Bitcoin CME’s Open Interest drops by 40% as consolidation commences

Over the past week, Bitcoin’s value collapsed under $9000, a movement that continued its pattern since the king coin fell below $9300. The support at $8900 could not facilitate a bounce-back either as at press time, Bitcoin remained just above $8700.

Another week of substantial downward movement has affected some of Bitcoin’s key metrics.

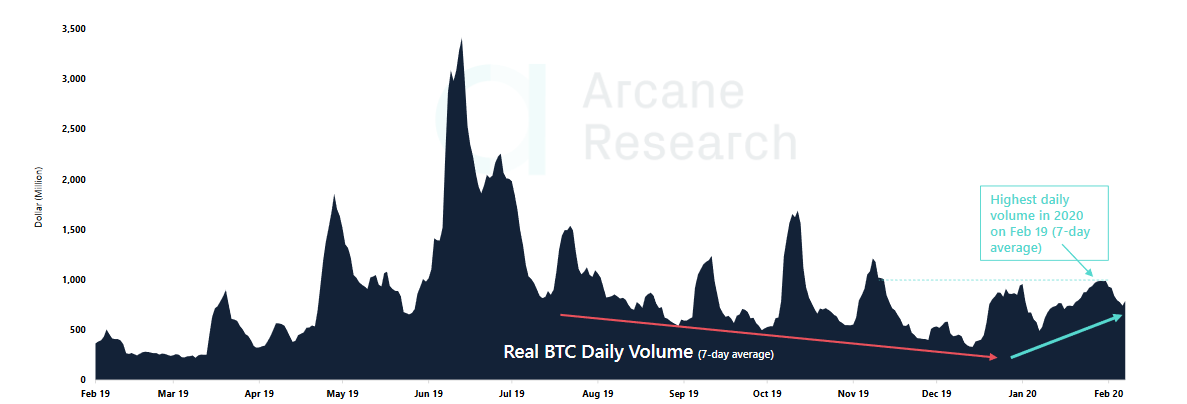

Previously, despite strong bearish pressure from the market over the 3rd week of February, Bitcoin managed to record a 7-day average trading volume of $1 billion, a figure that was the highest since the first week of November 2019.

Source: Arcane Research

However, according to data, the trading volume has been falling even more significantly this past week. Although a drop in volume is usually seen as a bullish signal, low trading volume with falling prices indicates that there is weak support at the lower price. However, an anomaly was noticed on 26 February when the price drop was backed by a high daily volume of $1.4 billion.

The Fear and Greed index continued to drop as well, with the index showing ‘Extreme Fear.’ The rating recorded by the metric was 38 at press time, dropping from 40 last week.

A bearish trend reversal was also observed from the institutional end. On 18 February, a record of $1.1 billion was traded on the CME since its peak in 2019. Things changed a couple of days later, however, as the daily trading volume for BTC Futures went down to $118 million. At press time, the daily volume for BTC Futures was just under $300 million. However, it remained significantly lower than on 18 February.

Source: Skew

The attached Skew markets chart also indicated that the Aggregated Open Interest for CME BTC Futures had dropped from $338 million on 14 February to $210 million on 18 February. The OI is still more than the average witnessed in October-December 2019, but the considerable drop over the last 2 weeks is a worrying sign.

Bitcoin’s volatility continued to spike over the past 14 days after steadily dropping during the majority of the bullish rally. Although a spike in volatility does not indicate a bearish or bullish trend, volatility hitting an incline during a price slump may suggest that low consolidation is a temporary price point for the largest crypto-asset.