Bitcoin

Bitcoin volatility ‘appreciating smoothly’ as $10k left in wake

It’s been almost 5 months since Bitcoin fell out of the five-figure heaven, but organic signs are consolidating its return. With the spot price leaving $10,000 in its wake, the market, on both the volatility and volume fronts are showing less erratic and more healthy moves.

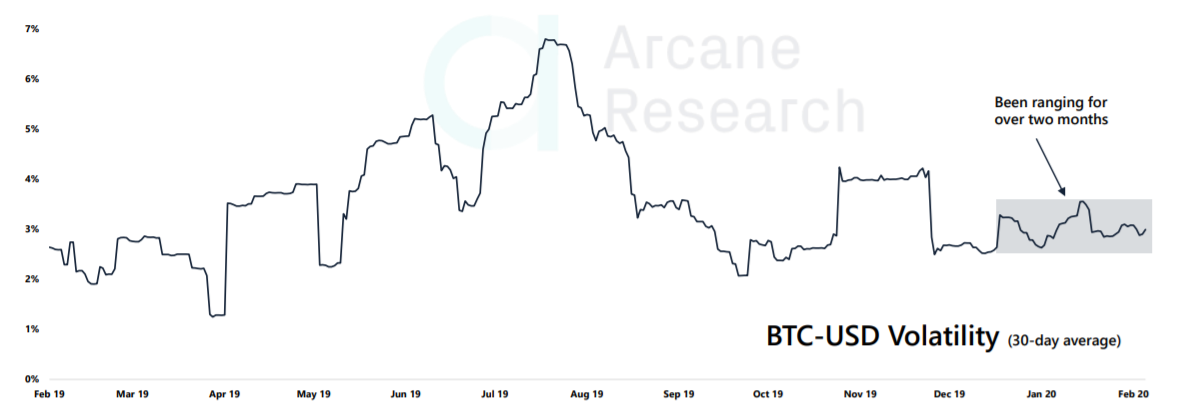

According to a recent report by Arcane Research, the volatility for Bitcoin is “moving sideways.” Despite Bitcoin being seen as a “wild west” asset thanks to its massive fluctuations and sketchy regulation, the report noted that these days “volatility does not move much.”

Source: Bitcoin 30-day volatility, Arcane Research

Noting that the uptrend is still “intact,” the report stated that over the last two months, 30-day Bitcoin volatility has been locked in the 2.5 percent to 3.5 percent range, which the report added is a result of “smooth appreciating.”

The uptrend referred to here, began right at the start of the year, with Bitcoin rekindling its ambitions as a “safe haven” asset, surging with gold, following the US missile attack on the Iranian commander.

Responding positively to the coronavirus-induced market fears, Bitcoin continued its upward trajectory, during late-January, as most major stock indexes fell sick.

The report added that this “uptrend,” shows signs of a “robust” move, unlike the pump-and-dumps that the cryptocurrency ecosystem is accustomed to,

“This is an indication that the current appreciation is more robust than what we have seen in a long time.”

Compounding this organic-move further, volume supports a “bullish outlook.” Following last week’s “healthy signs,” the report noted that the volume in the Bitcoin markets, over the past week, has been continuing upwards, based on the 7-day average volume of the real-10 exchanges as per Bitwise.

Source: Bitcoin 7-day average volume, Arcane Research

Since the holiday-blues of December, when the 7-day average volume was under $500 million, there has been an increase in spot trading. The volume has been continuously climbing since, almost doubling in mid-January. The past week’s volume was over $700 million per day.

All in all, the signs look positive for consolidation over $10,000. Bitcoin is $1,000 clear of its 200-day MA, which it passed 10 days ago, its volume and volatility suggest healthy growth, indicating that a move above will be backed by organic market conditions, rather than brief skirmishes.

With the halving three months away, things are looking positive for Bitcoin.