increased worries not just among investors but also for Bitcoin’s miner community.

Marco Streng, CEO of Genesis Mining, in the latest episode of the Crypto Conversation podcast, elaborated on how the upcoming halving may affect the miner community. He highlighted that the block reward halving that is to take place is not an ‘unpredictable event’ for “anyone that takes mining seriously”. Commenting on the recent crypto price crash, the global uncertainty resulting from the COVID-19 pandemic and even events like the halving, Streng said,

“I see the halving which is coming up as an event that will clear out the mining space… will lead to some more consolidation, obviously, and that really will motivate the miners and will really push the miners to innovate and to keep on increasing their efficiencies.”

When asked about whether he agrees that Bitcoin mining is a ‘tense game of attrition’ Streng pointed out the intrinsic competitiveness withing the Bitcoin mining ecosystem, he said,

“In the mining world, as soon as you manufacture machines and they get out and get shipped, every hour counts. You want to get them to the network and you want to get them mining and it’s always kind of nerve-racking which in the end you never get used to it.”

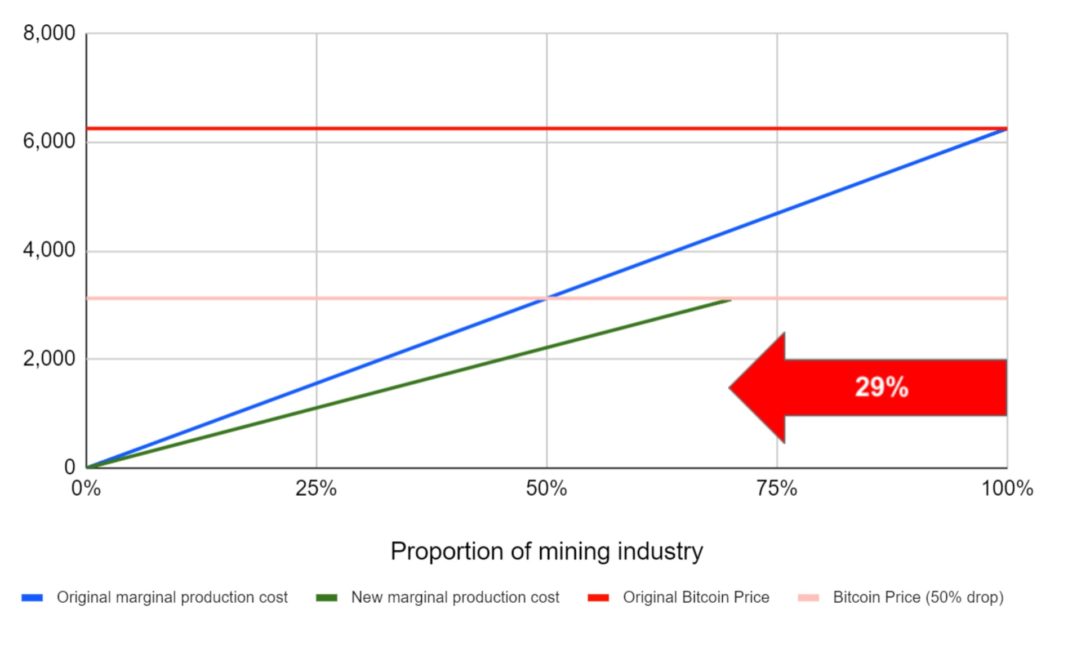

Source: BitMEX

A recent report by BitMEX analyzed the impact of the upcoming halving event and has projected that in one of the possible scenarios the network’s hash rate may drop by 29 percent after the halving. It highlighted,

“Excluding the impact of transaction fees, the impact on the miners should be almost exactly the same as a sudden 50% drop in the Bitcoin price. One may think that a sudden 50% fall in the price of Bitcoin means the mining industry should fall in size by 50%. This is true with respect to industry revenue, after the halving, all else being equal, mining industry revenue should fall by around 50%. This is therefore likely to be a very challenging time for the industry.”

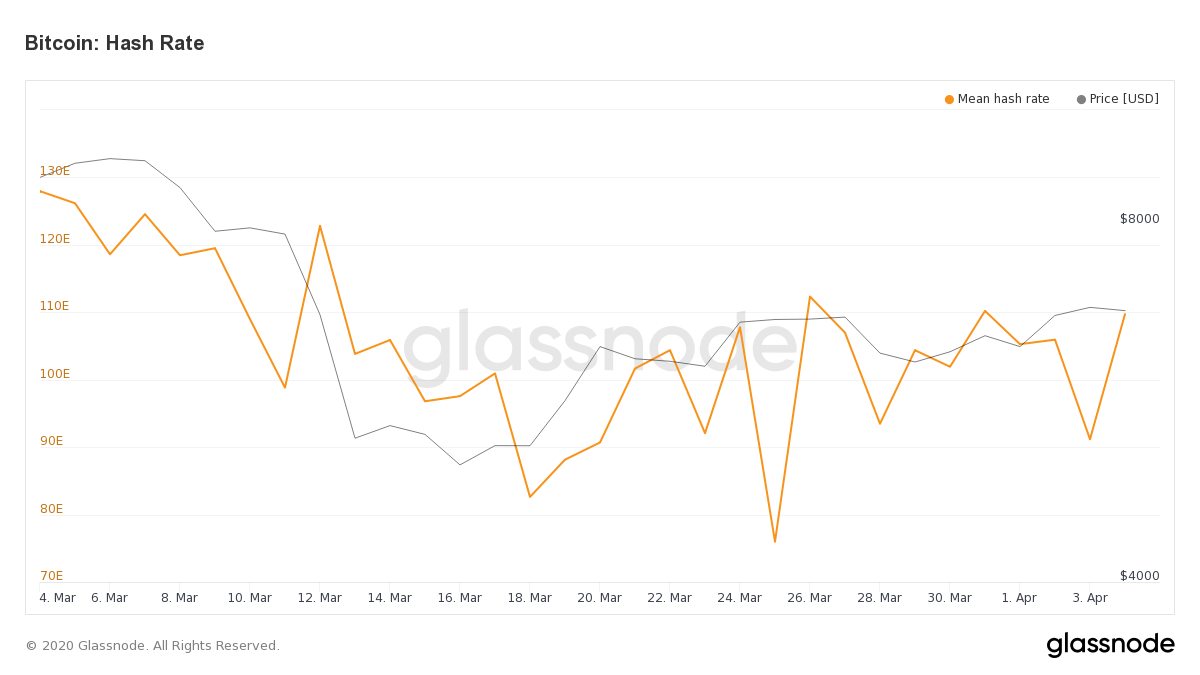

Souce: Glassnode

In over a month’s time, Bitcoin’s hash rate has fallen from 127E to 109E which raises the question of its fortunes after the halving. Streng highlighted the need for miners to be ‘ahead of the curve’ in such scenarios, he added efficient miners can take advantage of the halving, he said,

“Some miners will get into the red figures and they’ll have non-profitable operations and those will be the ones that have to drop out and when they drop out the hash rate will drop and the difficulty will drop. And the ones who remain in the market, they have a higher market share and they have a compensated downside.”