Here’s how the crypto-market fared in November

- The AUM for institutional crypto products climbed by 14.1% to $43.3 billion.

- GBTC’s discount to underlying Bitcoin dropped to its lowest level since August 2021.

Building on its bullish rally that started mid-October, Bitcoin [BTC] pushed further to the north by more than 10% in November, leading many experts to declare the ongoing phase as the early stage of a crypto bull market.

During the month, the king coin reclaimed levels last seen just before the onset of the bear market. As of this writing, it was exchanging hands at $38,016, AMBCrypto found out using CoinMarketCap’s data.

Institutional interest in cryptos on the rise

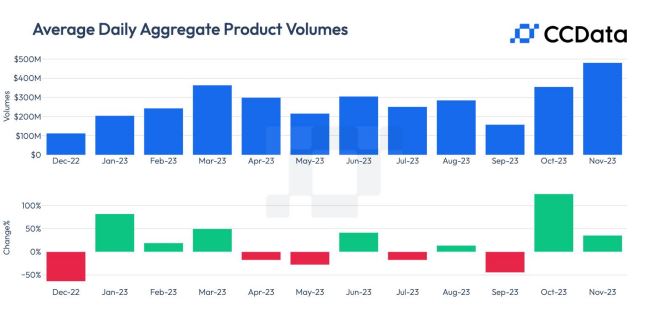

The bullish momentum continued to attract the attention of institutional investors. According to crypto market data provider CCData, the average daily volume of digital asset investment products jumped 35.3% to $481 million.

This was the highest registered monthly volume in 2023 since March.

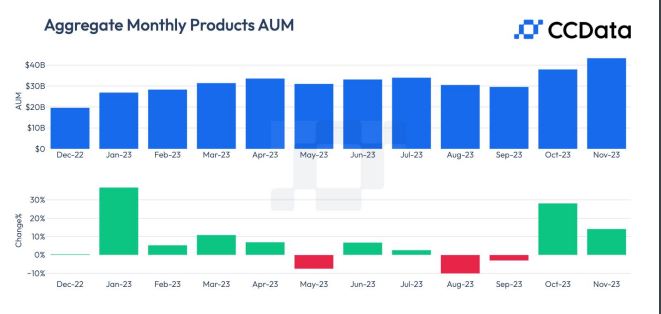

Moreover, the total assets under management (AUM) for institutional crypto products climbed by 14.1% to $43.3 billion, a significantly higher growth rate when compared to the previous month.

In fact, the total AUM since the start of 2023 has more than doubled.

The AUM is a measure of the flow of investor money in and out of a fund and the price performance of the underlying asset.

As you would hear everyone in the market say these days, the institutional interest was linked to the hype spot exchange-traded funds (ETFs) of both Bitcoin and Ethereum [ETH].

Leading investment products witness rise in AUM

For Bitcoin, the optimism was hinging on the potential approval of at least a dozen submitted applications.

On the other hand, the number of TradFi giants applying for a spot Ether ETF also increased significantly in November.

Indeed, big names like Blackrock and Fidelity filed spot Ether ETF applications with the U.S. Securities and Exchange Commission (SEC) in November. With this, the total number of such filings has risen to seven.

Bitcoin-based investment products extended their winning streak in November.

The AUM rose 12.5% to $31.8 billion during the month, cementing its dominance in the market. On a year-to-date (YTD) basis, the cumulative rise was 140%.

In a positive development, Ethereum-based products saw their AUM increase by 17.8% to more than $8.55 billion in the month. The turnaround happened after consecutive months of subpar performances.

The entry of world’s largest asset manager Blackrock to the spot Ether ETF race might have helped in changing the sentiment. Note that ETH recorded a monthly growth rate of 13.82%, higher than BTC.

Additionally, other altcoin-linked products witnessed a sharp jump in market worth. The AUM for Solana [SOL] products, for instance, nearly doubled to $424 million in November.

Impressive price gains aided in increasing the market worth of SOL-linked products. Indeed, SOL was the best-performing large-cap crypto in the last 30 days, bouncing by more than 68%, per CoinMarketCap.

Grayscale leads the change

Grayscale Investments, the world’s largest digital asset manager, observed a 10.3% increase in its AUM to more than $30 billion. Subsequently, its market dominance reached more than 70%.

Notably, the market leader’s AUM surged by 109% since the previous year.

As expected, the growth was led by its most popular products, Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE). While GBTC registered an increase of 8.7% to $23.5 billion, ETHE grew 16.5% to $6.21 billion.

The most noteworthy event, however, was GBTC’s reduction of the discount to the underlying assets to its lowest level in over two years.

The discount to the NAV was nearly 45% in June. However, growing optimism over conversion to a spot Bitcoin ETF, helped by recent court verdicts, led to a sharp decline.

As of 24th November, the GBTC discount was just 8%.

Typically, a reducing discount between a trust’s shares and the net asset value (NAV) of its holdings suggests a bullish outlook.

Crypto stocks build on the bullishness

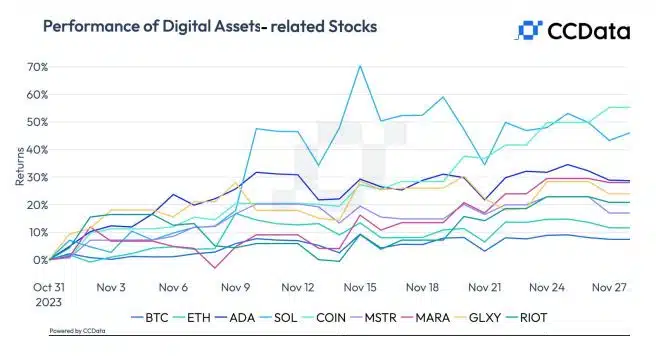

The upbeat mood in the digital assets market tricked down to related entities in TradFi as well.

Crypto-related stocks pocketed considerable gains during the month. Coinbase [COIN], the largest crypto exchange in the U.S., led the surge with a more than 55% increase.