Bitcoin v. Ethereum: Are derivatives traders more willing to bet on the altcoin?

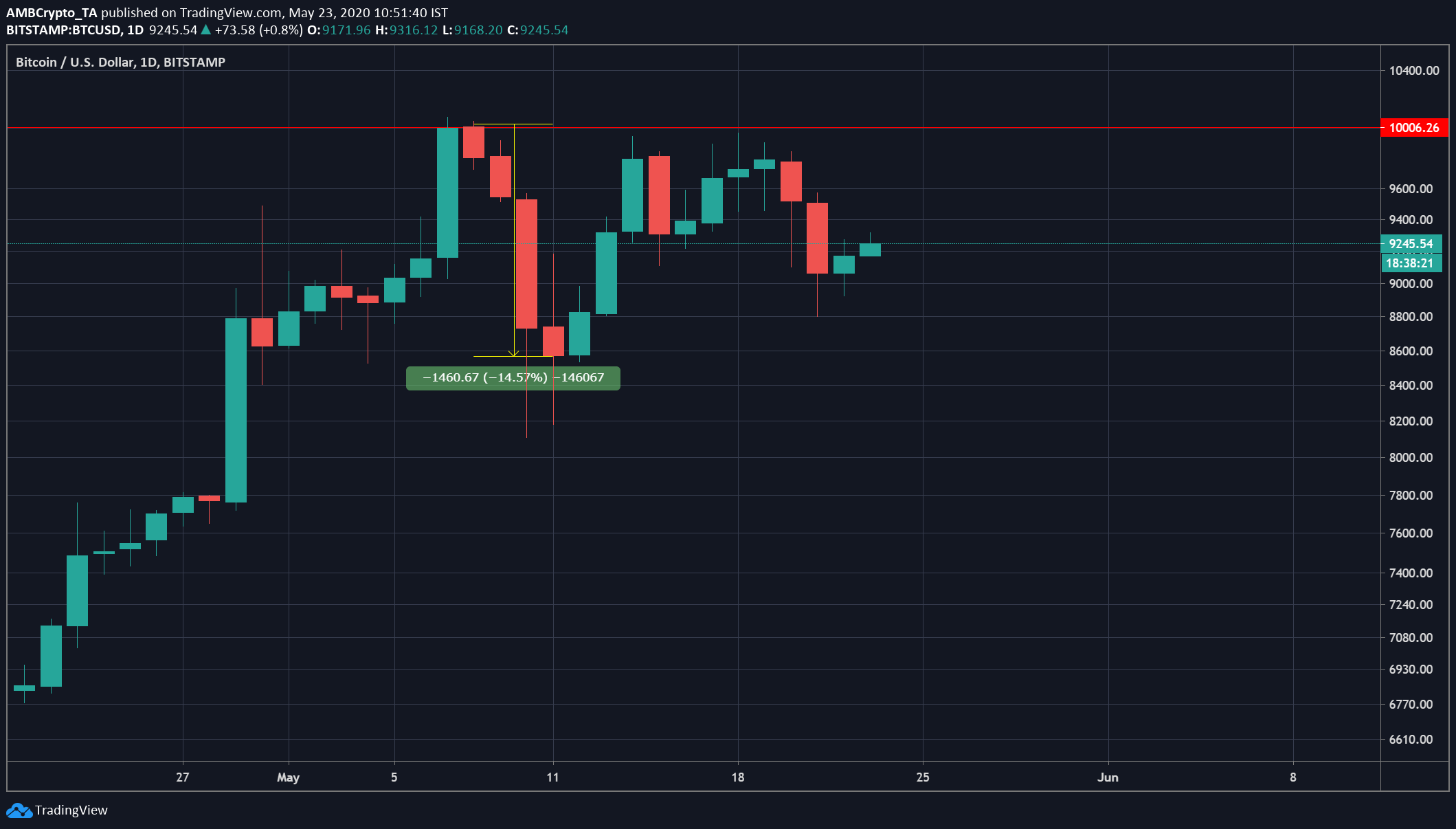

Bitcoin and Ethereum, the top two coins in the crypto-market, have not been able to break their key resistance levels yet, with Bitcoin’s at $10,000 and Ethereum’s at $220. As seen in the attached charts, Bitcoin registered significant gains in the month of April and even managed to reach the $10,000-mark on 7 May. However, the coin soon fell by 14.5% the very next day. It was trading at $9,250, at the time of writing.

Source: BTC/USD, TradingView

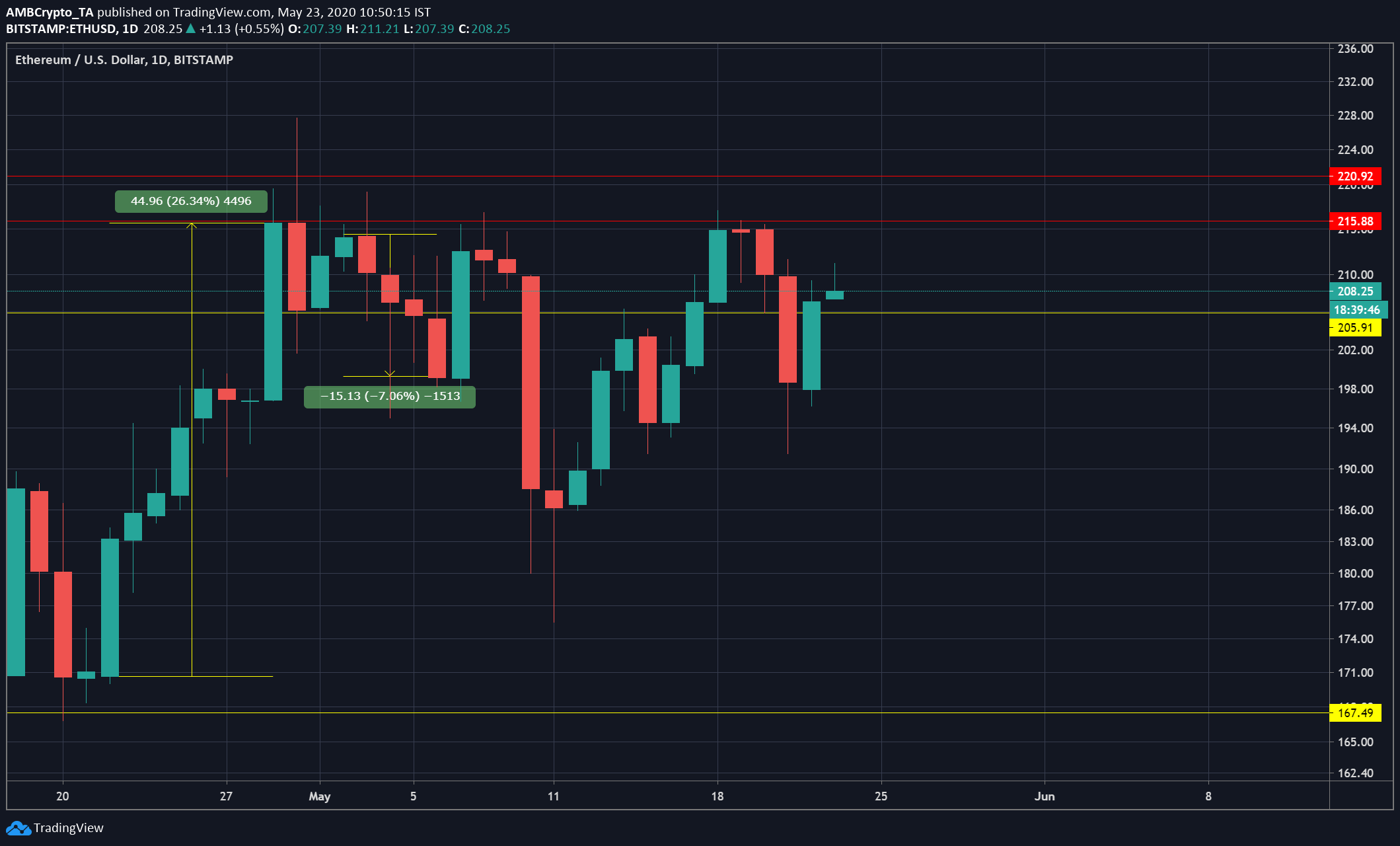

Talking about ETH, the coin has been trying to breach the $220 level for over two months now. It managed to touch $215 on 29 April, but it was soon met by a 7% drop. The coin, at the time of writing, was trading at a price of $208.

Source: Ethereum/USD, TradingView

The king coin was supposed to rise up and breach its resistance and reach new heights post the third halving, as predicted by so many traders and analysts. But, as can be seen on the charts, the top coin is still struggling to reach its key resistance level, while the same goes for the market’s top altcoin. What does this say about the current state of the crypto-market? Where is it heading?

A recent report released by OKEx noted that the Implied volatility [IV] of ETH had recovered while the IV of BTC was relatively fluctuating. The report, in its findings, opined that ETH seemed “comparatively favorable or, at least, more willing to be bet on by traders.”

On the contrary, the Options markets showed that the probability of ETH moving over $220 by the end of June is just about 28%, while the likelihood of BTC being above $10,000 by the end of June is around 29%. This implies that even if the top coin and ETH manage to breach their key resistance levels by the end of June, the Options market believes the probability of this happening to be just 1 in 3.

Interestingly, the report also looked into Bitcoin’s rising put/call ratio, with OKEx noting that “the put/call ratio has surged to a level where BTC has touched 10000 in early May. That could indicate that options traders may not anticipate a BTC price rebound at current levels.”

Such is the case not just for Bitcoin and Ethereum, but also for other coins like Litecoin, XRP, Monero, and many others.

Litecoin has been trying to reach its key resistance level of $63 since 13 March. At the time of writing, it was trading at $44. Similarly, XRP has been trying to reach the $0.24 level for a while. And, while the coin did manage to reach $0.22 on 29 April, it could not hold it for long. It was trading at $0.20, at press time.

Putting things into perspective, the crypto-space, despite the flowery predictions being made, is still a long way away from breaching their resistance levels on the charts.