Bitcoin to replace fixed-income allocations in portfolios soon?

Asset managers are riddled with low-yield fixed-income allocations, however, they are constituents of most portfolios. The role of fixed-income allocations is to deliver consistent returns, though the overall impact on the portfolio’s ROI is low. To improve this ROI, some fund managers turned to Bitcoin for exposing their funds to a higher risk-adjusted return.

Traditionally portfolio managers would turn to the precious metal for its “store of value” narrative and promising returns. However, in the current context, Bitcoin has outperformed Gold and its correlation spread with Gold is increasing. Bitcoin’s price rallied back in July 2020 and it is considered that it is currently rallying towards the previous ATH. Due to massive volatility, and relatively low BTC reserves on spot exchanges, there may be corrections intraday or a few times every week but the open and close values are holding stead.

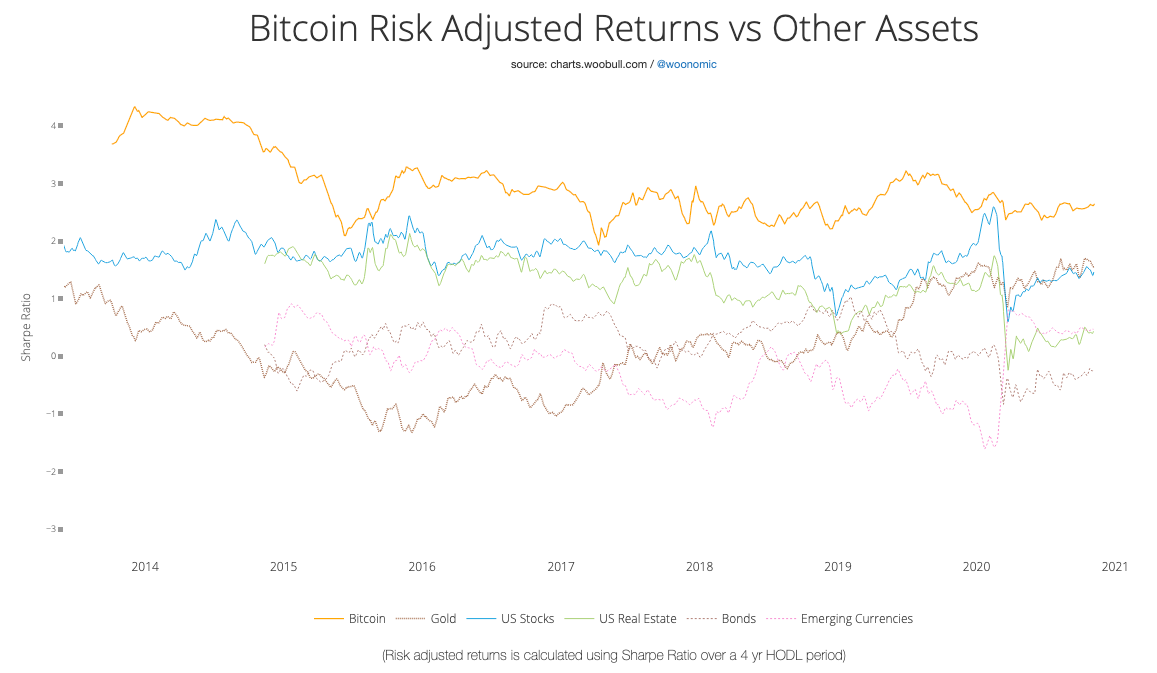

Bitcoin’s risk-adjusted returns || Source: Woobull Charts

Based on data from Woobull Charts, compared to non-crypto, traditional assets like Gold, US Stocks, Real Estate, Bonds and Emerging Fiat Currencies, Bitcoin’s risk-adjusted returns are the highest. Returns from US Stocks have come close to Bitcoin’s returns a month or two back, but that’s the closest it gets. Bitcoin has consistently outperformed Gold, Real Estate, and Stocks.

This makes it a lucrative addition to a modern-day portfolio. To examine its relevance, let’s consider Bitcoin’s case for Modern Portfolio Theory. Modern Portfolio Theory is a theory on how risk-averse investors can construct portfolios to maximize their expected returns within the given market risk. It proposes a framework for how investors can reduce overall risk while maximizing return by holding a diversified portfolio. This portfolio consists of non-correlated assets primarily. The first on a modern-day asset managers list would possibly be Bitcoin and US Stocks or Gold.

As opposed to viewing the risk-return characteristics of each asset in isolation, the aforementioned theory assesses the risk and return for the broader portfolio based on the cumulative interactions between the portfolio’s assets. Since the assets are uncorrelated, the portfolio’s performance is not skewed towards a particular asset’s performance. An exposure of 1-2% Bitcoin, if not other cryptocurrencies, offers higher risk-adjusted returns than fixed-income that have ironically yielded fixed returns and dropped the overall ROI.

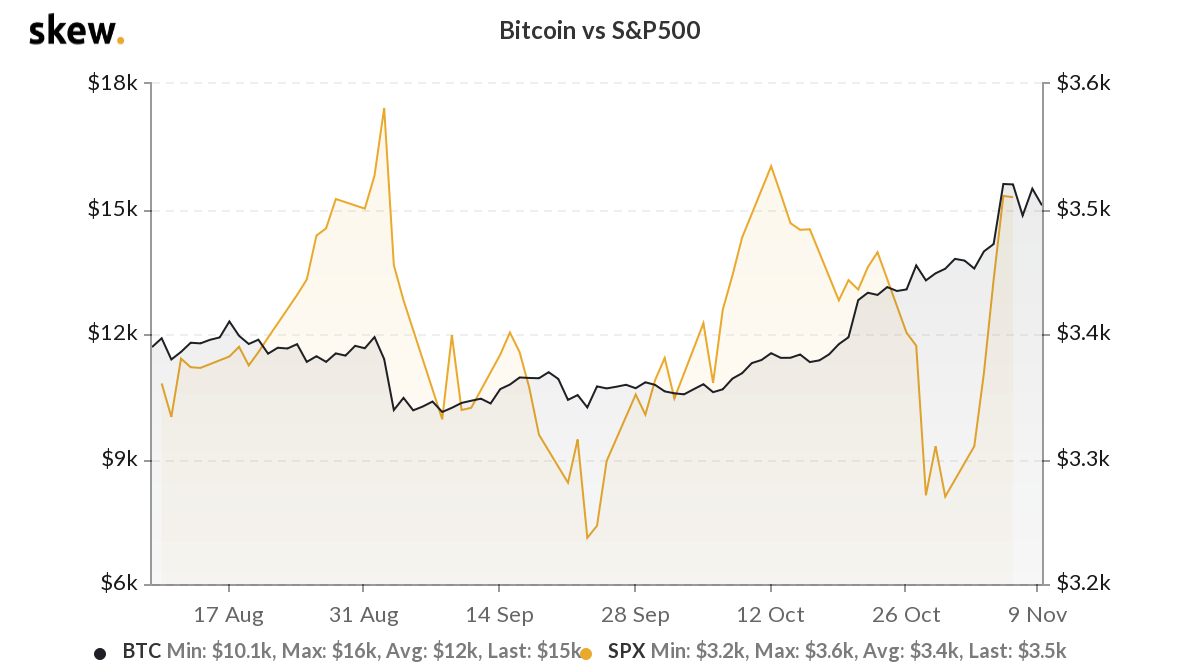

For institutional investors, 1-2% may amount to several thousand or hundred thousand BTC and this may be the key reason why institutions are piling up BTC, buying even above $14-$15k. In addition to offering the highest risk-adjusted returns, BTC leaves the portfolio manager with several options when picking an uncorrelated asset to add to the mix. BTC’s correlation with stocks hit zero in the last week of October 2020 and ever since the asset has slowly become more uncorrelated with the S&P 500.

BTC S&P 500 correlation chart || Source: Skew

The dropping correlation with S&P 500 may benefit BTC and its price in the long run. Institutions interested in higher risk-adjusted returns may possibly include Bitcoin in their portfolios, rather than low-return fixed income securities in the near future.