Analysis

Bitcoin SV, Zcash, Compound Price Analysis: 14 October

The three digital assets, Bitcoin SV, Zcash, and Compound showed bearish signals throughout the day. With over 5% in losses since yesterday, for Zcash and Compound, strong selling pressure could last longer for the two coins.

Bitcoin SV on the other hand, while also witnessing a sell-off, dipped only slightly after finally breaking out of its sideways price consolidation.

Bitcoin SV [BSV]

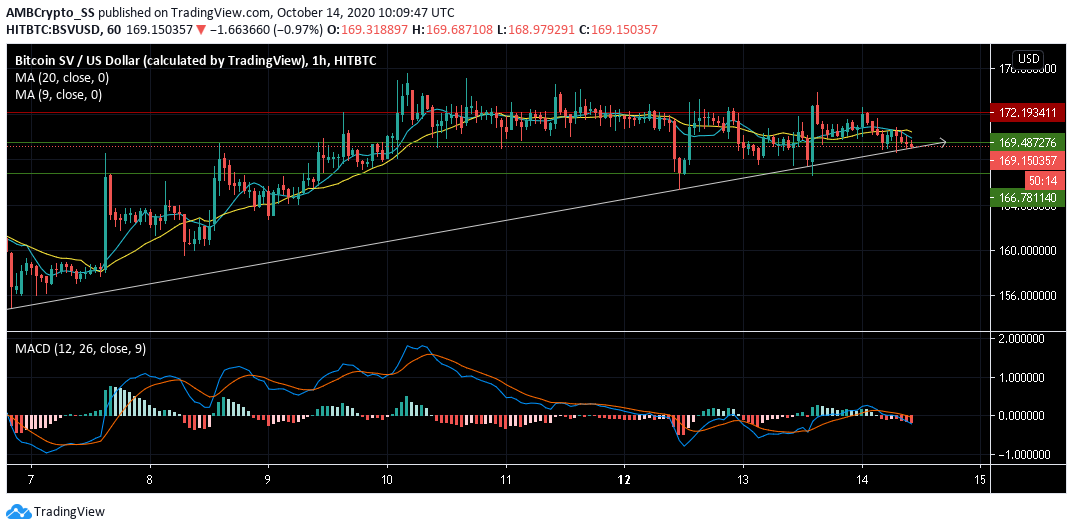

Source: BSV/USD on TradingView

Bitcoin SV’s price has been moving sideways against the USD over the last 4 days. BSV remained flat in price, with a slight dip seen since yesterday. Despite this slow movement, the digital asset maintained an overall bearish outlook for the short-term period.

The price was seen entering the red zone, as it dived below both its moving averages. Further indicating bearishness, the 20 MA (yellow) was above the 9 MA (cyan).

Well into the bearish territory the MACD too suggested, a breakout below the trendline could be a possibility in the upcoming trading sessions.

Zcash [ZEC]

Source: ZEC/USD on TradingView

Zcash was down by almost 5% since yesterday and was trading at $ 69.130 at press time.

With the capital flowing out of the Zcash market as outlined by the significant drop of the Chaikin Money Flow Indicator below the zero line, a clear bearish strength was thus being witnessed.

The Relative Strength Index also turned south, and was well below the 40 level, indicating a growing presence of selling pressure.

A price action towards the next support at $ 67.35 could be likely over the next few trading sessions, given the highly bearish scenario painted by the digital asset’s technical indicators.

Compound [COMP]

Source: COMP/USD on TradingView

The Aroon Indicator gave a strong sell signal, with the Aroon down (Blue) rising above the Aroon Up (orange). The event coincided with Compound retesting the $ 112.23 support level.

The below-average levels of buy volume ruled out any price reversal possibility due to a lack of immediate buying strength.

Further, the recent 6.5% dip over the last 24 hours in the COMP market hinted towards the market being controlled by the bears, with the scope of a further downside during the next few days.