Bitcoin Futures premium double; institutions poised for upheaval

Institutional investors are more bullish on Bitcoin than before.

Since the derivatives market began to muster significance in 2018, its growth has been essential for the industry. The Futures contracts help chart the sentiment around Bitcoin, both customer and price. The latter is expecting the former to pump.

According to a recent report by Arcane Research, derivatives traders, both on institutional friendly and retail heavy platforms are expecting a price increase in the next few months, based on the contracts’ premiums.

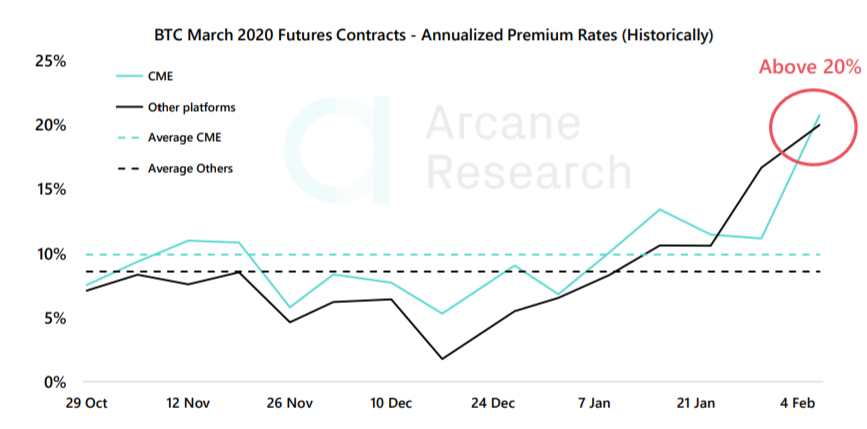

Source: BTC Futures Premium, Arcane Research

The institutional market is defined by the contracts on the Chicago Mercantile Exchange [CME], considering the CBOE left the market a year ago, and Bakkt’s volumes are too paltry to make a larger-picture estimate. On the unregulated front, the retail crowd is represented by Kraken, BitMEX, Deribit, and FTX.

Across both categories, in the short term, the outlook is bullish. The annualized premiums for contracts expiring in February and March are well above 20 percent. To put that in perspective, since the close of October, the average premium for CME contracts was 10 percent, and for unregulated exchanges it was in single digits, sometimes going as low as 1-2 percent.

Earlier this year, as Bitcoin found lost momentum, the premiums began picking up, rising above the average. What’s even more impressive is recently the premiums on CME contracts have overtaken their unregulated counterparts, showing a more favorable outlook for institutions.

As the short-term looks very bullish, in the long-term reality sets in. The Futures annualized premiums for the contracts expiring in June i.e. post the May 2020 halving, shows a steep decline.

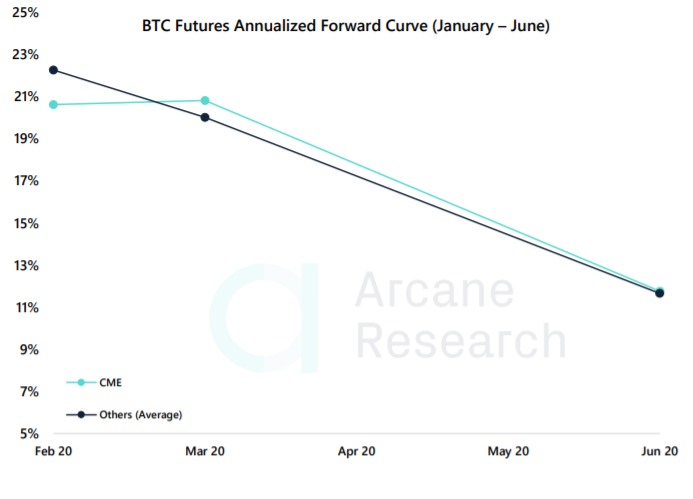

Source: BTC Futures Annualized Forward Curve, Arcane Research

The report noted that the annualized forward curve from January to June dropped from well over 20 percent to 11 percent, for both exchanges.

Based on the two charts it signals that derivative traders are expecting the price to increase till the halving, and post the same it would see a steady decline.

These charts further compound the heated debate around the priced-in effect [or not] of the Bitcoin halving. Some suggest that the markets have priced-in the decrease in incentives for the miners to continue adding blocks, based on the price increase in 2019 [over 90 percent] and the bullish sentiments of 2020.

Others are of the opinion, that it is not, and a significant price move is on the horizon.