Bitcoin-based portfolio ousted by BNB-based allocation in 2019

Portfolio Management in the digital asset industry has picked up pace in the financial industry over the past couple of years and over time, a lot of analysis has been drawn between the performance of stocks and crypto within the same portfolio.

Portfolio Optimization with Bitcoin is an obvious favorite of the traders and a recent collaborative report between 21Shares and Binance Research identified the performance of traditional US equity and fixed-income portfolios, with and without the involvement of digital assets.

According to the report, portfolio optimization with BNB was also a major point of discussion.

Source: 21Shares

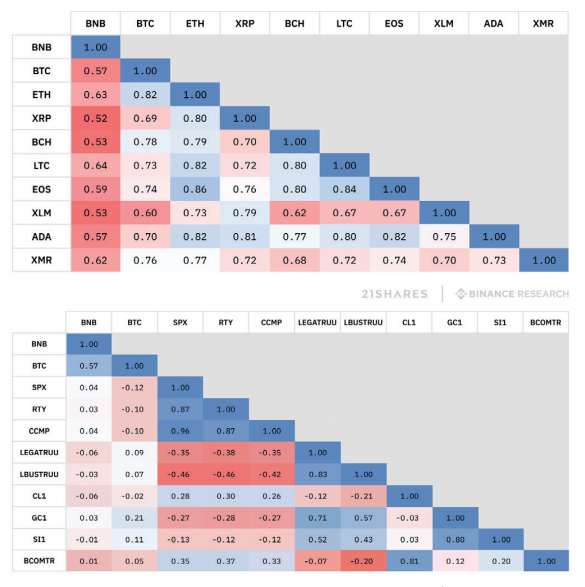

The characteristics of BNB were highlighted in the report as it was one of the lowest correlated assets with other digital assets and it also incurred a low correlation index with traditional financial assets in 2019.

The report went forward with two general approaches for the construction of the portfolio as stated below.

Source: 21shares

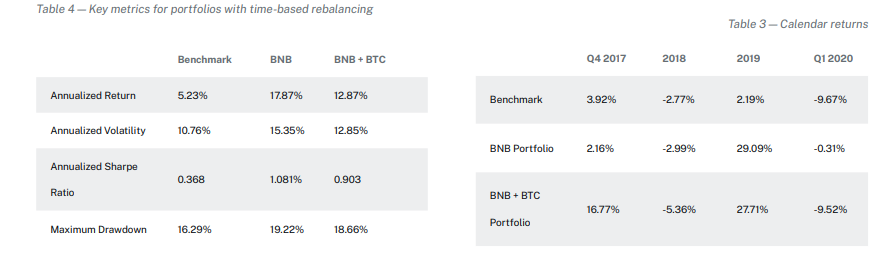

Results based Time-Rebalancing

It was reported that the Binance token portfolio indicated a high level of volatility in comparison to the BTC+BNB portfolio but the excessive volatility was largely compensated because BNB outperformed both the benchmark portfolio with crypto and the BNB+BTC portfolio. The BNB portfolio had a significantly higher Sharpe ratio of 1.081 in comparison to benchmark’s o.368 and BNB+BTC’s 0.903 in the charts. The report added,

“It is important to note, however, that the large deviation from the ideal BNB allocation of 5% could have unnecessarily given an investor a more-than-ideal exposure to the crypto market during the early months of the 2018 downturn.”

Source: 21shares

Results based on Tolerance-based Rebalancing

Following am identical trend in the time-rebalancing portfolios when we look at the tolerance rebalancing approach. The BNB portfolio performed better in this regard as well with both the benchmark and the BNB+BTC portfolios playing second fiddle in terms of profit returns.

The report added that the analysis suggested a tolerance-rebalancing strategy exhibited a more reliable way for an investor to ensure their portfolios are never unnecessarily over-exposed to the crypto-asset industry.

Majority of Financial Advisors against Crypto Investments

In contrary to the above, a report by Bitwise Asset Management in early 2020 stated that more than half of the financial advisors suggested against cryptocurrency investments.

A survey was conducted within 415 top financial advisors in the United States and even though they admitted that 90 percent of their clients had queried about crypto investments in 2019, the advisors strictly remained against the investment and believed that regulatory uncertainty was a major red flag in this decision.

With the digital asset industry expanding as we speak, the above narrative may change by the end of this year if crypto assets are able to survive the current economic meltdown.