Bitcoin

Bitcoin: Will the upcoming mining difficulty adjustment help small miners?

With Bitcoin’s price hitting a 10-month low, a mining disaster seemed inevitable. In fact, several major mining rigs may be on the verge of shutting down owing to the current market situation.

According to a recent report, 2.3 million S9 miners were wiped out in China, resulting in a large-scale shutdown. A Chinese industry insider told a media outlet that according to F2pool’s calculation of the entire network, roughly 2.3 million S9 miners were shut down from 10 March to 22 March.

A recent Okex report also noted that the stock price of the first-listed Chinese mining machine manufacturer, Canaan Inc. [CAN], dropped to its lowest level on 13 March. The firm’s market capitalization was down to $533 million from $1.3 billion one month ago. The report also went on to claim that the potential miner capitulation could probably hit other major manufacturers too, including Bitmain.

Bitcoin miner and cryptocurrency investor Kris, in a recent podcast, was of a similar opinion. He had said that the COVID-19 pandemic is impacting everybody on every level, adding that big mining firms are no different from this fate.

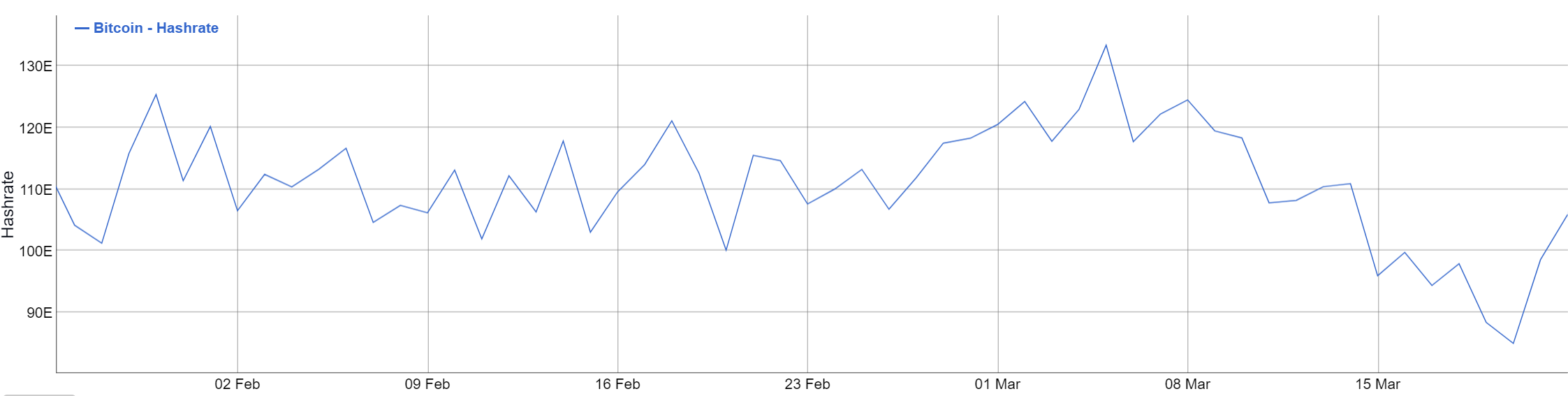

Source: Bitcoin Hashrate historical chart, bitinfocharts

Bitcoin’s hashrate dropped from 133.29 EH/S, the highest since the start of 2020, to 85.09 EH/S on 20 March. The hashrate was at 108.16 on 12 March and saw a significant dip in just two days. The hashrate was 105.87 EH/S, at press time.

Additionally, the electricity costs of new generation mining rigs, such as the Antminer s19 series and MicroBT M30 series, are taking up more than 50 percent of the daily mining revenue. The returns on Bitcoin Cash [BCH] and Bitcoin SV [BSV] are also the same, thus a mining disaster was indeed inevitable, with the upcoming May halving, asserted this OKEx report.

On the other hand, the next difficulty adjustment is estimated to take place on 25 March, which will reduce the difficulty by 10%; this is told to be one of the biggest difficulty adjustments for the cryptocurrency, according to BTC.com. This reduction in mining difficulty might make it easier for miners with increasing profits. This might also help small miners who are now shutting down their mining firms to stay in business.

Additionally, Gate.io had recently released a report that discussed the price level Bitcoin needs to attain for miners to remain profitable. The terminology used by the report was ‘Shut-Down Price,’ and it suggested that if BTC’s value dropped under the shut-down price of a mining rig, miners were more likely to lose capital. The report explained,

“The shut-down price = mining cost per day/ number of bitcoin mined per day, service fee from the mining pool, transaction fees, and other handling fees are not considered in this calculation.”