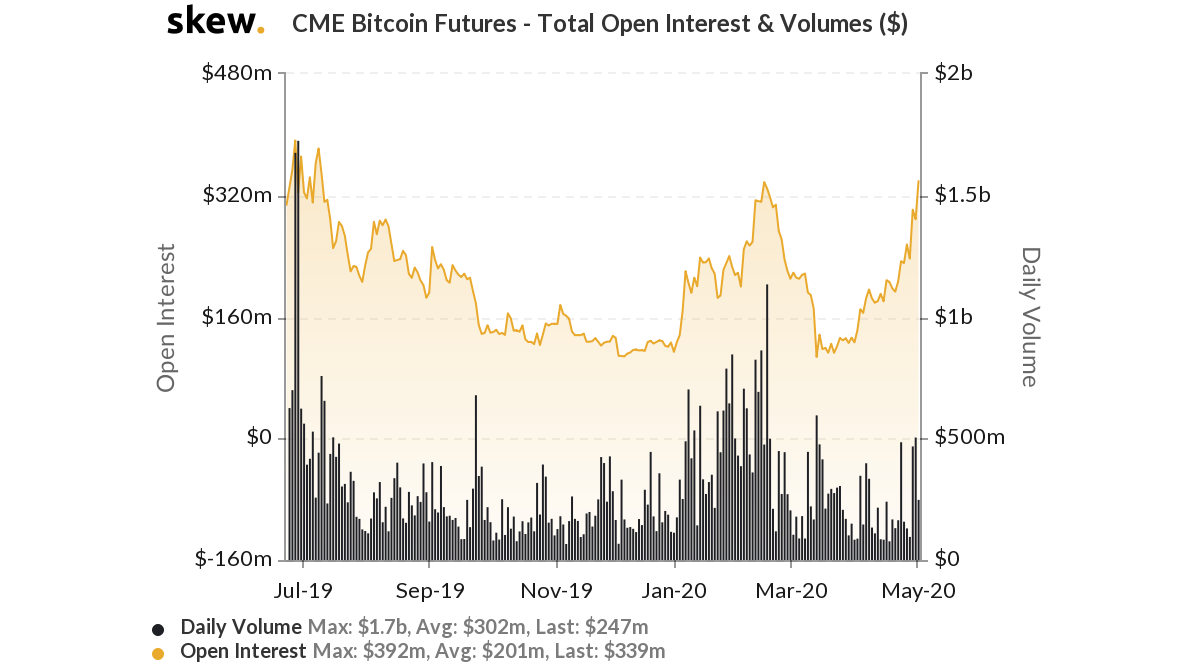

Bitcoin Futures on CME witness strong institutional confidence as OI rises to $339 mil

Bitcoin Futures open interest [OI] on derivatives platform CME marked a new yearly high. This also paved the way for the platform to register nearly 10-month high OI climbing all the way up to $339 million. According to the latest charts from the analytic platform, Skew, open interest for BTC Futures rose to a previous yearly high of $338 million on 14th February. The figures suffered a setback thereafter rolling down to $107 million a month later.

Source: Skew

Since the crash, open interest on CME was up by 216.8%. There were reports suggesting that one of the largest hedge funds in the world was eyeing the Bitcoin futures market. Renaissance Technologies’ Medallion fund, which is considered to be one of the most successful hedge funds ever, was reportedly “permitted” to jump into Bitcoin Futures market of CME.

On the price front, Bitcoin is, currently, in a consolidation phase. The spike in the open interest figures may have been triggered by Bitcoin ‘s latest rally, though short-lived, beyond the $9,000-level. While open interest figures have seen a substantial increase after a rather dull month of March, the BTC Futures’ daily volume has been slow to catch up. The volume figures rose to $504 million on 30th April, a level unseen since 12th March.

This indicated that institutions are returning to the market in anticipation of a price surge as the block reward halving nears. The latest run past $9,000 and the rising institutional expectation of a bullish phase is an indication of a growing positive macro sentiment in the BTC ecosystem with just 10 days to halving.

Overall, after a rather flat month in terms of aggregated daily volumes, figures rose substantially on 29th April to levels that were last seen on 13th March. Huobi and Binance led the cue with $7.4 billion and $7.3 billion respectively.

Another crucial institutional trading platform, Bakkt also saw a significant surge in both volumes as well as the open interest of BTC Futures. Volume for Bakkt’s physically-settled BTC Futures hit a three-month high on April 30 after it hit $29 million. The volume for cash-settled BTC Futures also rose to $4.8 million.