Bitcoin Options on Deribit record ATH volume after new KYC requirements

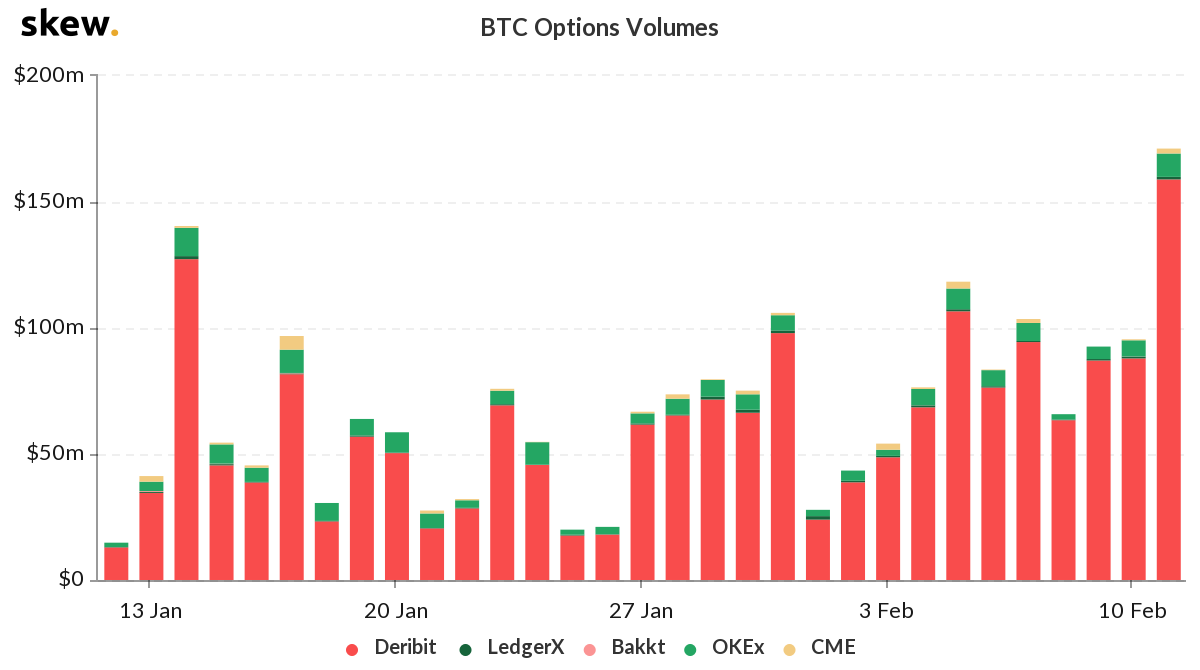

Deribit exchange continues to maintain its dominance in the Bitcoin Options market, with its trading volume over the last few months continuing to dwarf other exchanges, despite competition from the likes of Bakkt, CME, OKEx, and FTX.

Crypto-derivatives data analytics firm Skew recently reported that Bitcoin Options on Deribit had touched a new all-time high. With $159 million worth of contracts sold in a single day, the exchange dwarfed volumes on competing exchanges by a margin of at least 1650%.

Source: Skew

This rise in trade volume on Deribit comes on the heels of a proposal to impose tighter KYC requirements on users withdrawing over 1 BTC per day. “Global regulations are changing and even though the various changes are not applicable to companies based in Panama, we always strive to prevent illegal activities on our platform,” noted the updated KYC requirements page of the exchange. It added, “Nonetheless, we want to remain competitive and not restrict our clients too much.”

Interestingly, Futures volumes on the exchange did not vary by much, consistently trading at over $200 million in contracts per day for the last few weeks. However, we could see more activity as we move closer to expiry toward the end of the quarter.

On the same day, the Intercontinental Exchange-backed Bakkt saw $40,000 worth of Bitcoin options contracts sold after a solid gap of one week with no volume. The CME also recorded an overall increasing volume trend since the start of the year.

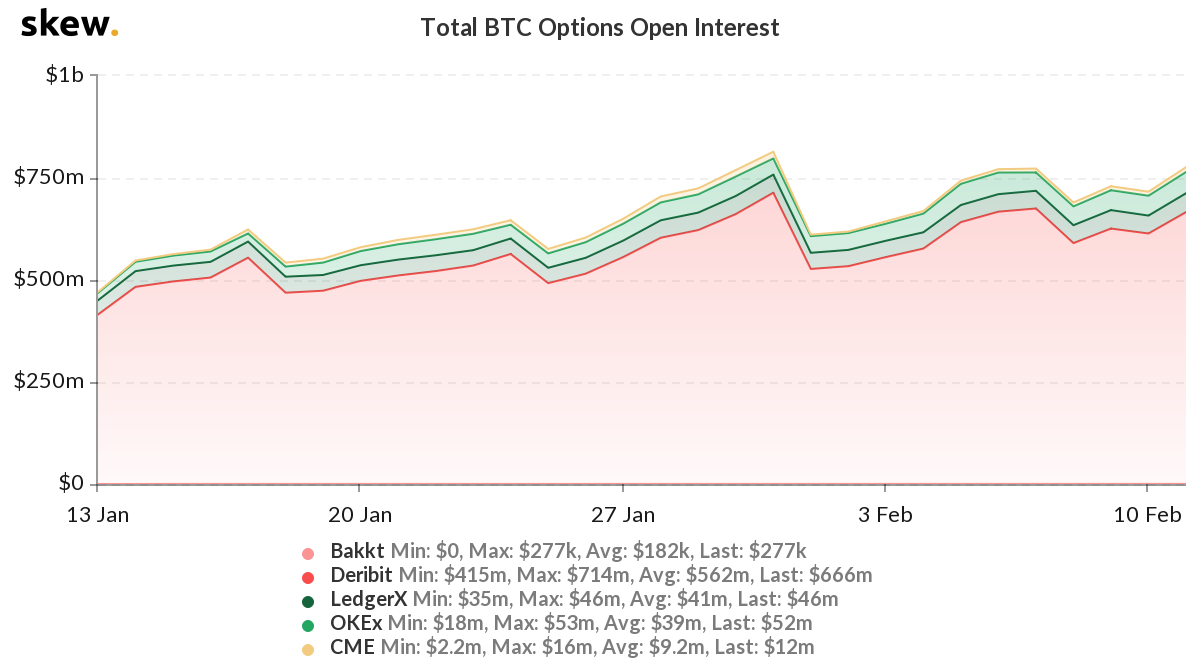

Source: Skew

However, Deribit still took the cake for the highest Open Interest, with Skew reporting an OI of $666 million on Bitcoin Options contracts, at the time of writing. Though not listed on Skew’s platform, FTX has also been performing incredibly well, representing an Open Interest of nearly 7800 BTC or around $80 million at the current market value.

Considering the recent pump that pushed Bitcoin back above the $10,000 level, investor sentiment seems to be more positive. With Open Interest displaying an overall rising trend this year, we could see better price discovery as the Bitcoin halving approaches.