Bitcoin halving in the midst of pandemic to favor Chinese miners

Bitcoin miners generated a total of $387 million in revenue for March 2020. Cumulatively, miners have earnt over $12.5 billion in revenue between 2018 and 2020. Hence mining has become an increasingly competitive industry. With the 3rd bitcoin halving around the corner, China remains the dominant player and its share might increase post-halving.

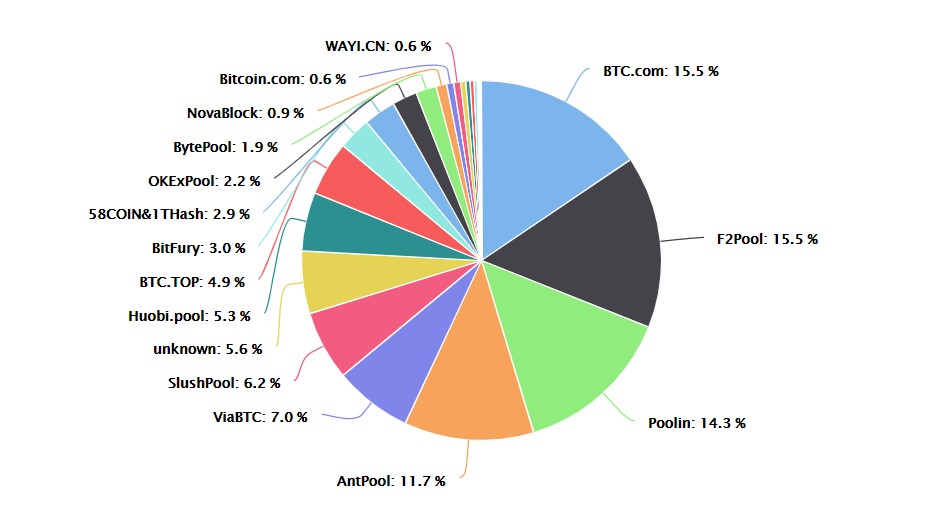

Currently, the top 5 mining pools for Bitcoin (BTC.com, F2Pool, Poolin, AntPool, and ViaBTC) all belong to China and 64% of hashrate comes from these pools. Further, about 50% of the hashrate from these top 5 pools come directly from Sichuan province, with the rest spread out over other regions.

Source: BTC.com

Additionally, Bitmain, a top mining equipment manufacturer based in China, controls two mining pools, BTC.com and AntPool, and to an extent ViaBTC. Together Bitmain controls over 37% [44%] of the Bitcoin hashrate. However, this has dropped from 40% and above and is mainly due to the problems being faced by the company.

Being the biggest player in the industry also means being able to withstand major drops in hashrate. Take, for example, the recent plunge in Bitcoin price, which reduced the hashrate from 123 EH/s to 93EH/s. Antpool was hit the worst, a 30% drop in hashrate was observed during this crash. F2Pool handled the crash relatively better with only a 14% drop in its hashrate contribution.

Chinese miners still use Bitmain’s famous Antpool S9 miners since the electricity costs are relatively less and hence these older rigs can produce profits, provided the price remains above the break-even point. However, the Black Thursday showed that when the price dips below this point, these machines will no longer stay competitive/profitable, hence, causing miners to switch them off. The result of this can be observed in the hashrate drop mentioned above.

Ethan Vera, the Head of Finance at Luxor pool mentioned in an interview with AMBCrypto that,

“The higher efficiency you have, the better chance you have staying in business, so mining rigs like S9 are near the bottom of that. Unless you have sub 1.5 cents power, so a good portion of them will most likely fall-off the network.”

However, he also mentioned that there were regions with low or virtually free electricity areas where these rigs could still operate and that this was a minority of them.

Speaking with AMBCrypto, Thomas Heller, the Global Business Director of F2Pool stated that the drop was significantly due to the availability of newer mining machines with the F2Pool. The drop in other mining pools was due to the use of older mining equipment like the Antminer S9. Speaking about the third halving, which is slated on May 12, Heller added

“A lot of people expect a huge number of machines to switch off at the halving but if Bitcoin price is at $9,000, I don’t think it is going to be as huge as people expect it to be.”

He also explained that there will be machines going offline but China will not be as affected, this time, as they were during the March 12, price drop and owes this to the higher electricity cost.

China’s ties with Bitcoin

Since the early days of Bitcoin, China has been at the forefront, especially when it comes to manufacturing mining equipment. Although the development of ASIC miners was done largely by hackers, the development and manufacture of a full-scale ASIC miner were by Butterfly Labs [BFL] based in the US. BFL had problems delivering in 2011 and by 2012 Chinese firms like Avalon and ASCIminers took control of the ASIC manufacturing game.

BitFutry [based in the Netherlands] also entered the game during the same time, however, radical improvements in manufacturing ASIC came with the competition of producing low electricity consuming devices. At one point in time, Bitmain controlled over 80% of the mining equipment market, albeit it reduced drastically due to the problems faced by the company over going public.

The takeaway from this is that China was in the right place and at the right time. China has managed to stay ahead of the competition and its share will grow post halving due to the following reasons,

- Cheap electricity

- Relatively small OpEx

- Supply chain and availability of mining equipment

Cheap Electricity & Operational Expenses

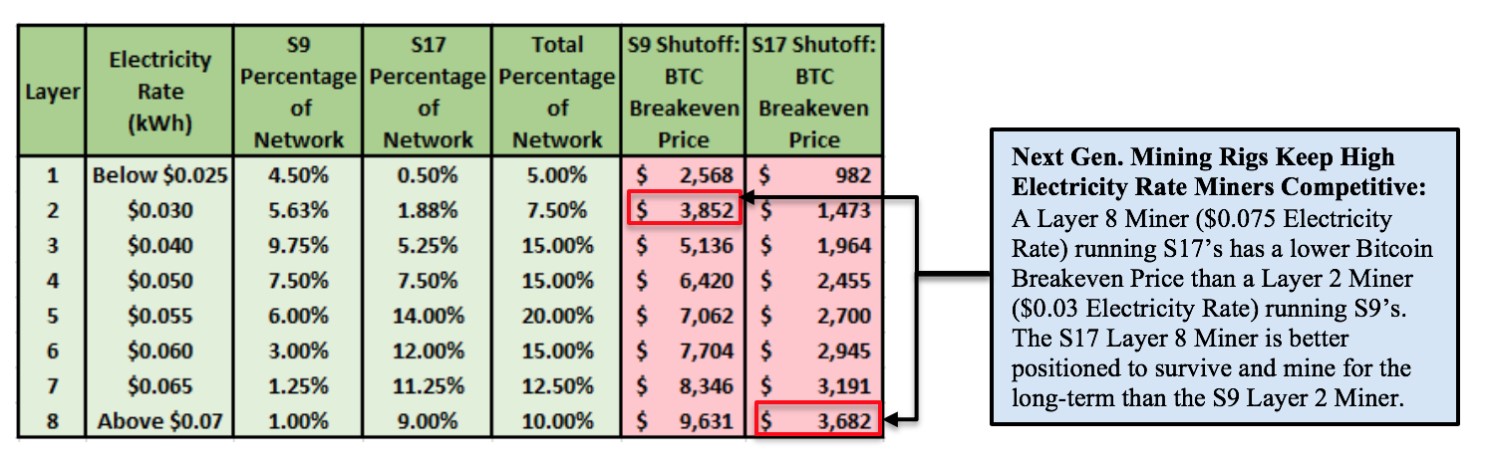

Electricity cost is incredibly important to miners as it constitutes 95% of the expenses incurred by a typical miner. Hence, miners with cheap electricity tend to cope better with price crashes than those with higher electricity costs. Hence electricity costs play one of the pivotal roles in determining the price floor or a break-even price for miners. Thus, for the latter group, the break-even price will be considerably lower. Another aspect that determines the break-even cost is the equipment being used.

A miner with cheap electricity does not need an upgrade to the latest mining equipment as this would create unnecessary expenses and thus reduce the RoI. However, for a miner with higher electricity costs, the miner has to upgrade his mining rig to stay competitive. Hence, the break-even cost for this group would be higher. Generally, the miners in the east, like in China, who have access to cheap electricity will have a competitive edge over the ones operating in the west.

Source: Blockware solutions

The attached chart shows this variation of break-even prices based on increasing electricity costs. An S9 miner mining at $0.030 KWh would have the same break-even cost as a miner mining with the latest S17 miner at $0.07 KWh. Hence, even during Black Thursday, most of the Chinese miners were not as badly affected as the miners in the US or Europe. However, the ones in the West definitely felt the brunt and which in turn caused some to even shut down mining till it became profitable.

Since 95% of the expense for a miner is electricity, miners with access to cheap electricity wouldn’t need to compete with other miners by purchasing new equipment, hence drastically reducing other expenses.

Alejandro De La Torre, the Vice President at Poolin added that,

“the rainy season is about to start in Sichuan province, which will lower the electricity costs so the mining farm operators [in China] are in a very good position.”

In addition, Alejandro mentioned that due to a combination of halving, COVID, and the availability of newer mining rigs to the Chinese miners will increase the hashrate concentration in China, at least temporarily.

Hence, after the third halving, the “wet season” coupled with massive amounts of inexpensive and excessive hydropower for miners to use, the concentration of Bitcoin mining will increase in China.

Supply chain and availability of mining equipment

China is the hub for electronic goods in the world and due to inexpensive labor, mining equipment manufacturers experience a major advantage by just being located in China.

Additionally, miners will have faster access to mining equipment due to well-connected supply chains, this would also provide the Chinese miners an unfair advantage as miners located in different parts of the world need to incur time delays and overhead expenses like import duty.

2020 is also the perfect time to explain, how China could siphon more control over Bitcoin hashrate. Due to the lockdown, the supply chain has halted and miners who are in other parts of the world cannot access the latest equipment. These upgrades are, however, available to inland miners.

The lockdown is acting as a double-edged sword, as it could push other mining equipment manufacturers to on-board/capture consumers and spark innovation thereby reducing reliance on Chinese mining equipment.

So, all of the above indicates that China clearly has an advantage when it comes to Bitcoin mining, be it manufacturing mining equipment, or miners.

Levels of Centralization

Ethan Vera provided clarity on this and explained the centralization in China comes in three levels – centralization of manufacturers, production of mining hashrate, centralization of mining pool operators

Speaking about the first level of centralization, Vera added,

“This centralization will not change leading out of the halving in the short to mid-term, it is going to remain China dominated”

As for the production of hashrate, Ver added that it would increase, as “domestic clients have been prioritized due to the COVID situation”. He also mentioned that after the halving this would slightly reduce and perhaps shift to North America in 1-2 years.

Vera expressed concern for the third level of centralization since mining pool operators decide what block gets added to the network. He added,

“About 90-95% of the network is managed by Chinese pools and it gets even more complicated when you look at it on a per-company basis so the top three companies control over 60-70% of the network… and that’s a massive concentration in China for management of the hashrate, [and these managers] are the ones that are actually building blocks and have the ability to do harmful things to the network and that this is quite scary”

What does this mean? [aka conclusion]

These reasons explain why mining is predominantly concentrated in China. However, after the third halving, China will consolidate an even bigger share, but this will only be for the short term. After the wet season, the electricity prices in China will rise from under 3 cents to 5 cents and above, whereas places like North America will attract a lot of miners and hence reduce to the centralization of miners and perhaps, mining pool operators as well.

Vera added,

“I think over the long run, we will see a bigger shift to North America, if I had to assume, in the next two years, China’s [concentration of hashrate] will decrease from 65% to 50-55% and most of that will go to North America, specifically, Texas.”

Alejandro also agreed that North America is better positioned in terms of infrastructure to act as the next hub for Bitcoin mining.

All-in-all, the third halving will cause a decrease in hashrate and therefore knockout miners who are barely breaking even. Although in the short to medium term, the concentration of the hashrate in China will increase, the mining pool operators agree that in the long term, it will distribute.

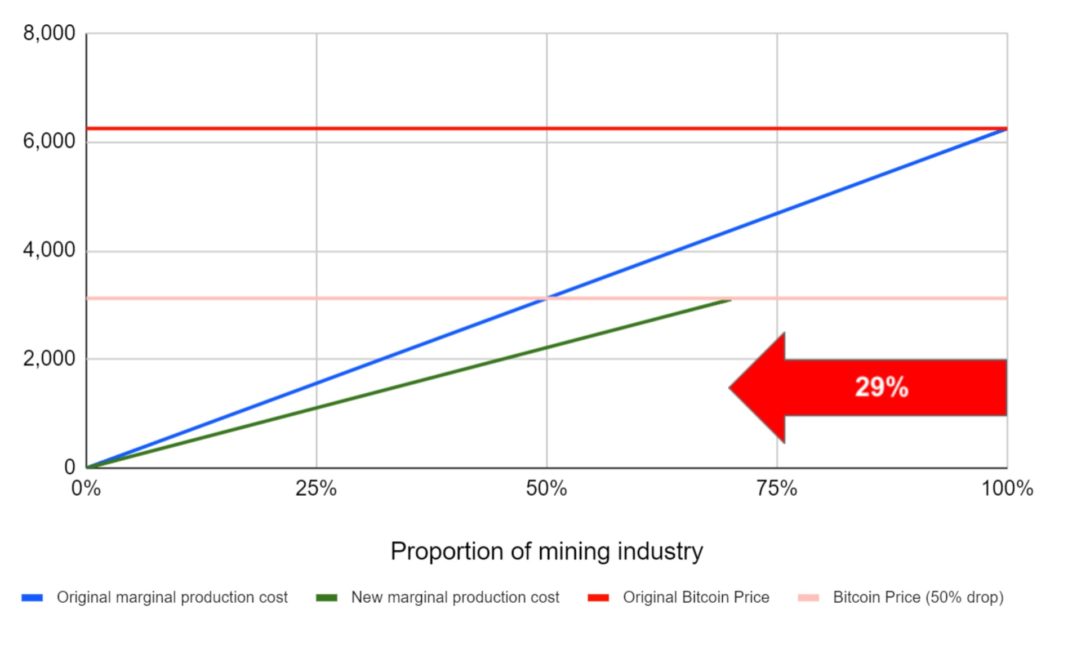

Source: BitMEX Research

As discussed earlier, the hashrate after the third halving might drop by 34%, similar to the recent decline in the hashrate on Black Thursday. However, if the price doesn’t increase after the event, the miners with cheap electricity [Chinese miners] can withstand the drop in hashrate and the block reward, whereas, miners with higher operating costs, will need to shut off their farms. With the lockdown in place for most of the countries, the equipment will largely be available at first to the Chinese miners, further increasing their profitability. Hence, due to special circumstances, the unfoldings of the third Bitcoin halving will be an interesting event.