Bitcoin: One size doesn’t fit all for UTXO management

Bitcoin has noted a host of varying narratives with regard to its potential use-cases over the past decade. However, despite being developed to take on normalized forms of currency such as central-bank regulated fiat, Bitcoin has struggled to pose a threat owing to its network-intensive process of validation and consensus.

While most upgrades have sought to bring down network congestion by making the process quicker such as in the case of layered solutions like the Lightning Network, technological improvements such as its coin selection algorithm may also play a crucial part.

On the latest episode of the Stephan Livera podcast, Bitcoin Engineer at BitGo, Murch, spoke about Bitcoin coin selection and its impact on transaction fees on the Bitcoin network. Coin selection roughly refers to the manner in which the Bitcoin networks algorithm ends up selecting coins from its UTXO [unspent transaction output] for upcoming transactions.

With regard to the need to balance privacy versus reducing transaction fees when choosing whether or not to consolidate UTXOs, Murch argued,

“It totally depends on your tradeoffs and that’s also why there’s no one size fits all coin selection for everyone and not one size fits all UTXO management for everyone.”

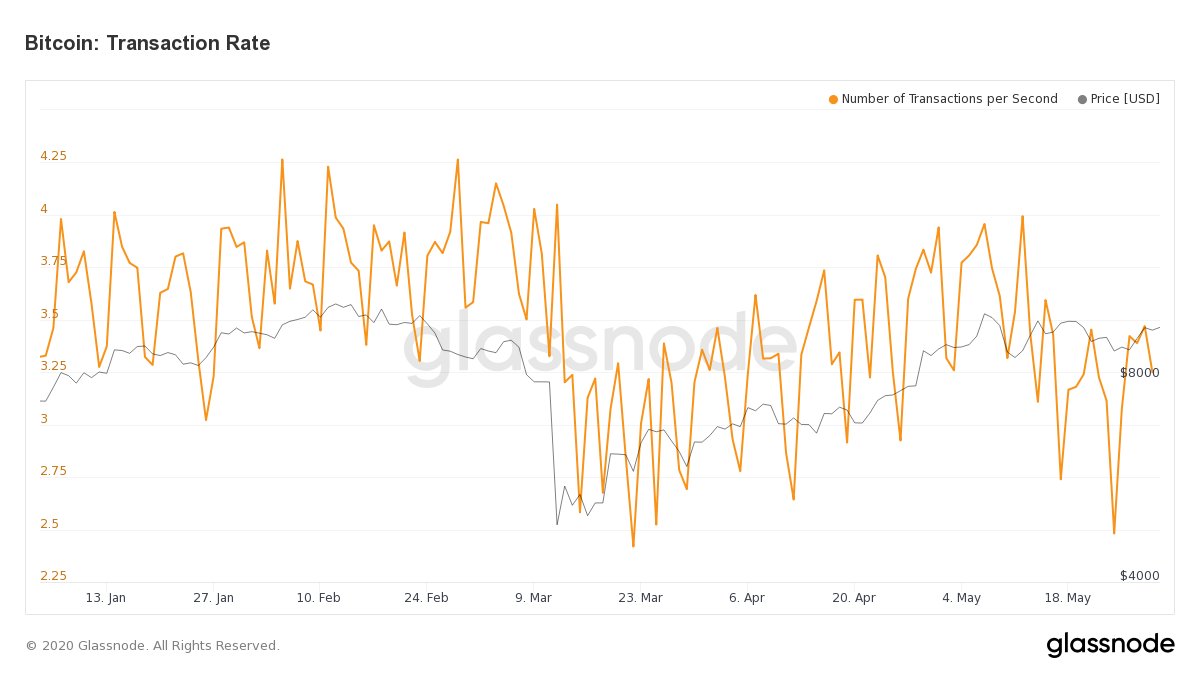

Source: Glassnode

According to data from Glassnode, since the start of the year, while the price has registered notable fluctuations, Bitcoin’s transaction count has recorded a relative decline, mirroring the price pattern to a certain degree.

Murch also argued that there are many implications when it comes to managing large wallets as there are smaller pieces of Bitcoin in them. He also noted that as larger enterprises get more deposits than withdrawals, they really need to figure out how to combine smaller units of the crypto into larger chunks. He highlighted,

“They really have to consider how they will ever combine all those tiny pieces of Bitcoin into two larger chunks because when the fees go to 200 you don’t want to send a transaction with over a hundred inputs in order to pay us and go withdraw.”

Murch further noted that spending inputs should be cheaper because it makes it easier to reduce the UTXO and with updates like the Schnorr/Taproot implementation, the cost of sending Bitcoin is going to be a lot cheaper, something that may even attract more use-cases and a wider audience towards the world’s largest cryptocurrency.