Bitcoin Futures: Binance is catching up to BitMEX

For years, the Bitcoin derivatives market has been dominated by one exchange and one exchange only – BitMEX. But in 2019, the Seychelles-based exchange saw competition from the big dogs, and now one of those big dogs is closing in.

Binance, considered one of the largest cryptocurrency exchanges in the world, threw its hat in the Bitcoin Futures market back in September. In less than 5 months, the Malta-based exchange is now catching up with the derivatives veteran BitMEX.

According to data provided by Skew markets, the liquidity for Binance is steadily increasing. While it is still a long way from threatening BitMEX, there might be a few raised eyebrows.

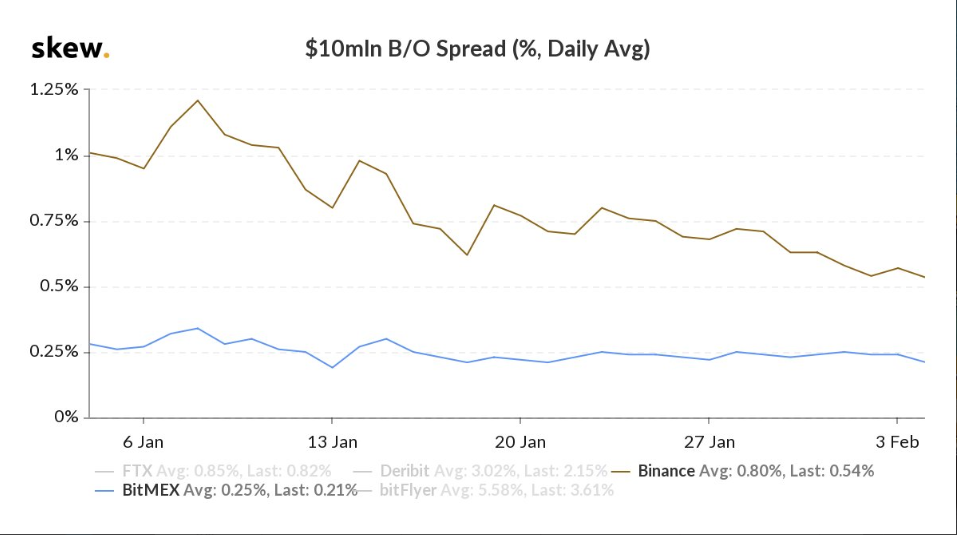

The bid/offer spread for Binance contracts since the beginning of January has dropped to 50 basis points [bps] for contracts worth $10 million, compared to BitMEX’s spread which stands at 25 bps. Here, it should be noted that the average for Binance is still quite high at 80 bps.

Source: BitMEX vs Binance B/O, skew

At the beginning of the year, the spread for Binance was well over 100 bps, almost touching 125. However, then began a steady drop and at press time, the B/O spread hovered over 50 bps.

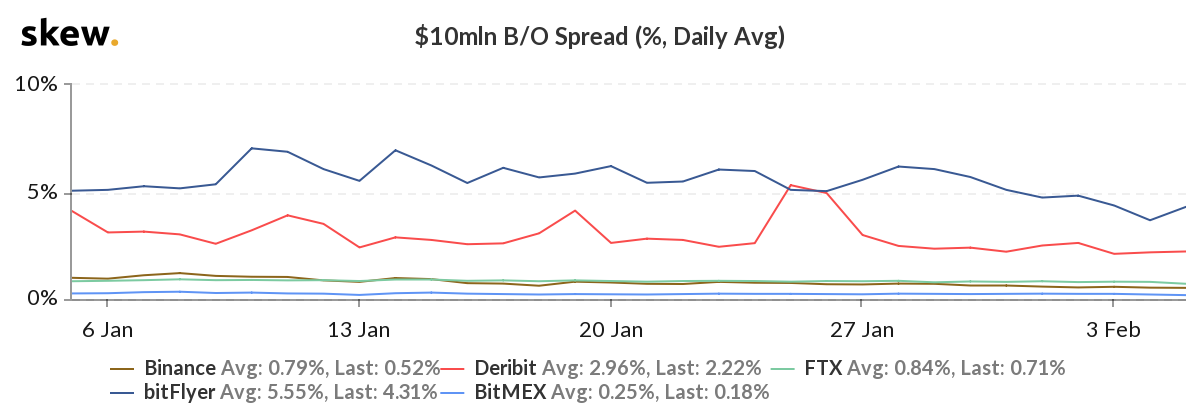

Liquidity on other Futures platforms showed greater spread. The Futures spread on bitFlyers showed a spread of over 500 basis points since the beginning of January, with only a brief dip seen recently. Deribit, on the other hand, showed massive volatility in B/O spread, ranging from 2.41 to 5.32 percent, over a relatively short time period.

Source: B/O Spread, skew

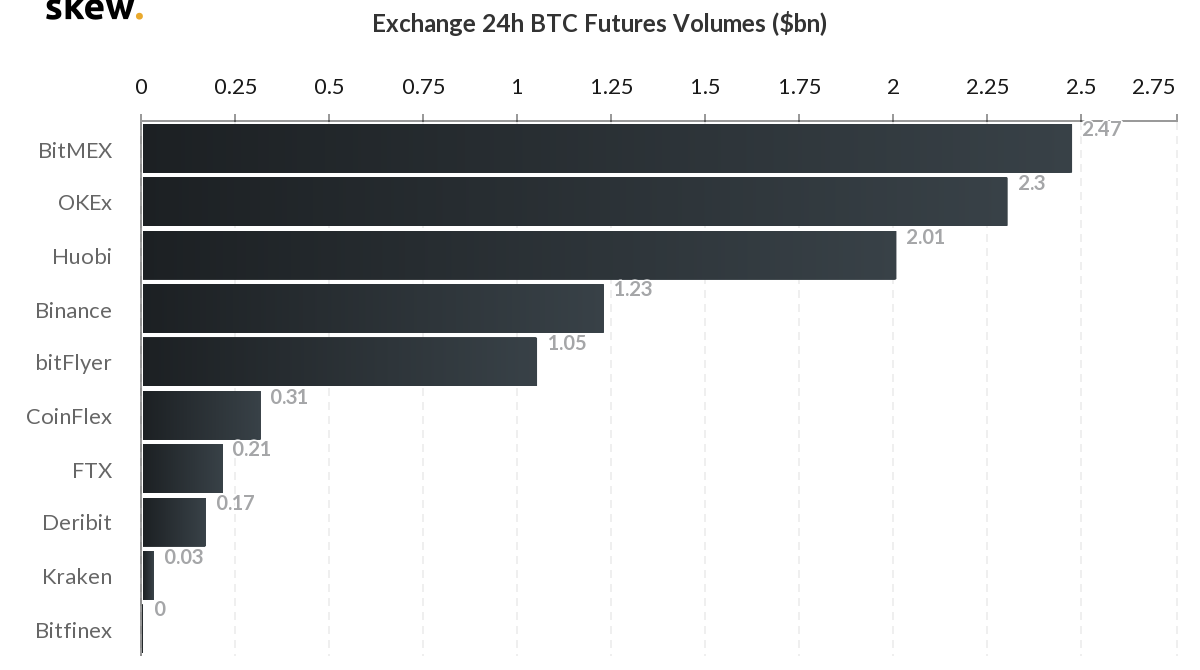

In terms of volume, however, BitMEX still takes the cake. The 24-hour trade volume for Bitcoin Future contracts traded on BitMEX was $2.57 billion. Taking second place was Maltese-exchange OKEx, which also launched its Futures platform in the second half of 2019, with $2.37 billion.

Binance could only manage the fourth spot with $1.23 billion in volume.

Source: Bitcoin Futures volume, skew

Open Interest told a similar story. On BitMEX’s coffers, the number of outstanding contracts was well over $1.47 billion, while Binance was in the fifth spot with $210 million, seven times lower than BitMEX’s open positions.