Bitcoin against the next recession : Survival of the fittest

People are not embracing collectivism because they have accepted bad economics. They are accepting bad economics because they have embraced collectivism.

―

To most people, Bitcoin is nothing more than an investment; a speculative asset that will yield good returns provided one hodls, at least till it hits the peak of the bull run. To a few however, Bitcoin represents a symbol that is the very embodiment of libertarianism and fin-freedom from the so-called fiat currency that is controlled by a single entity, the government. To the former, Bitcoin is supposed to act as a hedge against macroeconomic events or perhaps, even as a safe-haven asset.

Will it?

Will it actually act as a hedge and a financial safe-haven asset, especially when push comes to shove?

Most investors in cryptocurrencies and Bitcoin are millennials who grew up with the Internet and rapidly evolving technologies. To them, Bitcoin represents ease of transactions and in a vague sense, ubiquity; to them, it is a respite from banks, cheques, and other mundane ways to access one’s own wealth and nothing more than that. To cypherpunks, it means more; perhaps to Satoshi Nakamoto, it meant something else.

Satoshi’s message in the genesis block hinted at his dislike towards the centralized issuance of fiat money.

But why?

Most millennials grew up with it. But, most do not even have the slightest idea as to how this form of money came into existence and why it poses problems.

The History of Money

Throughout the history of civilizations, there have been different forms that money has taken, from cattle to cotton and gold coins to copper coins. Over time, money has morphed into various forms due to market demand. Only later on did centralized authorities take control of the narrative of money and build it to further assist the selfish motives of its cabals.

Austrian Economists define money as not a specific good or a commodity, but as whichever money emerges freely chosen on the market by the people who transact it and that which is not imposed on them by a coercive authority. Such money is not said to be determined by a government authority, but through market interaction. Gold was one such money used by various civilizations. It was further used to back ‘paper money,’ the latter was used as money since holding and transacting via gold was tedious and redundant.

The Gold Standard

Unlike other forms of money, the gold-backed monetary system was unrivaled; the reasons being that gold, as a metal, was scarce. Hence, it was hard money, a higher stock-to-flow ration which wouldn’t corrode or degrade over time, and would be widely used and accepted by people around the world. So, when centralized authorities did manage to back money with gold, it became an instant hit. The “La Belle Époque” as they called it, was when gold-backed money became a standard.

Global trade flourished since gold was valued the same across different nations and one could directly exchange currencies for gold, pay an exchange fee, and be done with it. All good things must come to an end, and so did the gold standard with World War I. To support the brewing war, the powers went off the gold standard and hence, the collapse of sound money began. Only Switzerland and Sweden did not move away from the gold standard. Hence, Swiss Francs are used as a hedge against global events like a recession.

After World War II and the Bretton Woods conference, the U.S. dollar would become the global reserve currency. At the time, the U.S dollar was still backed by gold. The dollar would fall off the gold backing in two steps; the first when President Franklin D. Roosevelt banned the redemption of gold and the second step was when President Richard Nixon announced the end of dollar convertibility to gold, thus letting the gold price float in the market freely. The reason for this is the same reason why countries and kingdoms moved away from the gold standard during World War I; they were constrained by the amount of money they could print.

The End of Golden Era & The Start of Fiat

The U.S.A, after getting rid of the backing by gold, could now print as much money as it wanted. This would be extremely troublesome for the citizens as more money would eventually lead to its devaluation and increase in inflation. However, it would be helpful for the government. To paint a picture of the difference between the Gold standard and Fiat, inflation during the former averaged between 0.5% and 1%, while the latter has had inflation figures that went up to double digits.

Perhaps, Ludwig von Mises said it best.

“[G]overnments believe that … when there is a choice between an unpopular tax and a very popular expenditure, there is a way out for them—the way toward inflation. This illustrates the problem of going away from the gold standard.”

Most countries around the world today employ the fiat system, which explains the rampant inflation, recessions and the devaluation of currencies and trade wars. The current monetary system is failing and the best example is the 2008 recession. Although people knew how the current monetary system was negatively affecting them, they couldn’t just revolt against it, even under a democratic regime. There was a necessity for new money to emerge, one which would render government useless, especially when it comes to confiscating it or prohibiting people from using it.

F. A. Hayek might have envisioned it back in 1984 when he said,

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.”

In the midst of the chaos caused by recession and inflation, a certain cryptographically coded form of money emerged.

It was Bitcoin.

A man going under a pseudonym, Satoshi Nakamoto, gave people a taste of money emerging from the free market, just as the Austrian economists said. It was devoid of a central controlling authority, meaning the government could not control it and at most, they could regulate it. They couldn’t stop it since it was a peer-to-peer system and needed no trusted third party to validate transactions.

Fast Forward a decade later. Bitcoin is worth approximately $10,000 and has gained attention from the mainstream media and even the President of the U.S.A. With Bitcoin, many cryptocurrencies have emerged, trying to solve different problems using blockchain. However, Libra is the only currency that came very close to threatening the sovereign currency.

As Austrian economists said, only the most efficient and sound money accepted by the market will survive in the end. Gold survived as long as it did since it was the closest thing to sound money. One that remains unaffected during times of global events, or at least tries to. In recent times, Bitcoin is being heralded as that hedge and even as Gold 2.0 for obvious reasons. Hedge or not, one thing can be said with utmost certainty; Bitcoin has never faced a recession and the attributions to it as Gold 2.0, a financial safe haven asset or hedge against recession, will be put to test.

Bitcoin as Store of Value

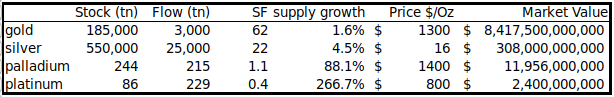

More often than not, Bitcoin is compared to gold due to various reasons. It is minable, it’s a scarce good, both have to be mined and so on. This also brings up the topic of stock-to-flow, which determines how good an asset is as a store of value as it factors all the above-mentioned reasons.

S2F model of Bitcoin and gold

Source: Plan B

Above are SF numbers of some of the important scarce metals. Gold has the highest SF number – 62, which means that it would take approximately 62 years to replenish all the gold present on the surface at that given moment. Silver and others have numbers less than that of gold. Basically, a high SF number indicates a better store of value.

Source: Plan B

According to Plan B’s post,

“What is very interesting is that gold and silver, which are totally different markets, are in line with the bitcoin model values for SF. This gives extra confidence in the model. Note that at the peak of the bull market in Dec 2017 bitcoin SF was 22 and bitcoin market value was $230bn, very close to silver.”

Now that it is established that Bitcoin does fall into the store of value category, the next important question is if Bitcoin will actually hold up during an ‘impending recession’ that most of the mainstream media is painting a picture of.

Bitcoin v. The Doomsday aka Recession

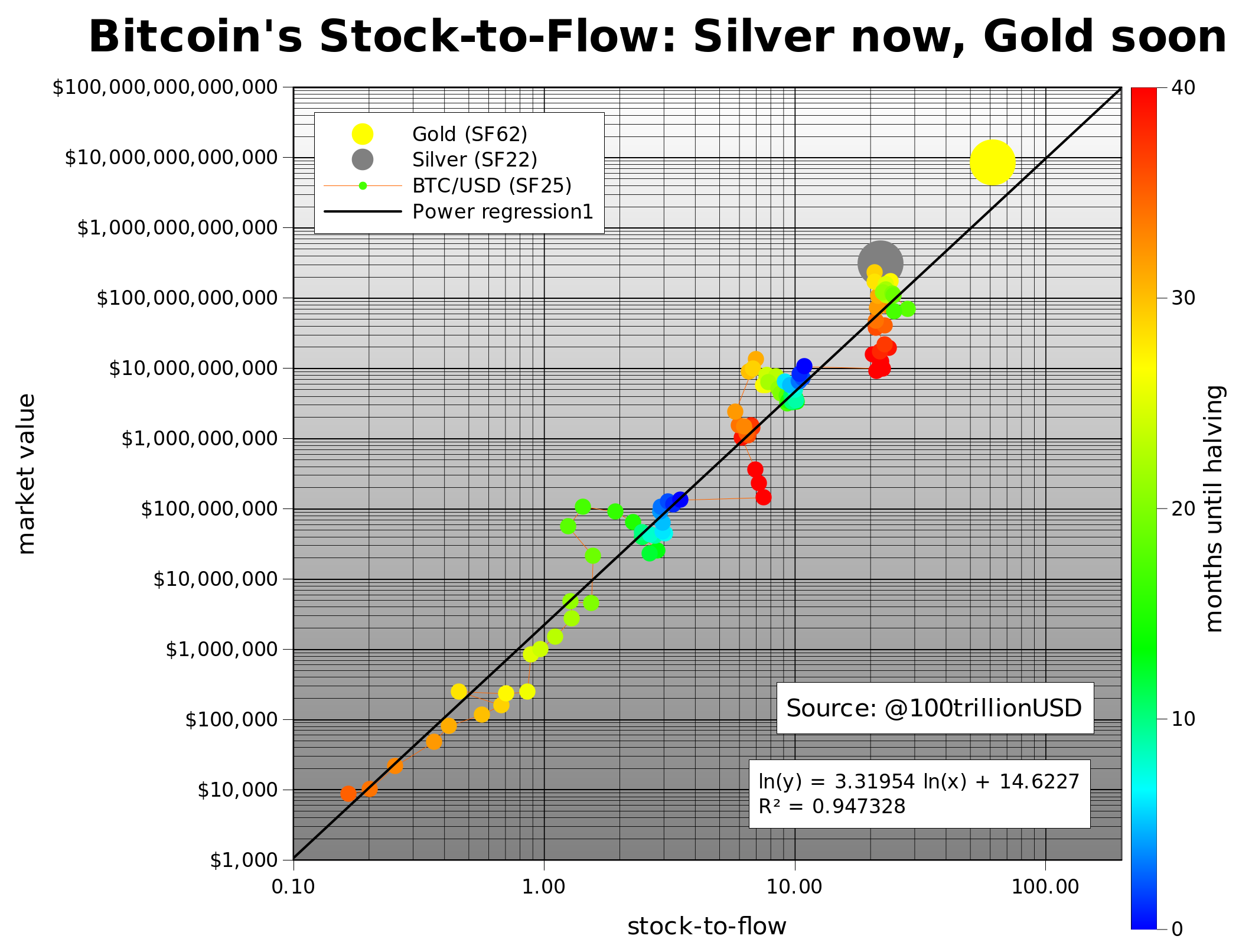

During the 2008 recession, it was clear that fiat currencies around the world collapsed like dominos. One way to guess how Bitcoin will react to its first recession is to look at the correlation of Bitcoin to assets that tanked during recession and those that served as a hedge.

Source: Coinmetrics.io

From the charts, it is clear that Bitcoin’s correlation with different traditional assets is inconclusive since the assets are varying about zero and hence, inconsistent. Bitcoin v. U.S. Dollar currency index had a positive correlation until 2018. It is however, on a decline since 2014.

For S&P500, the correlation went from negatively correlated to positive, which is astounding and completely mauls the ‘Bitcoin as a hedge’ narrative. However, there is good news for that narrative due to the increasing and positive correlation seen between Bitcoin and Gold or Bitcoin and VIX index.

Paul Vigna, a WSJ reporter, stated in one his articles in December 2018,

“Bitcoin also traded at a 0.77 correlation to the Chicago Board of Options Exchange’s VIX index, which measures market volatility… It makes sense that bitcoin would trade in step with the market’s “fear gauge.”

If Bitcoin were to truly act as a hedge against global events such as a recession, it should be negatively correlated with the S&P or the U.S. dollar currency index and positively correlated with gold, which is a known hedge. But somehow, it shows both strong and weak correlation, varying over time with the former. This indicates that the data obtained is inconclusive and that Bitcoin, as an asset, has to mature to derive conclusive proof from correlation.

Speaking to AMBCrypto, Alex Krüger, an Economist and trader, claimed that “Bitcoin is not a global hedge against a recession” and that the correlations for Bitcoin with “risk assets hover around zero.”

Krüger mentioned,

“Correlations hover around zero yet may increase the more institutionalized the space becomes, as institutional traders move amoung asset classes.”

Krüger has made it sufficiently clear that it is too early to judge if Bitcoin is a hedge against macroeconomic events and that the scales could tip either way.

Bitcoin – stocks correlations will likely emerge once the market becomes more institutionalized.

Will it be a risk-on (positive correlation with risk assets such as stocks) or a risk-off (safe haven) instrument?

Both are possible.

The jury is out on that.— Alex Krüger (@krugermacro) June 11, 2019

eToro’s Senior Market Analyst, Mati Greenspan, had a different approach to Bitcoin being a hedge against macroeconomic events. Greenspan told AMBcrypto that it would depend on the severity of the ‘impending recession.’

“In the case of a mild economic downturn, I’m not sure that there would be very much demand on Bitcoin as people would likely want to spend the little money they have on goods and services they need. However, if there was an erosion of trust in banks and government money, then Bitcoin could provide an excellent hedge for that.”

Emin Gün Sirer, Founder and CEO at Ava Labs, disagreed with the narrative of Bitcoin being a store of value or digital gold and told AMBCrypto that “mining the coins does not create a price floor or provide the opportunity to sell your coins at miner cost.”

“Mining extracts around $300m or so of value from the overall ecosystem to the miners and power companies, so the price has a continued inclination to go down unless there is a continuous influx of fresh cash into the system. As a result, we see that Bitcoin is not correlated with hedge-like price moves. Its price movements aren’t correlated with gold or other inflation hedges.”

To conclude, Emin Gün Sirer mentioned,

“Cryptocurrencies can provide alternatives to the fiat payment systems, but Bitcoin is too unscalable to use for payments and too unpredictable to use as a hedge. Its main use is just speculation at this point.”

The question still remains. Will Bitcoin actually act as a hedge in the next recession? Or will it collapse like the rest of the market?