Binance Futures: High leverage trading most popular among retail traders

Leverage in futures trading essentially enables users to take larger future positions than buying actual cryptocurrency. Binance has leveled up this game by increasing leverage on its futures products. And according to Binance, “the higher the leverage is, the lower the user needs to spend on that position”.

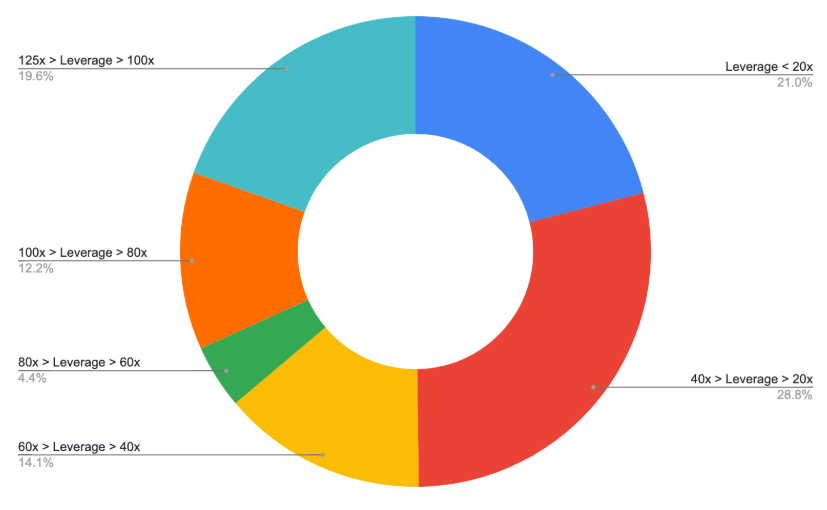

Binance’s latest report on leverage and derivatives stated that most of the traders on its platform trade at 20x leverage or higher while only a small portion of the users traded with 100x or more leverage. Binance also noted that high leverage trading is “most popular” among the retail traders. Its post stated,

“On average, over 80% of traders on Binance Futures trade at a leverage of 20x or higher. Additionally, 20% of the users trade with 100x or more leverage. While high leverage trading is most popular among Binance Futures retail traders, most of its institutional traders, who contribute to 81% of the total trading volume, tend to trade at a leverage of 20x or less.”

Source: Binance Research | A 30-day average of leverage usages on Binance Futures as of 1st January 2020

Binance has witnessed its futures trading volume spike following the increase in leverage which subsequently led Futures trade volume to surpass that of spot. However, not everyone is a big fan of increasing leverage.

Economist and crypto skeptic, Nouriel Roubini had previously argued that higher leverage exposes traders to more risk. This comment was directed towards BitMEX which reportedly came under the U.S. Commodity Futures Trading Commission’s [CFTC] investigation in July 2019.

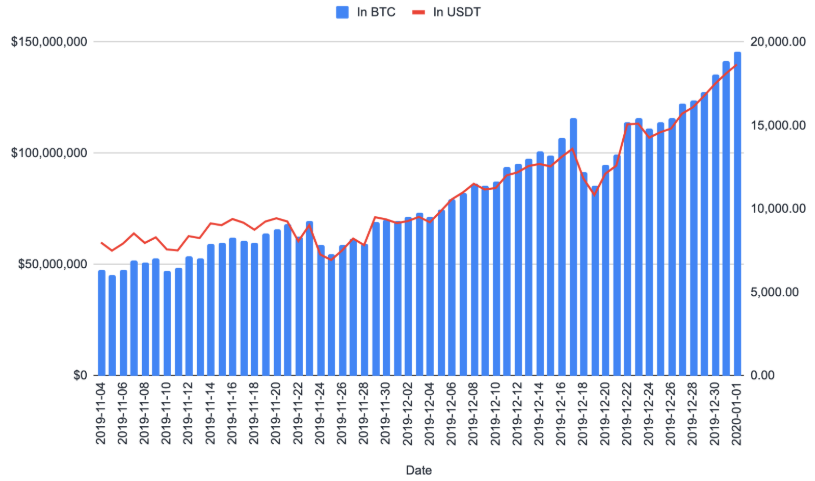

Besides, Binance Futures has also witnessed a steady growth in terms of its open interest despite hitting a minor slump in December, shortly after it first hit the $100 million mark. Binance’s latest blog stated,

“In early November, the open interest on Binance Futures was less than $50 million daily. On December 17th, the open interest on Binance Futures broke the $100 million mark as Bitcoin hovers around its recent low, it has been the case ever since. Today, its open interest is approaching the $150 million mark, which is triple its size from two months ago.”

Source: Binance | Daily Open interest (OI) from November 4th 2019 to January 1st, 2020