Bitcoin locked in DeFi marks an ATH, as Ethereum continues to trend low

DeFi leverages decentralized networks to transform old financial products into trustless and transparent protocols. The platform that supported Ethereum as collateral along with USDC and BAT recently added Wrapped Bitcoin (WBTC), an Ethereum-based token backed 1:1 by Bitcoin to its list of collateral types.

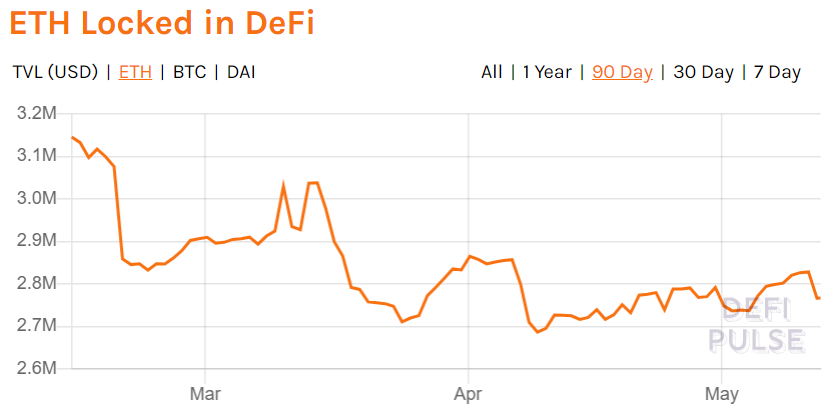

Even though ETH was one of its oldest collateral, ETH locked in DeFi has been falling. ETH in DeFi noted an all-time high in January 2020 when the value had reached 3.235 million, following which it trended downward. This was further exacerbated by the Black Thursday disaster in March and the value of ETH on the platform fell further. The value of ETH in DeFi fell by 5% since the peak and was reported to be 2.766 million, at press time.

Source: DeFi Pulse

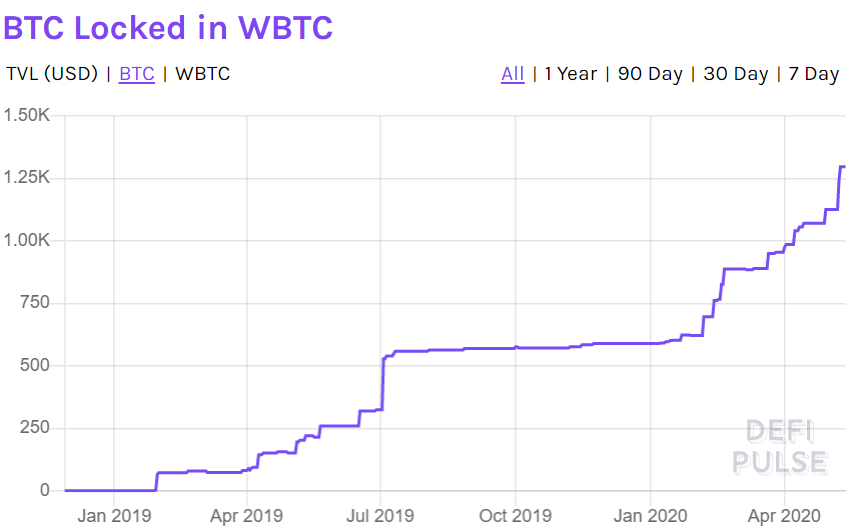

Meanwhile, BTC locked in DeFi has been on the rise; the total BTC locked in DeFi reached 2.238k on 12 May marking an ATH.

WBTC has also been making strides on the platform. The Total Value Locked [USD] in WBTC had noted a peak of $12.682 million on 9 May. It noted a minor dip but the TVL remained $11.436 Million.

Source: DeFi Pulse

A total of 292,266.36 Dai has been minted thus far with WBTC as collateral, according to data from DaiStats. Approximately 83.491 WBTC was locked in Dai, which accounted for 6.43% of its total supply.