Binance eats into Huobi’s China market; registers 259K BTC in inflows

Binance has been one of the most active crypto-exchanges in 2019 in terms of expansion and active trading volume across the industry. The Malta-based exchange has experimented with tapping into several unfamiliar trading markets, while slowly solidifying its stature as the largest exchange in the space.

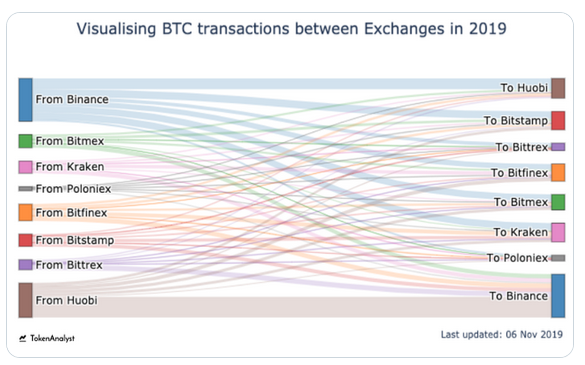

Equally, China has also been very active in the crypto-ecosystem recently, and according to a recent report by TokenAnalyst, the flow of Bitcoin wallets between different exchanges suggests an increasing rise in demand for crypto from the Asian country.

Source: Twitter

The report found that a significant portion of crypto-volumes had been transferred from Huobi wallets to Binance in 2019. A total of 259,000 BTC was sent over this channel, with over 48,000 transactions taking place for the same. The average transaction value was found to be around 5.4 BTC.

Huobi, an exchange that was founded in China, largely caters to the Asian market and the higher outflow to Binance suggests that it is losing much of its share in the Chinese market to the CZ-backed Malta-based exchange.

However, it was also noticed that the 2nd largest ‘interflow’ took place from Binance to Huobi, wherein around 137,000 BTC were transferred over a total of 44,000 transactions. The reverse movement of BTC suggested that Huobi still had a significant hold in the market. The Singapore-based exchange also made important announcements in the OTC markets recently, revealing its large-scale expansion plans with smartphones.

However, the advantage Binance holds over Huobi was made evident by the report. The higher outflow of BTC transfers from Binance to OTC exchanges and institutional platforms is also a sign of things to come, with the exchange continuing to improve its position in the global cryptocurrency market.

Binance’s success might have a lot of implications as since domestic exchanges were banned in China, a majority of the potential investors, many of the retail markets especially, had limited options when it came to trading on global exchanges.