Bitcoin perpetual swaps show consistent positive basis

Recently, Bitcoin data analytics firm, Skew reported a consistent positive basis between Bitcoin‘s perpetual swap contracts and its underlying spot market. Basis is the difference between the spot price and its derivative. In this case, a positive basis means a relatively higher Bitcoin spot price relative to the price of perpetual swap contracts derived from it.

Further, Skew claimed this consistent positive nature of the basis caused the futures term structure graph to steepen, as market participants expect positive funding for longer term, which usually accompanies a higher bullish sentiment toward an asset.

During positive funding, long holders pay the funding amount, while traders in short positions receive the amount. This implies that more perpetual swaps traders are expecting the price of Bitcoin to go up. A high positive basis is also indicative of high demand for the asset relative to its supply, causing its cash price to rise higher than its derivative.

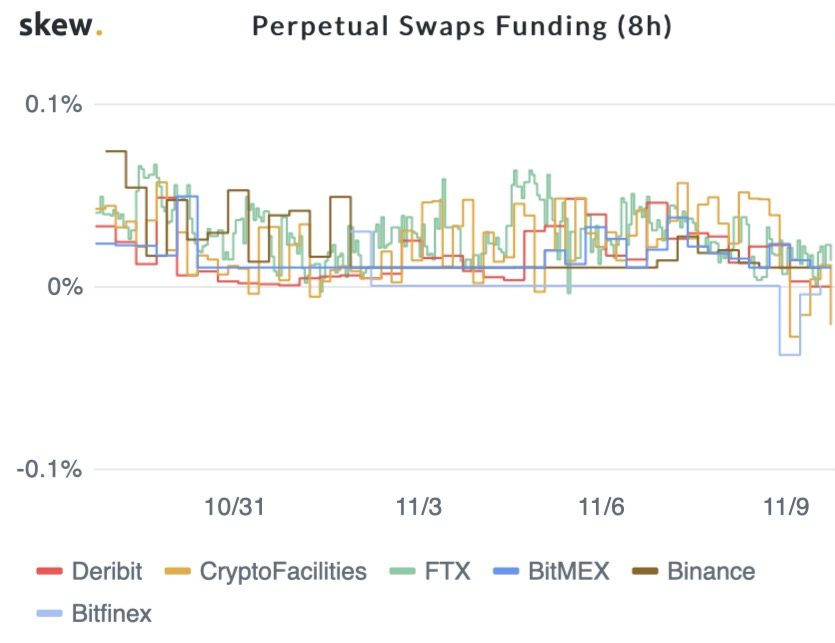

A look at historical funding data for perpetual swaps shows mostly positive funding since October 28th, only stepping down to negative funding rates over the last 24 hours.

Source: skew.com

Earlier, Skew also reported that Bakkt’s Bitcoin futures volumes had increased by nearly 2.4 times since the previous day, up to almost $16 million. However, its open interest remained relatively consistent, around $2 million. This implies more contracts are being traded rather than being created.