Bitcoin on-chain metrics climb, but market signals caution before halving

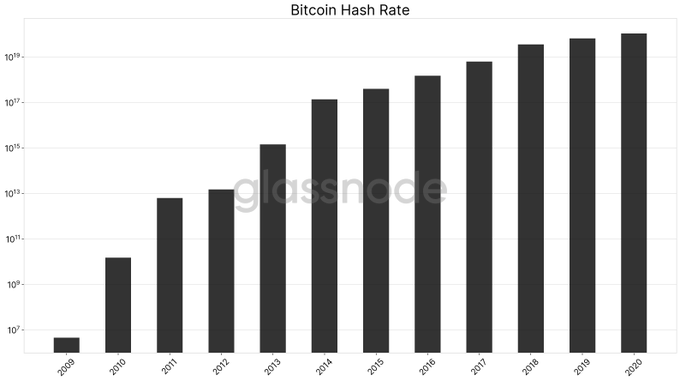

As the Bitcoin miners were working on the 629,927 block, at press time, the halving event was just 72 blocks away. The bitcoin hash rate has reached 141.16 Eh/s, whereas the difficulty had also climbed to 16.10 trillion [T], which was close to the network’s all-time high of 16.55 T. According to data, the BTC hash rate has increased by 6800% since the last halving, while miners keep at it.

Source: Glassnode

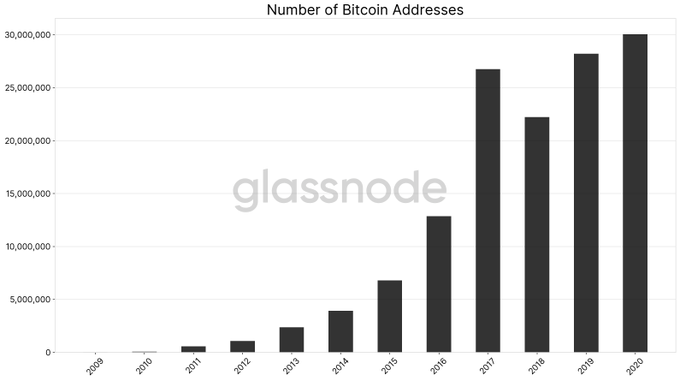

However, apart from Bitcoin mining and hash rate, its on-chain metrics have recorded great rise over time, in anticipation of the halving. The important metric to look at was the number of Bitcoin addresses had grown to mark an ATH, according to Glassnode. The bitcoin addresses recently crossed the 30 million addresses milestone, as BTC price fluctuates. Comparing this number to the last halving event, it was growth by 234%.

Source: Glassnode

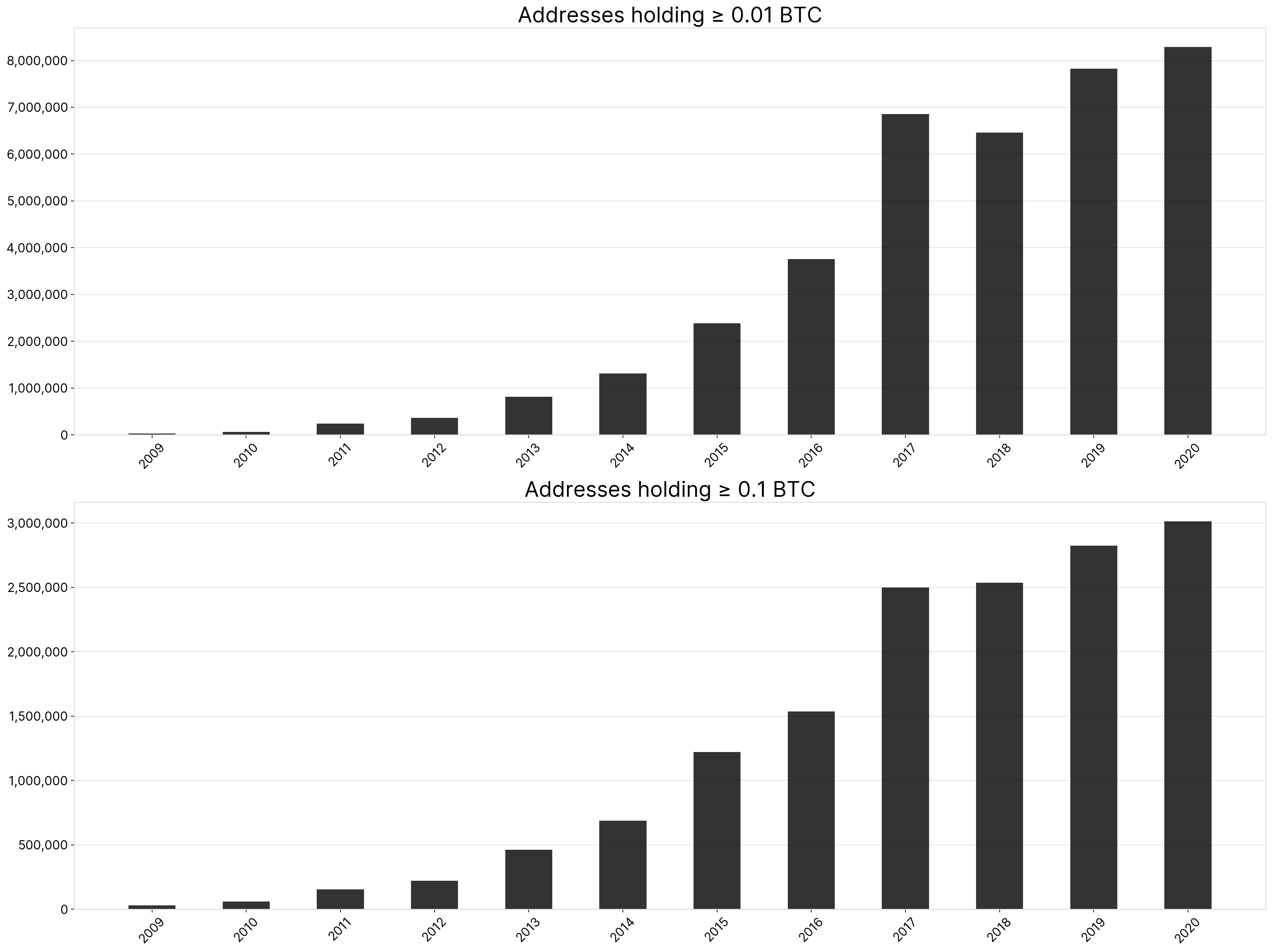

As the number of BTC addresses grew, the volatility in the market gave rise to various buying activities. The retail addresses that held at least 0.001 BTC and 0.1 BTC were reporting new ATHs in 2020 almost on a daily basis. The number of addresses holding at least 0.001 BTC or above has crossed 8 million in 2020, while the number of addresses holding 0.1 BTC has surpassed 3 million.

Source: Glassnode

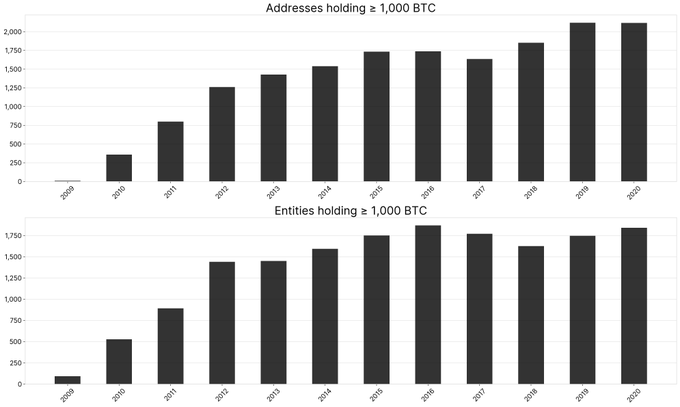

Similarly, the preparation for halving has been generating more wholecoiners, as the addresses that held at lead 1 BTC have climbed to 800,000 marking another ATH. Comparing data to the last halving, the population of wholecoiners had increased 64% since July 2016. Whereas Whales, still are the violent creatures in the sea of Bitcoins. The number of Bitcoin addresses and entities holding over 1,000 BTC also marked ATH.

Source: Glassnode

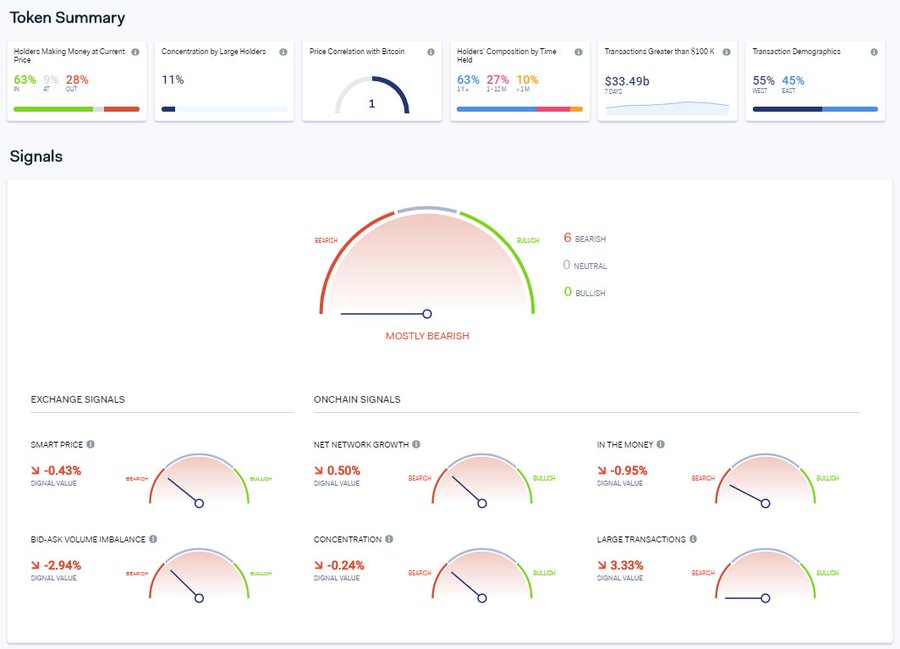

However, despite registering ATH in various on-chain metrics, it indicated bearish momentum. According to the findings of IntoTheBlock, the BTC network was not growing as fast as it was before. The network was noticing less accumulation by its large holders. Similarly, a reduction in large transactions [>$100k] was also noted.

Source: IntoTheBlock

As the halving was 10 hours and 47 mins away, at press time, the on-chain metric indicated a pattern of growing support for Bitcoin. However, with the event a few hours away, the holders might be cautious of the impact halving could bring. The turbulence in the BTC market might be indicative of this caution practiced by the holders as a high sell-off was recorded on 10 May.