Bitcoin

Bitcoin Options worth $7.8M set to expire today; Drop to $6K or $5.8K?

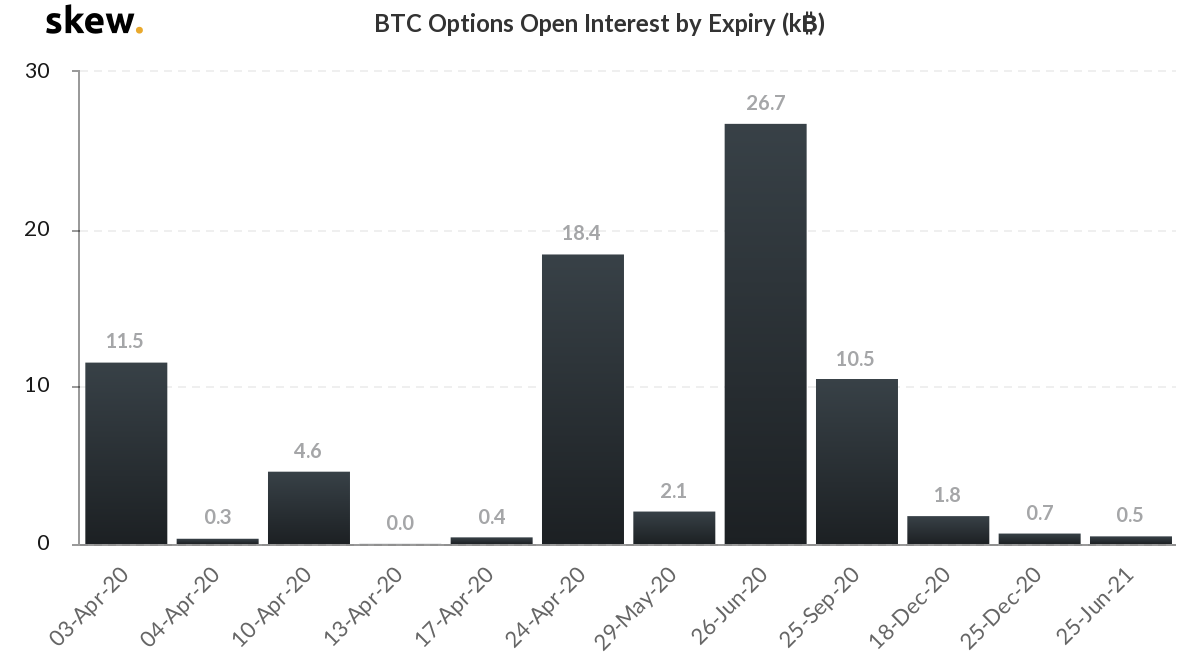

As of 3 April 2020, Bitcoin Options worth $7.82 million or 11,500 BTC Options contracts will expire and this might have an effect on the spot prices. Bitcoin Options and Futures are popular products that institutional investors invest in, especially considering the size of their investments. Hence, a surge in Open Interest and volume in either of these products would, to an extent, indicate institutional activity.

After the 13 March disaster, the Options and Futures markets on CME and Bakkt dried up; however, they have been seeing a surge in recent times.

Source: Skew

At press time, however, 11,500 Options contracts were set to expire. As seen before, the expiry of sizeable Options or Futures contracts has an implication on the spot prices of Bitcoin and surely enough, there is a chance, today’s expiry will push the price down. Additionally, the Open Interest on Deribit, CME and Bakkt will face a small dip after these Options expire.

Further, other factors, like the CME Futures gap, Bitcoin’s technical indicators, etc. are also indicating that there is a possibility that the price will go down. Take, for example, the Bitcoin price, which is already in the resistance zone, explained in a previous article.

Source: BTCUSD on TradingView

The price saw a brief escape from this resistance range [$6,500 to $6,900]; however, due to excessive bearish pressure, the price fell back to the zone and was moving sideways, at the time of writing. The sideways movement might soon turn into a downward movement since the RSI has already been rejected at the overbought zone. Further, both the price and RSI have been rejected twice at this level; hence, this range will be strong resistance for the price to overcome.

Additionally, the CME Futures chart showed that a gap had developed from $6,620 to $6,000 on 29 March 2020. With the Options expiry, the resistance zone, and the CME futures, there is a strong possibility that the price will trend lower.