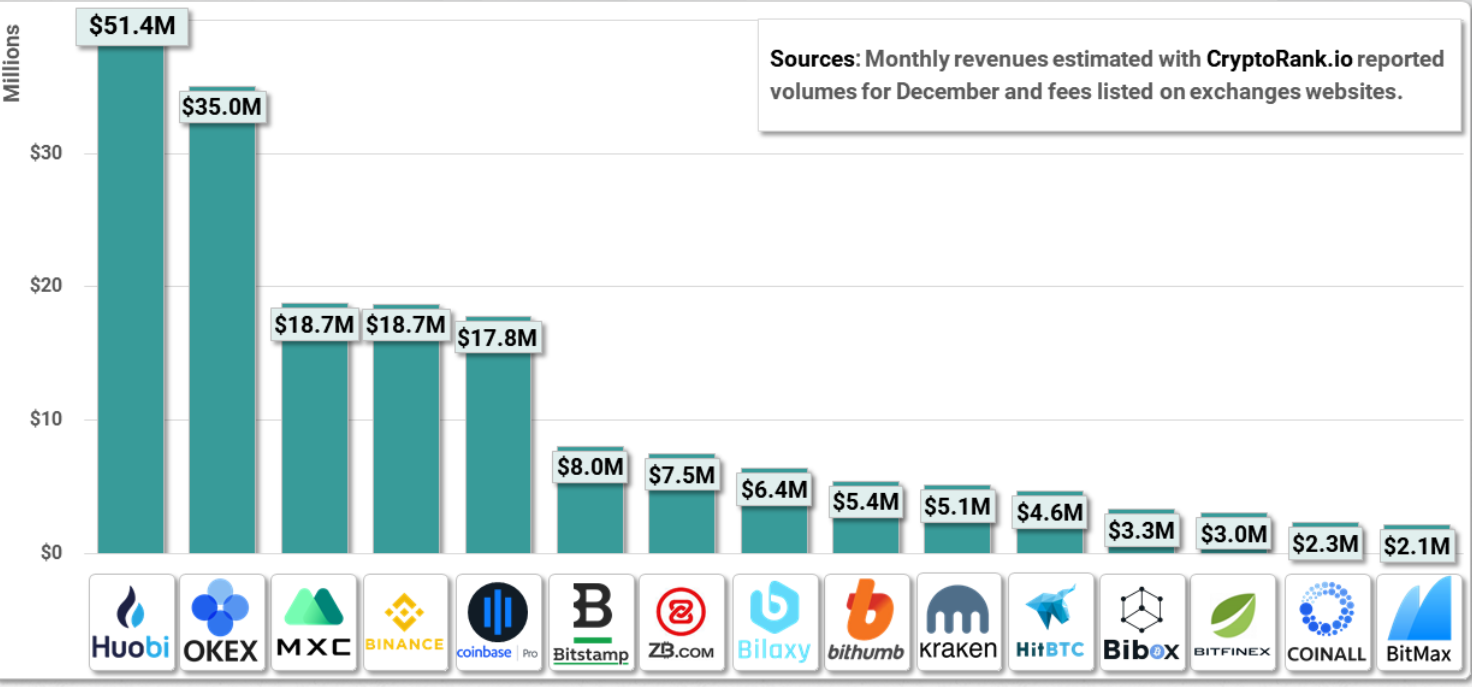

Binance lags behind Huobi and OKEx in terms of estimated trading fee revenue

Leading cryptocurrency exchange, Binance’s estimated trading fee revenue in December 2019 was $18.7 million. The estimated trading fee revenue was calculated using CryptoRank.io reported volumes for December multiplied by average trading fees listed on the websites of the exchanges.

The study which was conducted by CryptoDiffer revealed that the CZ-led platform was trailing behind the likes of Huobi and OKEx.

Dominating the chart was the Singapore-based cryptocurrency exchange, Huobi with an estimated trading fee revenue of $51.4 million for the same month. OKEx stood second with $35 million. This was followed by Binance and a lesser-known exchange MXC which recorded an estimated trading fee revenue of $18.7 million each, while Coinbase Pro was found to have $17.8 million.

According to CryptoDiffer’s estimates of the top five exchanges – Huobi, OKEx, MXC, Binance, and Coinbase Pro had more than $15 million per month in revenue, while the remaining top 10 exchanges had revenues from $2m to $8m. The study further noted,

“This is a very rough estimation considering trading/VIP discounts, market making, wash-trading and other factors that reduce the actual revenues of exchanges. Still, the numbers are very impressive.”

Source: CryptoDiffer | Top 15 exchanges by estimated trading fees revenues in Dec

Responding to the study, Binance CEO, CZ tweeted,

“No worries, we may not earn the most amount of money. But we try to do the most with it”

Previously, CryptoDiffer had noted a substantial decline in the volume in centralized exchanges [CEX] every month starting from August after reaching an all-time high for 2019 in July due to the price drop in Bitcoin and other altcoins. The study stated,

“..the total volume of centralized exchanges has dropped by almost 30%, thus the estimate revenues have dropped by approximately that percentage too.”