What the Bitcoin-Gold decoupling means for Bitcoin’s price

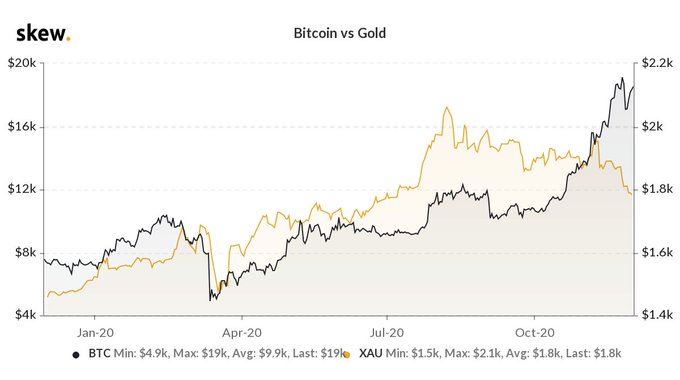

As Bitcoin’s price hit a new ATH before closing in November 2020, it is the ideal time to check Bitcoin’s correlation with Gold and the impact on price. Bitcoin and Gold decoupled earlier in November 2020, based on data from skew. The quarterly gain posted by Bitcoin is 72% and the monthly gain is 35%. Gold’s annual gain is 15% so far, in 2020.

Bitcoin v Gold || Source: Skew

In the push for the new ATH, it was anticipated by on-chain analysts that Bitcoin will possibly decouple from Gold. The price had crossed $19000 for the first time since 2017, a week ago, and it crossed $19861 (ATH on Coinbase) on several exchanges. However, conversely, the price of gold has dropped, thus showing that Bitcoin and Gold are not always correlated. While 2020 hasn’t been the best year for Gold’s price, Bitcoin experienced over a 100% surge in price since June. The demand on spot and derivatives exchanges created by institutional investors has kept Bitcoin Network Momentum High.

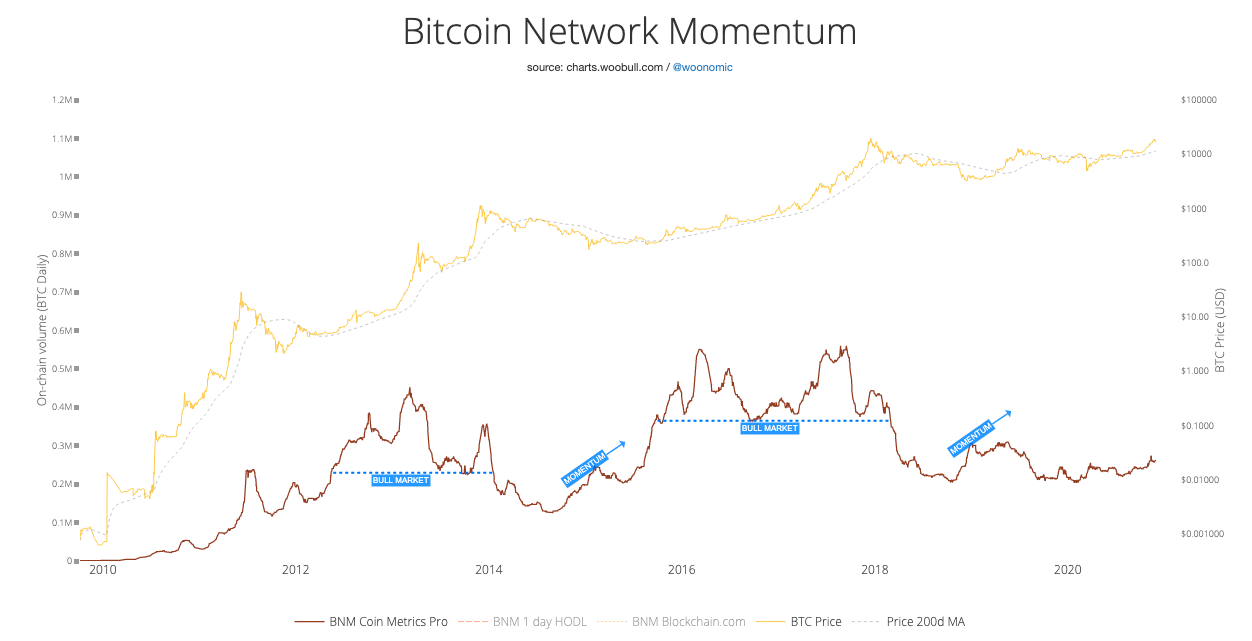

Bitcoin Network Momentum || Source: Woobull Charts

Willy Woo’s Bitcoin Network Momentum chart shows that momentum is sustained since the beginning of 2020. Though Gold is suffering from price blues, Bitcoin is being adopted as a store of value, replacing it, as digital Gold. @Davthewave recently tweeted on this,

“What is happening is that Bitcoin is gradually being adopted not so much as means of payment but as a store of value.”

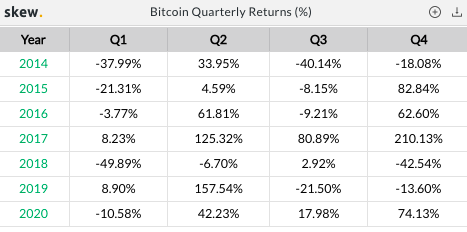

According to @davthewave, what is happening is Bitcoin is being monetized or capitalized and most analysts would agree after a look at the charts. A rationale for the retail traders who predict the price trend through TA is that the price chart has been more or less logarithmic since 2014. The pragmatic investor looking for a rationale can see quarterly returns for Bitcoin.

Bitcoin Quarterly Returns || Source: Skew

Another rewarding consequence of the decoupling is that Bitcoin can break free from the correlation with Gold which would have otherwise implied further correction. Since Gold is experiencing the same and having decoupled from Gold, Bitcoin’s price hit new ATH.