Bitcoin no longer dictates market terms

The start and conclusion of August echoed a similar note for Ethereum; both witnessed the beginning of a bullish rally. In between, the markets were extremely choppy but according to Deribit’s August Institutional Newsletter, the altcoin registered another positive month in terms of derivatives activity.

According to the newsletter shared with AMBCrypto, Ethereum’s turnover growth in August was more than $15 billion, registering a growth of 44 percent from July.

Source: Deribit

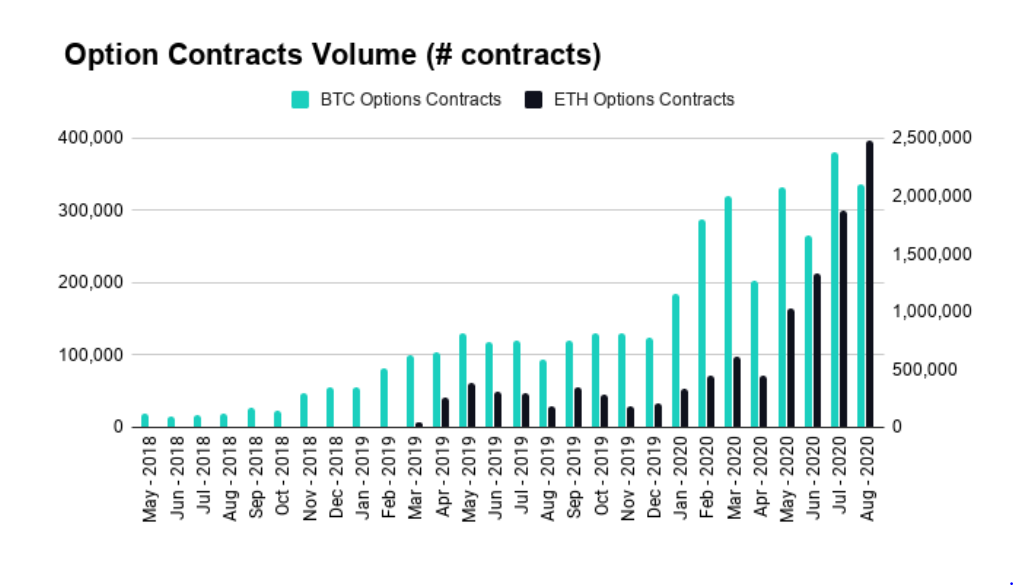

Further data suggested that 2,477,195 ETH option contracts were traded in August 2020, a 32% spike from July, and the total options turnover was $4.9 billion, a 15% growth from the previous month.

In the meantime, Bitcoin actually faltered behind Ethereum in terms of activity, trading 336,637 contracts in August, a 12% decline from July.

From a fundamental point of view, the comparison between these statistics is not co-dependent but the radical shift attained in derivatives activity is probably indicative of a change in the wind.

Does Bitcoin hold all the cards anymore?

Newcomers entering the crypto market in March 2020 might think so. Looking at their market dominance, astounding market cap, their choice to pick BTC above others would be reasonable but times have changed a lot, as suggested by the options activity.

Observe the chart above once again. Options activity associated with Ethereum hardly matched BTC’s over the past year but now, Ethereum has slowly bridged the gap and now, surpassed Bitcoin. And to be honest, it is not atrocious to say that the same thing is happening in the larger market as well.

Bitcoin is no more the only gateway to crypto exposure. Altcoins are hitting back hard and some of the projects are even flying high. The facts speak for themselves.

Take BitMEX for example. As previously reported, the lack of activity in BitMEX has been largely evident over the past few months and it is possibly due to being loyal to Bitcoin and only a few other altcoins.

Yes, Ethereum is listed on BitMEX but various projects such as LINK, YFI, SRM are not. The chances of being listed are slim as well. Who does it hurt overall? BitMEX themselves.

The likes of Binance ad FTX exchange have been consistently listing coins and the BTC Open Interest growth of FTX spoke volume.

People are expanding beyond Bitcoin

The plain truth or ugly truth but whatever you may term it, the fact is that Bitcoin might not actually hold all the cards anymore. If all bets were put in for the survivability of particular crypto, there would be synchronous cheer for Bitcoin but since the market is not facing Crypto Armageddon yet, exposure to Altcoins seems like the way to go.