Bitcoin is for a niche audience! Here’s who it is for

Grayscale’s recent Bitcoin Investor study has been painting a good picture for Bitcoin in terms of adoption. More than half [55%] of the United States investors were interested in Bitcoin investment products in 2020, compared to 36% observed in 2019. Major reasons for this boost have been the pandemic pushing people to sought to new means of investment and Bitcoin has proven to provide better profits in the aftermath of the COVID-19 led crash.

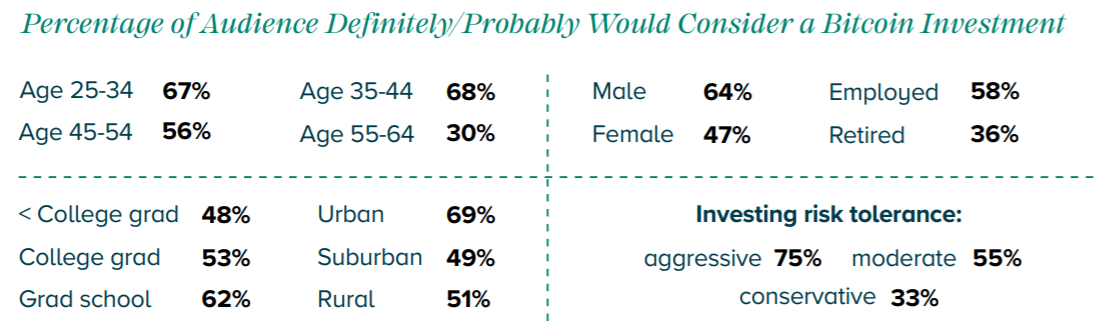

Despite the uptick in the adoption of Bitcoin, certain demographics have been expressing a lack of interest in Bitcoin investment products. According to Grayscale’s survey, only 40% of investors in the 55-64 age group, which was the oldest of the section surveyed, showed familiarity with Bitcoin. This value has been the lowest within any age group. Furthermore, only 30% of those aged 55-64 noted an inclination to consider Bitcoin investment products.

Source: Grayscale

The above chart provided a better picture of the interest Bitcoin has driven among the masses. Here we can note that the followers of Bitcoin were mostly from the younger generations spanning from Millenials to GenX.

Bitcoin concerns Boomers

We have known the adoption of technology has been difficult as we go higher up the age scale, however, that did not seem a major concern for crypto. However, the concerns reflected the circumstances of older investors pertaining to access investment income for approaching retirement.

While other concerns about Bitcoin volatility ailed nearly 81% of those disinterested. However, looking at the market performance of Bitcoin in 2020, the asset has reflected great maturity as the big announcements positive or negative have been absorbed by the Bitcoin market. The news about the investments from Square into Bitcoin or OKEx’s investigation did not impact the BTC value majorly. Owing to these concerns as an investment asset, 84% said BTC was “too risky for their investment profile.”

Male investors living in a rural area, age 51 who with investable asset between $100K and $250K stated the reason to keep Bitcoin at bay as:

“It’s not tangible, too many variables with its value.”

While female investors living in rural areas, age 37 with investable assets of $25k and $50k, were wary of the cyber attacks.

“Our company computer system was hacked by someone wanting a ransom in Bitcoin. I don’t trust it.”

Even as the research dictates the Millenials to inherit nearly $68 trillion from baby boomers within the next few decades, the current adoption is halted. Even though the security of the asset was one of the major concerns for not only boomers but the Millenials too, the regulatory concerns and no government oversight on Bitcoin added to this list.

Adoption on-track?

With existing issues, the adoption may seem to have been hitting a few roadblocks, but with active participation from financial institutions, some of these concerns are being resolved. The recent interest from MicroStrategy or DBS launching its own crypto exchange poised crypto in a positive light and offering the security of the digital asset, which may convince a large chunk.

Given the unexpected scenario of a pandemic definitely nudged many investors in Bitcoin’s direction and with the global economy changing many might keep a slot open for Bitcoin in their investment portfolios.