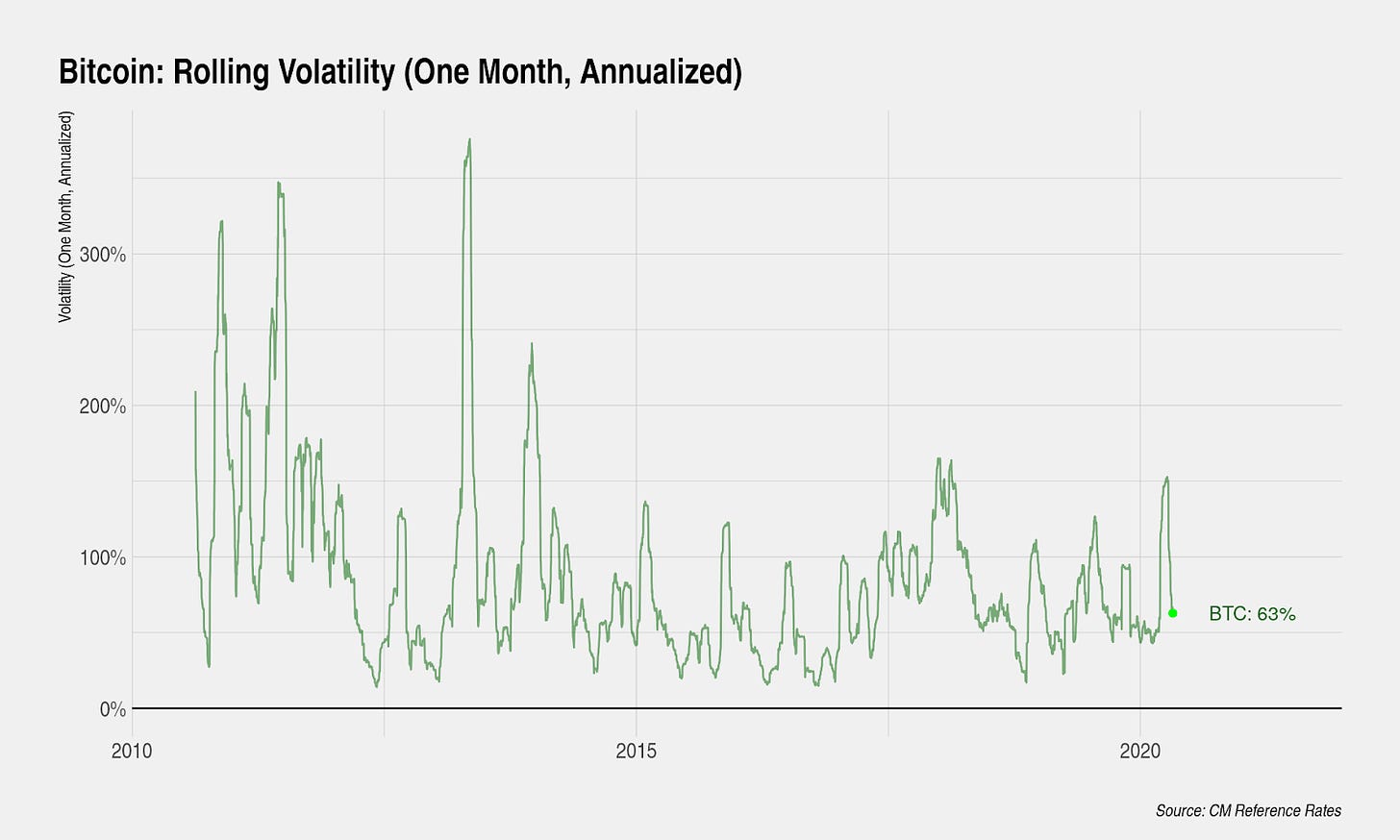

Bitcoin halving preparation on track as rolling volatility retracts

The cryptocurrency market suffered a big blow on 12 March. Many crypto-assets plummeted and this sudden drop gave rise to intense volatility in the market. The traders who would jump during such time, chose to sell Bitcoin, causing the price of the coin to sink more. Following the crash, the market remained passive, as BTC’s rolling volatility shot up to 150%, according to data provided by Coin Metrics.

However, this volatility began subsiding as bitcoin began consolidating between $6,400 and $7,000. The cryptocurrency’s restrictive move within the price points build the market and instilled trust among the buyers. Soon after, it hit $7,700 and managed to hold this value. According to a recent Coin Metrics report, such bullishness in the market was also a result of the rolling volatility retracting to its usual level-63%.

Source: CoinMetrics

A similar trend was noted in 2019 when the BTC market saw a significant crash on 24 September. The sudden drop that shook the market, saw BTC consolidate, shortly after, between $8,000 and $10,000. However, the volatility had not surpassed 100%, around the time, and thus was noticing a quick retraction and dropped to 59%.

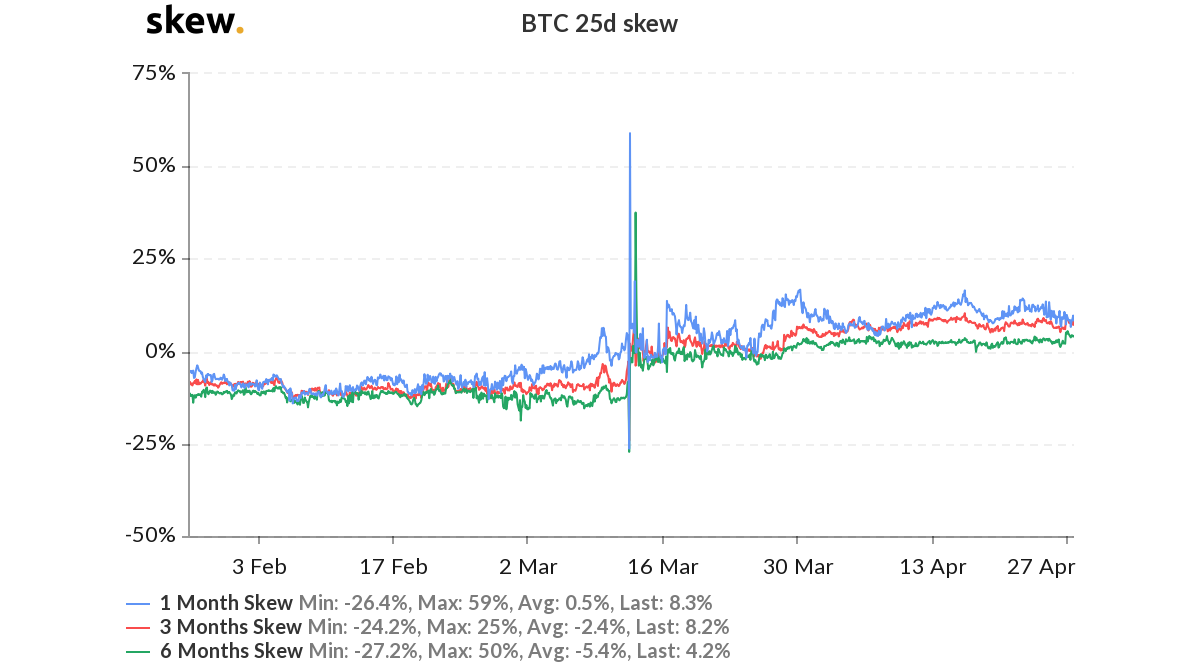

Bitcoin’s market has been reporting less volatility over the past few days. This was not only true for the spot market, but also for the derivatives market. According to data provider, Skew, the Bitcoin options metric, BTC skew, turned positive after laying in the negative territory since 2019.

Source: Skew

The metric indicated the options contract for Bitcoin, with different strike prices but which had the same expiration, will have different implied volatility. In 2019, this metric across all time frames had surged only briefly, but in 2020, it has once again surged and remained above 0%. This indicated the growing demand for Bitcoin Options contracts. Since the halving is also around the corner, traders will long on BTC, adding to the positive sentiment.