Bitcoin Futures: Spot prices not dictated by volume alone

Over the course of 2020, institutional investors have been keen on investing in Bitcoin Futures on regulated markets. A popular choice among institutions has been the derivatives giant Chicago Mercantile Exchange (CME). The popularity of the same can be highlighted by the fact that Bitcoin Options volume on CME rose by 1000% in May 2020 alone.

In fact, analysts had been speculating whether bullish positions built by short-term institutional investors were responsible for this. Corresponding to such interest, Bitcoin’s price crossed $9000 several times in May 2020. So, do Bitcoin Futures markets influence Bitcoin’s price on spot exchanges?

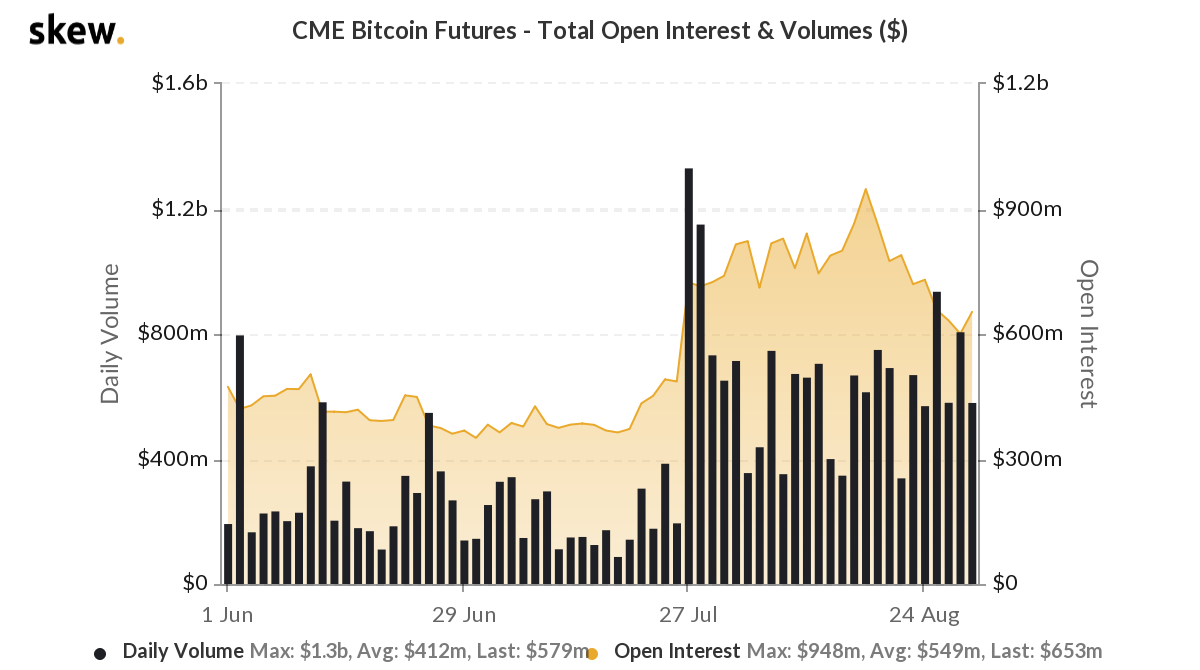

Source: Skew

In the past 90 days, Bitcoin Futures volume has hit highs above $800M on 4 days post-July 27, 2020. The daily volume, however, has consistently been above $500M since the same day. Now, consider the BTC/USD chart from TradingView.

Source: TradingView

BTC/USD crossed $9,900 on 27 July 2020, and since then, it has been rising and holding steadily on the charts with relatively low volatility. Consistently high daily BTC Futures volumes on CME have also corresponded to consistently high BTC/USD on spot exchanges.

However, daily Futures volume for BTC hit the Q1 2020 level only on 12, 13, and 20 August 2020. In Q1 of 2020, Bitcoin’s price was corresponding to this volume level, despite the former holding at $8400 and above. If daily Bitcoin Futures volume were to consistently fall below $400M, the cryptocurrency’s price may drop to the $8400-level.

Some analysts have argued that CME Bitcoin futures are not physically settled, unlike Bakkt. However, it is important to highlight that despite trading financially-settled BTC Futures, volume corresponds to the sentiment of institutions and retail traders. To counter this, the popular opinion among some crypto-analysts is that BTC Futures do not exert an influence on BTC’s spot prices. Plan B, a popular Bitcoin maximalist, is of this opinion as well. In fact, earlier this year, he had explained this through a tweet,

Source: Twitter

Ergo, it is irrational to assume that Futures market activity is the only factor influencing Bitcoin’s spot prices. Other factors influencing the price include Liquidity on spot exchanges, demand created by new buyers, and the influx of Tether on spot exchanges from East Asia.

Volume in BTC Futures is equivalent to bullish sentiment in the market as calls are expectations of a price rise in the future. Other metrics like put/call ratio and Open Interest can also be used to predict which direction Bitcoin’s spot prices will go.