Bitcoin’s struggle with $10,000 and why breaching it isn’t particularly bullish

After testing the $9,900 – $10,000 level more than thrice, the price is declining. At the time of writing, Bitcoin’s price was dropping below the $9,500 level yet again. How soon can we see BTC cross $10,000 again? I wouldn’t hold my breath just yet, especially with the ecosystem flashing “buy” and “bullish signals.”

The Fear and Greed Index has recovered from being in the low 10-levels [extreme fear] to neutral zones [45-50]. At press time, the FGI stood at 49, with more than 16 hours until the next adjustment.

Bitcoin’s third halving has been one of the biggest bullish indicators, and the difficulty saw an adjustment yesterday. The difficulty dropped by 5.34% and stood at 15.214T, at the time of writing. This drop will pave the way for miners who were borderline non-profitable. Thus, a slight increase in hashrate can be expected.

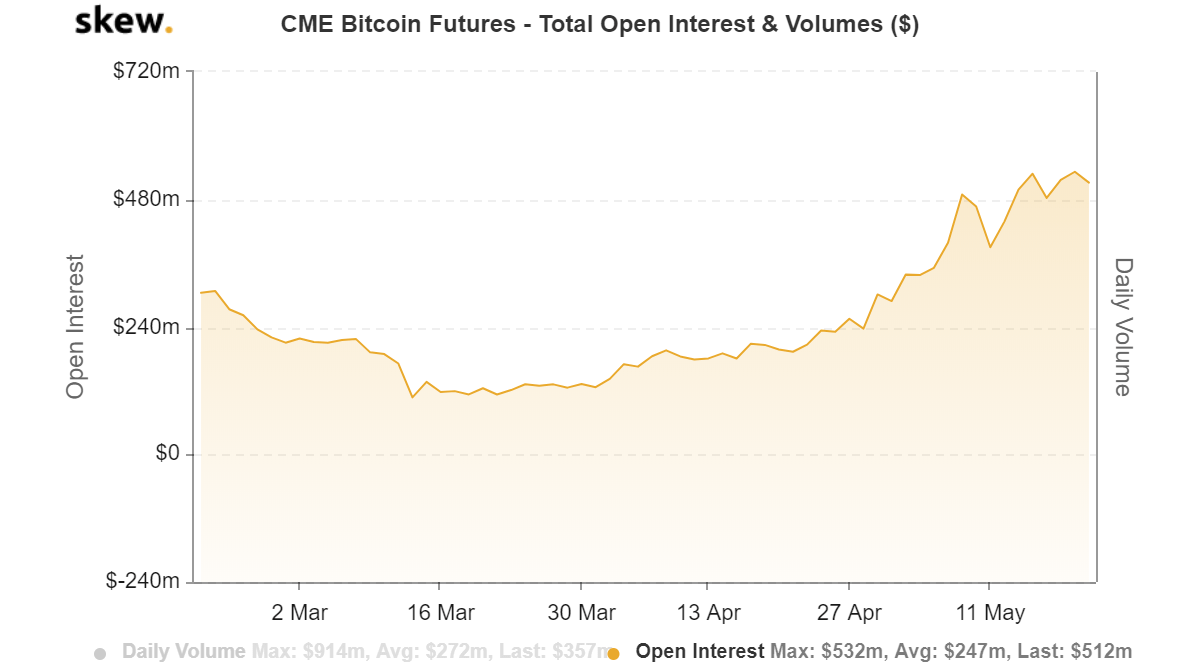

Additionally, the Bitcoin Futures market has been seeing a massive bump lately. The CME BTC Futures Open Interest registered a new ATH on 19 May, a day when it climbed from $529 million to $532 million.

Source: Skew

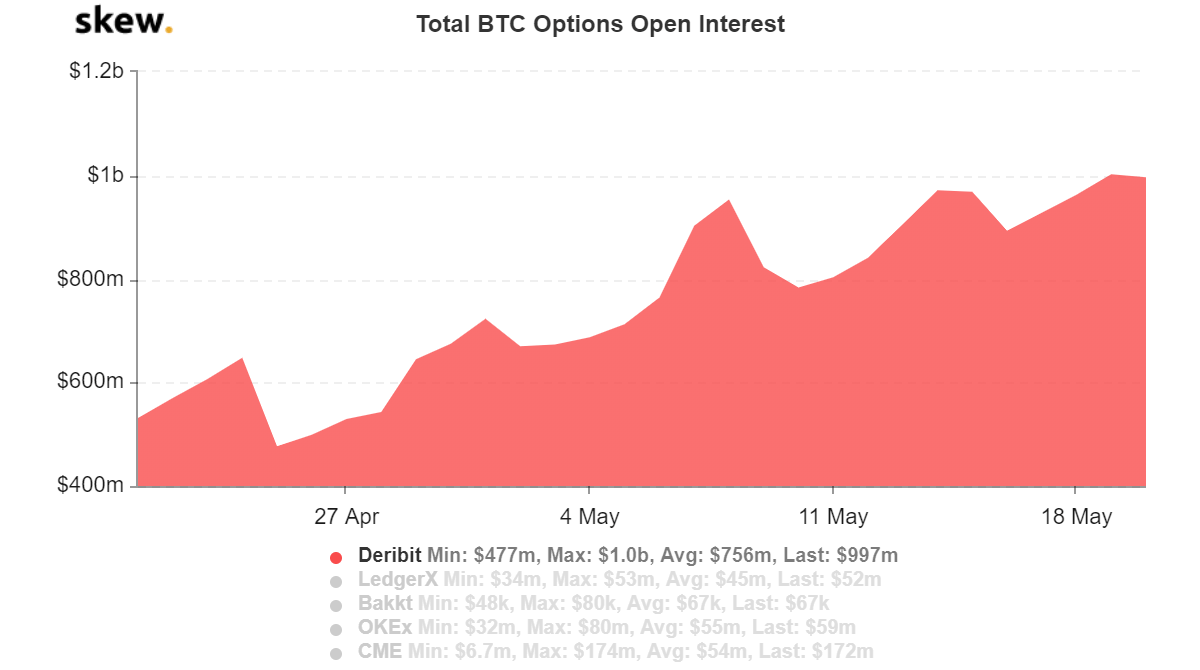

Deribit exchange’s Options OI hit a new high of $1 billion, showing significant demand for innovative products. All of this is institutional interest, a development that suggests that hedge funds and high rollers are interested in Bitcoin markets, especially since Paul Tudor Jones’ endorsement. Not only have the metrics surged, but they have also crossed pre-Black Thursday levels.

Source: Skew

Institutions v. Retail

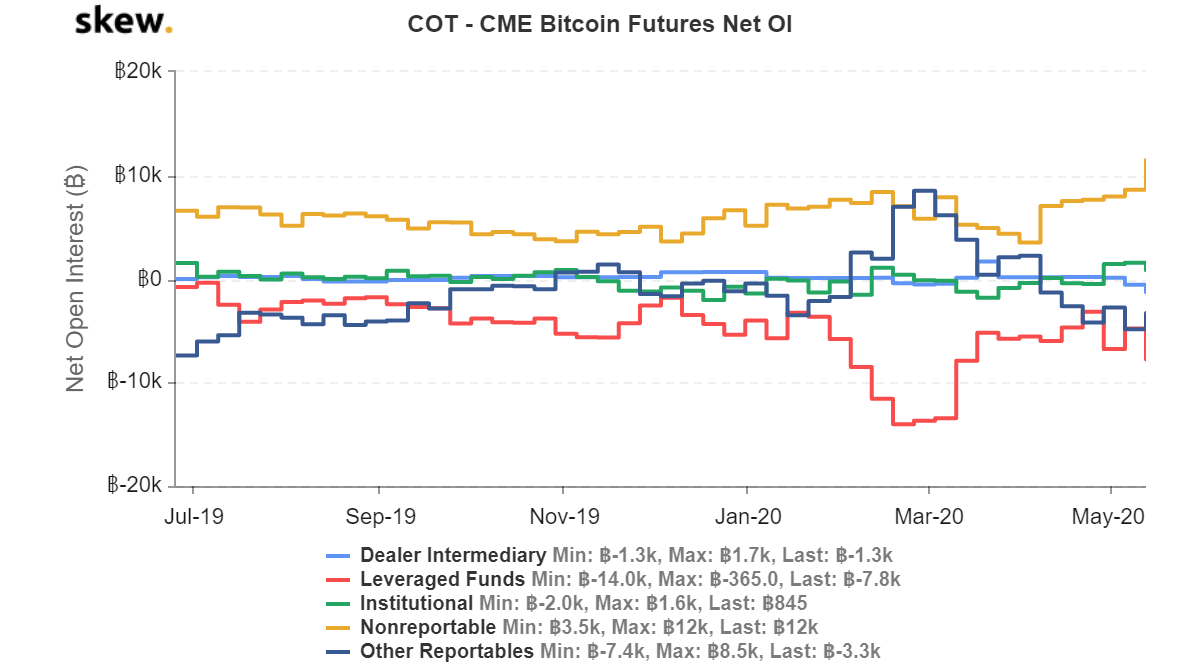

From the above metrics, it is clear that institutions have been busy; however, the retail side of things is also getting riled up. Retail interest in BTC has surged and they are long. Furthermore, the retail interest has surged to new highs as well, with total retail investments of around 12,000 BTCs.

Source: Skew

This is the first time since 2018 that the retail/non-reportable has gone to current levels. Meanwhile, hedge fund/institutional money is expecting the price of Bitcoin to head lower, indicating that they are short with over 7,800 BTC positions.

More often than not, the retail side is responsible for the pump and the institutional interest goes long during crashes to accumulate more Bitcoin. As pointed out by a previous article, the chances of BTC heading lower were low; however, with the current indicators flashing bullish signs, it would seem that the chances are now equal.

However, there is a key level at $10,500 that will prevent the price from heading higher, even after Bitcoin crosses the $10,000 level. Hence, the odds are ever so slightly skewed in favor of the bears.